And here are the goodies for this week…

Want to retire early? Make lots of money and don’t have kids (Think Save Retire)

“Yup, earning big money and not raising children is a fast track plan for financial independence and early retirement. It gets you there faster and completely streamlines the process. Funny how a big income and few expenses add up into significant net worth numbers!”

A controversial yet somewhat true statement. Having kids incur additional expense, from the point of pregnancy to raising them, that’s a lot of money. But that’s not saying that you can’t have kids on your journey to FI. In fact, that could be an impetus why we are choosing FI.

Fuck It FI aka When You Change Direction On The Path to Financial Independence (Miss Mazuma)

“There is NO guarantee that your path to FI will be straight – in fact, I can almost guarantee that it won’t be. Your expenses will change along the way. There will be choices and decisions and choose-your-own-adventure type forks in the road. Some will be optional, and some will be mandatory. But all of them will lead you to the hallowed land if you truly want to get there. You just have to trust the process.”

One of my favourite bloggers, it’s been a while since Miss Mazuma did a post update. Your path to FI might not be a straight road ahead, and that is fine. If you trust it enough, you will get there, it’s just a matter of when. Kind of mirrors the situation that we are in and just love this.

Lending Money To Friends Can Ruin A Friendship. This Is My Story. (Frugal Asian Finance)

“What I found the most frustrating about this incident is that our friend, the one we trusted so much, didn’t keep her promise. Her action made me wonder if she was hoping we would also forget about the money or if we didn’t matter enough for her to remember.”

Definitely a situation which many would have encounter. What was yours like?

Health vs. Wealth – Which Goes First? (Budgets Are Sexy)

“They asked over 1,000 consumers what their 2018 resolutions were back in January and “diet and fitness” goals superseded all financial ones, with the top response of “eating better” (54%) trumping the top financial goal of “saving more and spending less” (39%).”

Millennial are a special bunch and their values have departed much from their predecessors. Rather than chasing through the ranks for wealth and authority, many are seeking fulfilment and not surprisingly wealth over health (although I do think that most people nowadays, not just the millennial will be making this choice).

Adults need recess too. Here’s why you should make time to play (NBC News)

“The truth is, play is being joyfully immersed in the moment, and as adults, we rarely do that. In a way, it is an active form of mindfulness, which is widely recommended and advocates being present and in the moment.”

Too many times, we emphasize the importance of play for children. As it turns out, that is rather critical for adults too, albeit in a different format. Even if you are confines of your office cubicles, this article offers some great tips on what you can do to incorporate” play at work. I never knew doodling at conference calls is considered play…. gives me a good reason to continue 🙂

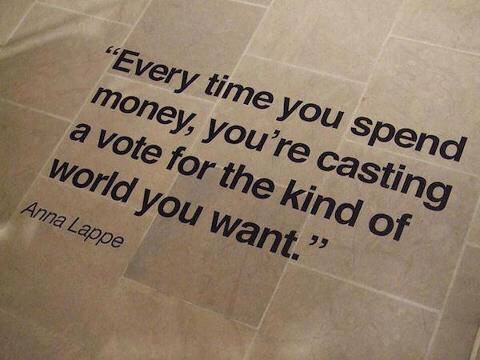

And here’s a quote to round it up.