April is quite an exciting month for us as we had engaged in quite a few activities with our extended family including birthday celebrations, excursions and other outdoor activities. In terms of blogging activities, we had also provided an outlook on our countdown to FI and also shared our thoughts on an interview series with My15hourworkweek. Furthermore, we had also signed up for the popular online decluttering course by Joshua Becker, the author behind prominent minimalist blog becomingminimalist. Hope to do a short review at the end of the 12 week course and share our experience with our readers. This highly sought after online course is suitable for people who are looking into decluttering their home or life and its only offered three times a year. Hence, if you missed out on the registration for last month, chances are that it will be opening up again in a few month’s time and we will provide updates for those who are interested.

On the personal and family front, we went to the polyclinic for Ashton’s vaccination which is provided free for Singapore Citizen under the National Childhood Immunization Programme. Kate also previously blogged about the potential savings you will enjoy if you opt for this national vaccination programme instead of going to the private clinics.

In addition, we had also visited the SEA Aquarium with extended family (including my parents and grandmother) as part of my dad’s birthday celebration. It was a fun-fulled occasion across 4 generations and all of us had so much fun, especially Ally, who was ecstatic looking at all the sea creatures.

We had also engaged in many firsts, including a bowling session with Ally. We had heard that there were kids’ bowling lanes and as such decided to bring her along with us. Kate and I hadn’t bowled in years so we were rather “rusty”, compared to Ally, who managed to hit most of the bowling pins (courtesy of the side rails that prevented the ball from rolling into the gut). We had lots of fun and certainly for Ally, as she looked forward to her next bowling session.

On a separate occasion, we had also visited a local fire station during their open house. It was conducted on a Saturday morning and is free of charge. It is a two-hour session conducted by the fireman to provide an overview of their job, roles and the station itself. Kate and I learnt a lot during the session and Ally as well, who was rather fascinated seeing the fire engines and ambulances up close.

Visit to the neighborhood park

Fitness Update

This month, I had managed to complete my first futsal session with my colleagues without much pain on my right knee. Seems like the fitness routine is paying off well and my knees are feeling much stronger. I also managed to run my first 5.6 km this year at the recent JP Morgan Corporate Challenge and clock a respectable time of 30:17 mins (even though it was raining heavily when I started my run). Hope to do a 10km run later this year so that i have a fitness target to go after.

My weekly minimalist fitness routine:

1) Daily static exercise routine (5 times a week):

- 20 x squats

- 20 x one-legged squats for each leg

- 20 x lunges for each leg

- 30 x push ups

- 45 secs plank

2) 1 x Swimming 16 laps (800m) (using the ActiveSG free credit) and will cycle home for about 2km using the bike sharing platform (Ofo bike)

3) 1 x Staircase climbing 30 levels up and down plus static exercise on both ground and top level. (Done during lunch time in my office building)

4) 1 x 4km (25 – 30 mins) Slow jogging adopting the exercise method elaborated by Prof. Hiroaki Tanaka (injury-free running technique, allowing safe beginning and efficient progress. It’s the natural and gentle forefoot landing and small steps at high cadence)

5) Using the Iphone Health app, I’m currently trying to average 8000 steps daily. (I started doing this after I saw my father lost 5kg within two months after averaging more than 10,000 steps daily!)

Financial Update

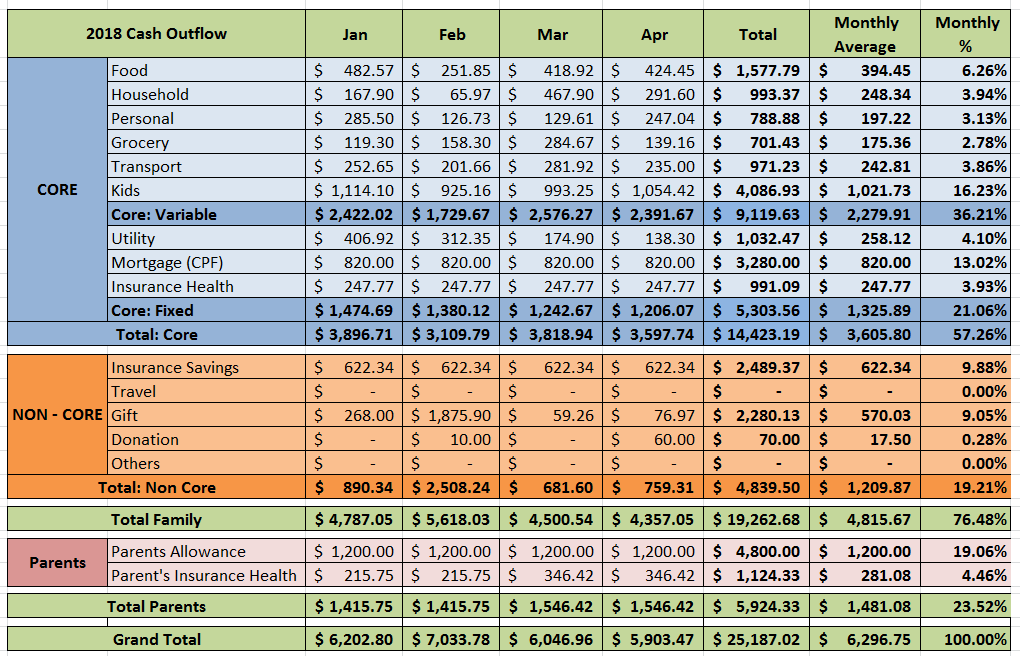

We had managed to compile our April cash outflow and below is a snapshot:

FAMILY ($4,357.05)

Core: Variable ($2,391.67)

Food ($424.45)

$424.45 – Mainly meals for our family of four (this includes bread, snacks, and drinks, etc.)

Household ($291.60)

$27.90 – Newspaper subscription for Kate’s parents

$14.70 – Household necessities

$249.00 – Shoe Rack (the existing one we had had fallen apart unfortunately so we had to get a new one)

Personal ($247.04)

$12.00 – Dave’s Futsal session with colleagues

$10.00 – Dave’s haircut

$92.00 – Kate’s Massage and Facials

$105.96 – Kate’s Skincare products

$18.50 – Moisturizing cream and cough syrup

$6.00 – Lottery (shared with friends for the fun of it)

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

Grocery ($139.16)

$139.16 – Mainly groceries and some other household items from the supermarket

Transport ($235.00)

$100.00 – Ezlink card reload for both of us (for bus and train rides)

$85.00 – Cab rides (plus some Grab credits top up)

$50.00 – Cashcard (Dave’s father car usage)

Kids ($1054.42)

Ally

$770.00 – Full day child care for Ally (inclusive of some optional enrichment class)

$17.70 – Music class

$12.95 – Water bottle

Ashton

$78.00 – Clothes

$101.66 – Diapers

$74.11 – Miscellaneous

Core: Fixed ($1,206.07)

Utility ($138.30)

$36.75 – Property Services and Conservancy Charges (0.5 months government rebate)

$101.55 – Mobile / Internet

Mortgage ($820.00) – Paying using our CPF. 20 year bank loan (First 3 years fixed interest and floating on the 4th year onward pegged against the FHR9). We would like to maintain an arbitrage on this home loan as the interest is less than 2% and we might repay it in full should the interest spike up when we reach FI.

Insurance – Health ($247.77) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Non-Core ($759.31)

Gift ($76.97) – Baby shower gift for friends

Donation ($60.00) – Orphanage

Insurance – Savings ($622.34) – Insurance premiums – includes savings and whole life policies (annual premiums amortized into 12 months)

PARENTS ($1,546.42)

Parents allowance ($1.200.00) – We will maintain this as long as both of us are still employed and will adjust this lower upon reaching FI.

Insurance – Health ($346.42) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Note:

Note:

- This monthly cash outflow report is use mainly to gauge our post FI expenses

- We included Insurance Savings as part of our cash outflow until they are fully paid up. The reason is that we will most probably still be paying for them even if we reach FI. We do acknowledge that this is not an expense but it is still a cash outflow nonetheless unless we monetize the accrued cash value of the savings policies.

- For an explanation on the above new categorization, you could refer here

- For our 2017 cash outflow full analysis, please click here

FI target family cash outflow (excluding parents) = $5,000 per month (core $3,500 and non-core $1,500)

Family ($4,357.05):

Core ($3,597.74) – This month our family core cash outflow seems to be pretty close to the monthly average of $3.6k for this year. With no foreseeable big expenses coming up, we should hopefully be able to maintain our cash outflow pretty constant towards the remainder of the year.

Non-core ($759.31) – This category remains pretty low with some occasional gifts to friends and donations to orphanage.

Parents ($1,546.42):

We had contacted CPF and they came up with some suggestions in regards to topping up our parent’s CPF account. Will update on this soon.

Grand Total ($5,903.47)

We spend about $4.3k on the family this month and it is also the lowest so far this year. We have been spending below our FI target family cash outflow of $5k per month. We hope to further lower our family and parents cash outflow through the remaining months of 2018. We shall see how this year will pan out for our family.

What was April like for you?

Thanks for sharing such detail information of your monthly breakdown. Keep up with the exercises as physical health is just as important, if not more, then financial health.

Thanks for reading our monthly updates. Totally agree that health is the most important. I always track my fitness routine and will slowly increase the frequency once my kids are a bit older.

I have two daughters under five so I totally understand what you mean by increasing the frequency when they are a bit older.

Yah, I guess its a matter of shifting our priorities. It’s all part of our lives and next time probably we could exercise as a family unit. 🙂

HI Dave, I like the table break down! It should always give us an idea how you compartmentalize the expenses.

Thanks Kyith! Hope this breakdown will give people a better idea on how much we are spending as a family of four and for our parents. I think this is important.