Photo from: Grampians, Victoria Australia A Quiet Start to the Year and I’ve finally settled back into my routines. After the school holiday break — and a long road trip up north that took us all the way to Penang — I’m easing back into writing. The journey felt like a small milestone for our…

My Financial Literacy Journey With CPF: Giving Back As A CPF Volunteer

As I sat down at the recent CPF Volunteer Appreciation dinner 2025 to reflect on the journey that has brought me to where I am today, I am filled with gratitude for the financial tools and resources that have helped me navigate life’s financial challenges. One of the most significant influences has been the Central…

Minimalist in the City – Our New Minimalist Home

We shifted to our new Minimalist home for more than 2 years back and would like to show you the design of it and what we enjoyed about living in it so far. As we really love our minimalist theme of our previous place so much that we decided to retained that design as much…

Dave’s Life story revealed – How Does One Go From A 6-Figure Debt To Financial Independence (Youtube released)

Finally, my interview with The Financial Coconut on my life story is finally up on Youtube. For those people who are not into podcasts which I did earlier, you could probably watch this video to gain more perspectives from the roller coaster ride of my financial journey and why minimalism is the ultimate achievement for…

Minimalist in the City – How we executed our “Great Resignation”

Do you feel like your current job lacks meaning or purpose? Is it in line with your values? Do you feel like your current workplace is toxic? Does WFH removes part of the office politics? Do you prefer a hybrid working arrangement? Would that solve the work-life balance equation that you crave for? Do you…

Investing Lessons Part 4: Why Physical Gold Became Part of My Portfolio

When I bought physical gold for the first time in 2024, it surprised some people — including myself who used to advocate Warren Buffett’s take on gold. Gold doesn’t generate income. It doesn’t compound. It doesn’t fit neatly into the discounted cash flow models I’d spent years studying. And yet, it felt inevitable. The Wrong…

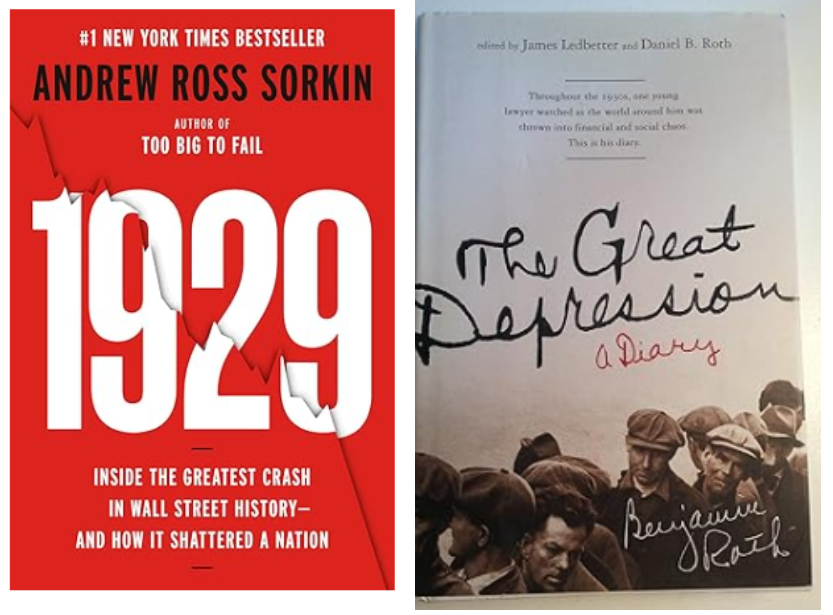

Investing Lessons Part 3: What the 1929 Crash Taught Me About Cash Reserves

Two books sat on my reading list for very different reasons. Both ended up teaching me the same lesson. The Great Depression: A Diary by Benjamin Roth is a quiet, intimate account—a lawyer in Youngstown, Ohio, documenting his observations and financial decisions from 1929 through the 1940s. His diary entries are remarkable for their immediacy…

Investing Lessons Part 2: Asset Allocation and Portfolio Resilience

After sharing how my investment approach evolved over two decades in Part 1, the natural question becomes: how does it all fit together? Asset allocation sounds technical, but at its core, it’s simply deciding how to distribute resources across different asset classes—and more importantly, why. From Theory to Reality: Our Great Resignation Test The true…

Investing Lessons Part 1: How My Investment Philosophy Evolved over more than two decades

(Originally shaped over two decades of investing) This year, I’ll be revisiting how some of my thinking has changed over time—including how I approach money and investing. This is the start of a series that explores not just what I invest in, but how I think about risk, reward, volatility, and building wealth with a…

Reinventing Midlife: “Why Some Wish They Had Quitted Their Careers 5 Years Earlier to try something else”

𝗧𝗵𝗲 “𝗣𝗮𝗹𝗲 𝗕𝗹𝘂𝗲 𝗗𝗼𝘁” 𝗶𝘀 𝗮𝗻 𝗶𝗰𝗼𝗻𝗶𝗰 𝗽𝗵𝗼𝘁𝗼𝗴𝗿𝗮𝗽𝗵 𝗼𝗳 𝗘𝗮𝗿𝘁𝗵 𝘁𝗮𝗸𝗲𝗻 𝗯𝘆 𝗡𝗔𝗦𝗔’𝘀 𝗩𝗼𝘆𝗮𝗴𝗲𝗿 𝟭 𝘀𝗽𝗮𝗰𝗲𝗰𝗿𝗮𝗳𝘁 𝗼𝗻 𝗙𝗲𝗯𝗿𝘂𝗮𝗿𝘆 𝟭𝟰, 𝟭𝟵𝟵𝟬, 𝗳𝗿𝗼𝗺 𝗮 𝗱𝗶𝘀𝘁𝗮𝗻𝗰𝗲 𝗼𝗳 𝟯.𝟳 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 𝗺𝗶𝗹𝗲𝘀 (𝟲 𝗯𝗶𝗹𝗹𝗶𝗼𝗻 𝗸𝗶𝗹𝗼𝗺𝗲𝘁𝗲𝗿𝘀). 𝗧𝗵𝗲 𝗶𝗺𝗮𝗴𝗲, 𝘄𝗵𝗶𝗰𝗵 𝘀𝗵𝗼𝘄𝘀 𝗘𝗮𝗿𝘁𝗵 𝗮𝘀 𝗮 𝘀𝗺𝗮𝗹𝗹, 𝗯𝗹𝘂𝗲 𝗱𝗼𝘁 𝗮𝗴𝗮𝗶𝗻𝘀𝘁 𝘁𝗵𝗲 𝘃𝗮𝘀𝘁𝗻𝗲𝘀𝘀 𝗼𝗳 𝘀𝗽𝗮𝗰𝗲, 𝗶𝗻𝘀𝗽𝗶𝗿𝗲𝗱 𝗖𝗮𝗿𝗹 𝗦𝗮𝗴𝗮𝗻 𝘁𝗼 𝘄𝗿𝗶𝘁𝗲 𝗵𝗶𝘀 𝗯𝗼𝗼𝗸 “𝗣𝗮𝗹𝗲 𝗕𝗹𝘂𝗲 𝗗𝗼𝘁: 𝗔 𝗩𝗶𝘀𝗶𝗼𝗻…

Reflections: The Balance of Life – Prolonging Existence Through Excess vs. Embracing Moments Through Minimalism

Why do we seek to prolong life? This calm yet provocative question came from a close friend whose parent, at over 80, had just undergone a costly self-funded treatment that amounted to half a million dollars. He wondered why humans can’t simply live out their natural lifespan and pass peacefully when the time comes like…

Lessons from the book The Great Depression: A Diary: Navigating Through the Current Market Challenges

In the context of recent economic turbulence, many individuals are feeling a sense of uncertainty, drawing parallels to the fears experienced during the Great Depression. A compelling resource that I read recently offers insight into this period is “The Great Depression: A Diary” by Benjamin Roth which chronicles the struggles faced by those living through…

The Price of Prosperity: A Reflection on Consumption and Morality

Recently, I had an eye-opening conversation with a self-proclaimed successful salesperson, Mr. B, who epitomized the luxury of our consumer-driven society. This was not our first encounter, but it was, by far, the most illuminating. Dressed in a tailored suit that likely cost more than my monthly mortgage, he exuded an air of success, punctuated…