Today, I will like to introduce you to the HENRYs. Yes, it’s a common name, and I know quite a few of them. In fact, I think you might know them too, although they might not be the same people. And depending on the definition, they could be much more common than we thought.

Ok, so what am I saying? And so who exactly are the HENRYs?

HENRY is an acronym for High Earner Not Rich Yet. According to Shawn Tully, a Fortune magazine writer who coined the acronym back in 2003, HENRYs are households with predominantly PMETs making between US$250,000 and US$500,000 a year in the US. Over the years though, there has been tweaks made to it, such as the one by Equitax, which has provided a broader definition – under age 55, with an income over US$100,000 and investable assets of less than US$1 million. CBS, a US news broadcaster, seems to equate the term with “rich millennial.”

Broadly speaking, based on the above, HENRYs have a great possibility for accumulating wealth in the future, coupled with the potential for high discretionary spending in the present. As such, HENRYs are a huge market and for many companies as this is a key and huge market that they can potentially tap into. In addition, there have been many research and studies conducted around this group, even focus groups to understand them, and from there, devising strategies to market to this group. A pretty good info graphic guide developed for the US market can be found here.

Juxtapose this into Singapore, the definition could be tweaked a little – not the acronym itself, but the definition by which we define rich, and the income that one generates to be considered “rich”.

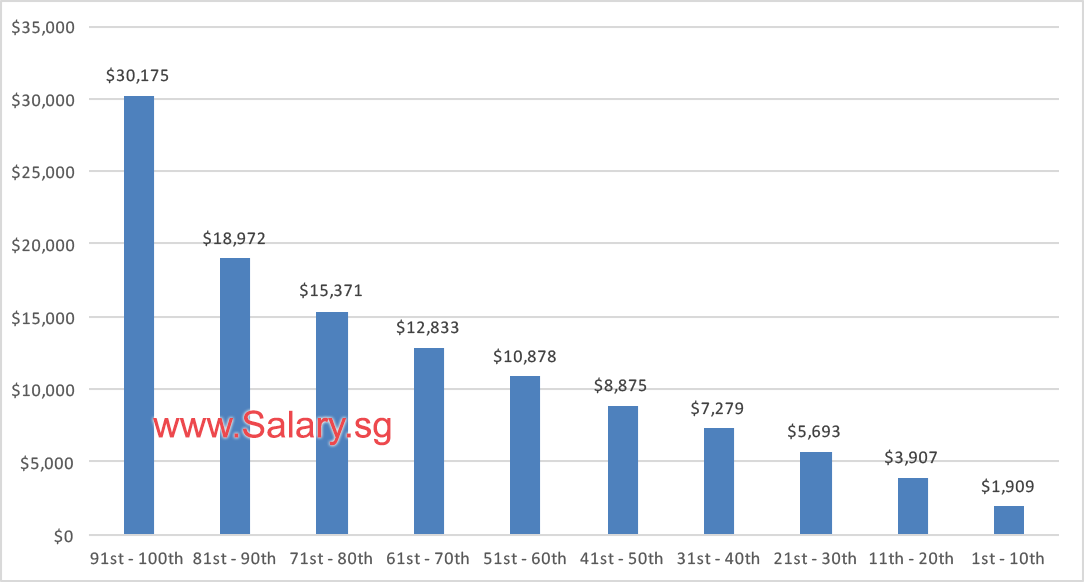

According to this chart by salary.sg, this is what the household income in Singapore looks like.

Having said that, this is still a rather skewed representation. Those at the upper echelons make a lot more. The families in the top 10% make an average of SG$30,175, which is disproportionately high. This figure is 60% more than what the next decile generates, and the figures for the remaining deciles go down linearly.

Personally, I would think that most of those that fall under the top decile are more often than not, the HERAs – High Earner Rich Already (boy, did I coined a new term?). They earn top dollars and are already rich, likely to have made into the exclusive private banking clubs, and/or are already high net-worth individuals.

As such, rather than using the average household income as a gauge, the median household income might perhaps offer a better representation. Below is a chart by Seedly.

In Singapore, I would tend to think that our average HENRY has a household income hovering anywhere between $14,000 to $20,000 (this is of course debatable, figure could be broader or narrower), considering that the median income level in the country is $8,846.

But what exactly is it about high income earners that are not yet rich? For many, the definition of rich more or less equates income.

That itself is a fallacy ready to be challenged. But you see, in this case, being rich is like wealth accumulation. We probably feel rich if we see a certain digit in our bank account, not by sheer delight of the monthly amount that is deposited in as we trade our hours for our job. Earning a six figure annual salary is impressive. But what would be even more remarkable is if we are able to amass a six figure portfolio or savings account or cumulative wealth for that matter.

What happens more often than not, is that our spending power raises proportionately based on our salary. When you earn less, you perhaps spend lesser. When you earn more, you tend to spend more.

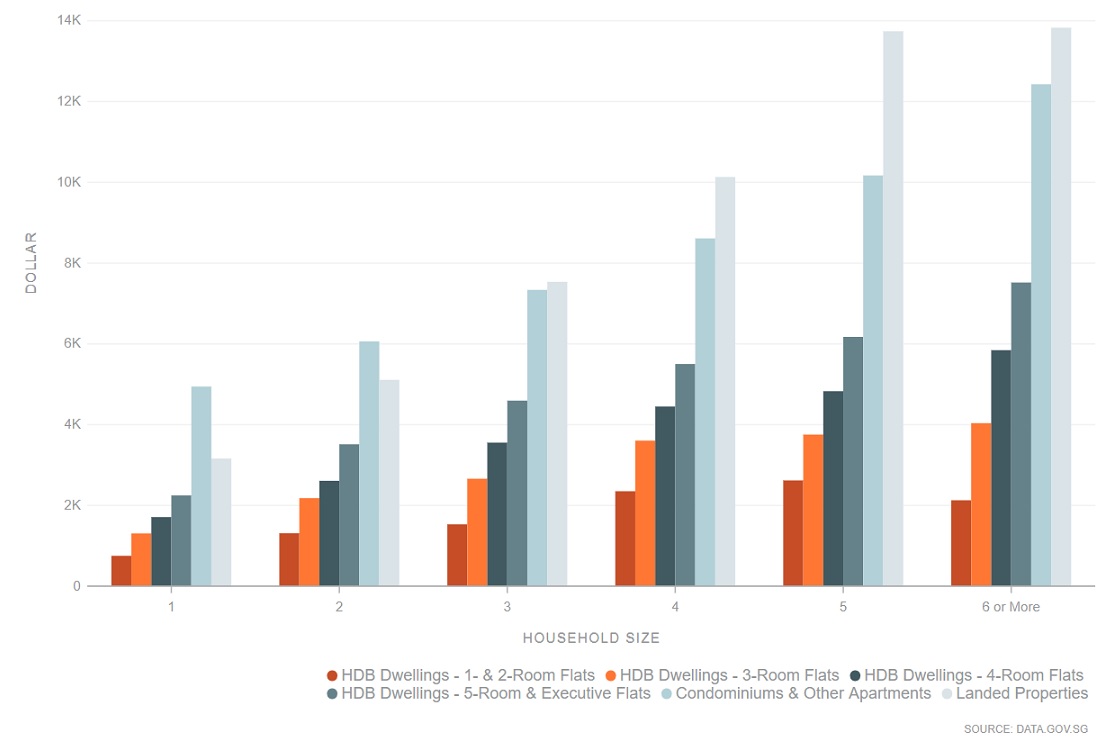

Let’s look at the below chart. This is an interesting chart that shows the corresponding household income based on the type of dwelling. What makes it even more fascinating is that they even make comparisons based on the household size.

The general trend is such that, the more expensive your household dwelling, the higher your household expenditure comparatively, keeping the household size constant. This does makes sense, considering that the more expensive your house is, the higher the mortgage, and I believe that the mortgage is being included as part of the expenditure here. And also, with this income group, most of these households are likely to have own at least a car (and we know how expensive cars are in Singapore) and these are likely factors that would have contributed to higher expenditure, among other things.

In addition, as the household size increase, expenditure also increases, which is also likely due to having kids and elderly in the family.

I guess it’s a no brainer from here why HENRYs do not feel rich. And also our definition of rich has also evolved tremendously. Rich used to mean that neighbour who drives a Mercedes. But nowadays, it has probably evolved to a District 10 address with a Porsche, Maserati and a few other branded cars parked in the garage. Coupled with the fact that we have multi-millionaires and billionaires who have decided to make Singapore their homes.

Rich, now feels more distant.