A lot of people might have read this best selling book “The Millionaire Next Door” by Dr Thomas J. Stanley. I read another great book from him call “Stop Acting Rich and Start Living like a Millionaire” during my trip to Bali back in 2017. These two books which encompass more than 30 years of research helps me gain new perspectives about a real millionaire habits, lifestyle and outlook towards living a purposeful life. It also ends the myth of how the rich really behaves and how are they different from all the other millionaire wannabes.

He detailed about how many high income earners who look ostensibly rich but are not affluent in terms of networth have fallen into the elite luxury brand trap that prevents them from acquiring wealth. They are more focus on getting a bigger pay cheque in order to fund their insatiable appetite of purchasing luxury status symbols like luxury watches, prestige cars and big houses. They generally place less emphasis on educating themselves on investment and most do not take up the job of investing their own money.

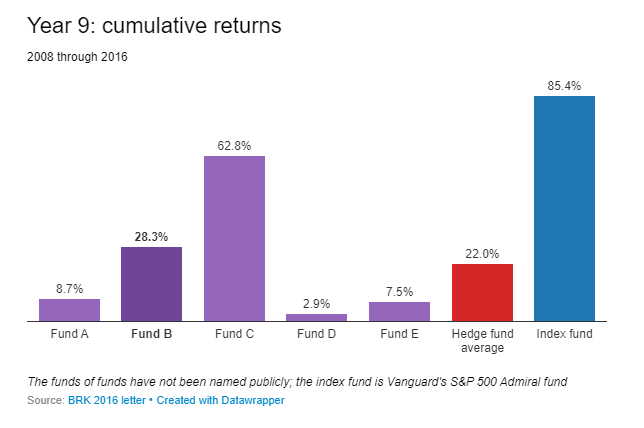

Some of the higher income earners would even leave their money to hedge fund managers who charge high management fees that constantly erodes their investment returns. For that reason, Warren Buffett famously place a US$1 million bet in 2008 that an index fund (S&P 500) will beat a hedge fund returns over a period of 10 years. The index fund is led with a return of 85.4% as compared to the hedge fund return of 22% as of 2016.

Majority of the millionaires are generally frugal as they feel that there is no utility to display their wealth. Most of them are also pretty low profile and believes that it takes time to accumulate wealth as the median age of millionaires in USA is 57 years old (according to the book). These are the people who are resourceful and maximize the potential of each dollar they spend. They normally go for quality over quantity and emphasize more on needs than wants.

As for the favorite watch for millionaires, it’s a close fight between Seiko, Rolex and Timex. When measuring a millionaire’s happiness level based on what watch they wore, all three came in at around a rating of 4.2 out of 5. But the price differential is quite substantial between Rolex and Seiko/Timex. As for market share among these 3 brands, Seiko came out top, followed by Rolex and Timex. One great example is my businessman idol, Li Ka Shing who is the richest man in Asia for decades with a net worth of more than US$30 billion during then. He is known for being frugal and has been wearing a Seiko watch for decades before he “upgraded” to the solar powered Citizen Eco drive watch worth US$500 then. He cited practical reasons for owning this watch like the watch does not require long time to charge and you could swim with it. Thus this research indicates that you could be far off happier and richer if you did not fork out the money to buy a Rolex.

Next, we shall talk about the favorite car for millionaires in term of market share. Yes! It’s TOYOTA followed by Lexus, Mercedes Benz, Ford and BMW according to the research featured in the book. Real millionaires normally go for quality and reliability of the car rather than prestige car brands. They also own their car for a longer period of time as compare to millionaire wannabes who change their cars every few years. Toyota millionaires are the most productive in transforming their income into wealth. Ask the average person under the age of 30 on the street about their dream car, few will say Toyota. You will hear a lot of people saying Audi, BMW or Mercedes which are the more popular brands among the prestige car makers. The problem nowadays are that people became too brand conscious and trappings of the material world prevents most from reaching the Millionaire milestone. Even the founder of Facebook, Mark Zuckerberg drives a Honda Accord (Acura) which he describes as safe and not ostentatious.

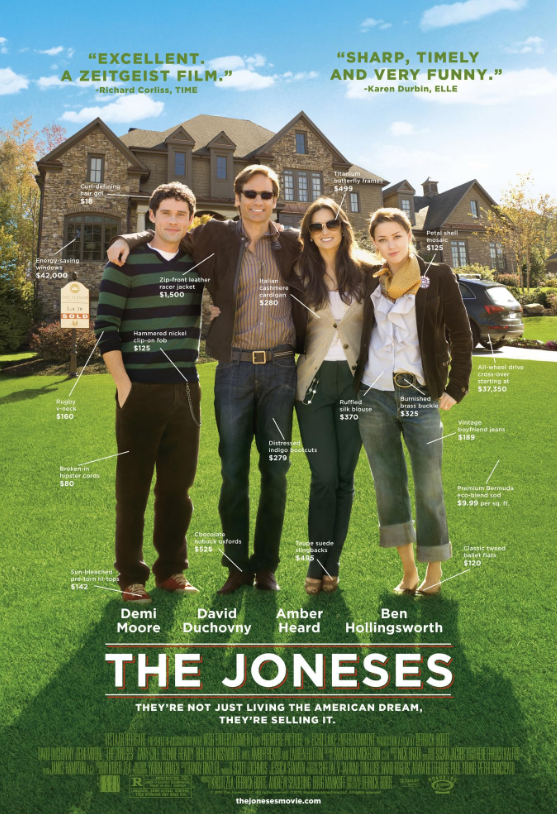

Most millionaires stays in less affluent estates which emphasize less on keeping up with the joneses but more on building up community with common interests. They spend more time on charitable events to raise funds within their estates as compared to those from affluent estates. They believe that giving back to society gives them a higher satisfaction in life as researchers also cited that there is a strong correlation between contributing to charitable causes and overall satisfaction with life.

After reading through this book, it helps me to put wealth in perspective and also how to live “rich” without spending more. “Rich” in this book means to lead a more fulfilling life encompass by rich life experiences and definitely not engaging in the endless pursuit to upgrade our material purchases. This book also details why we are spending lavishly nowadays and how to stop this destructive cycle of consumerism which at the same time is destroying our mother earth.

It also discussed about how being “rich” means more than just big houses, prestige watches and luxury cars. A defensive strategy for tough times especially after the 2008 recession, this book shows readers how to live a rich, happy life through accumulating more wealth and using it to achieve the type of financial freedom that will create true happiness and fulfilment. A recommended read for people who wants to find happiness in life and reach financial independence.

Hi Dave, Thanks for sharing. Indeed a very nice article to read. A 100 bucks and a 10,000buck watch. Basically you are looking at the same thing. TIME

You are most welcome! But a lot of people don’t see it this way like you do and they will be forever trap in the world of materialism. I hope to bring this point to more people who consume for the sake of consuming which is what the marketeers want you to believe that you really need these things.

I really enjoyed this book too. Here was my take on it almost 4 years ago.

http://www.my15hourworkweek.com/2013/11/30/what-does-it-take-to-be-a-millionaire-next-door/

Yah it’s all about frugality, simple living and smart financial decision. I’m always focus on smart financial decisions all my life until I chanced upon minimalism which kind of speed things up towards financial independence.