July is the month where the World Cup ended with the French lifting the World Cup title for the second time. I watched the game live on TV and seriously thought Croatia played better although the actual score did not really reflect that. I guess luck also played a very important role in games like this and this is what makes a soccer game exciting. Comparatively, the current French team is not as strong as the champions team 20 years ago that lifted the World Cup in 1998 with many star studded players including the current manager Didier Deschamps, Zinedine Zidane, Thierry Henry, and many more great players .

The next World Cup in 2022 will be be held in Qatar but we are more excited over the following World Cup in 2026 to be co-hosted by USA, Mexico and Canada. It has always been a soccer fan’s dream to watch a live World Cup game and that might be a potential venue for us to watch our first World Cup as a family, and perhaps planning some slow travelling in between. That will be eight years later so we shall see how things pan out. With our FI plan on the cards, that might not appear too remote for us.

Recently, I listened to Mad Fientist podcast on valuable lessons from his second year of freedom after FIRE. He and his wife went through an exercise on what a perfect day for them is like and what they eventually experience is very different. But it is a good exercise nevertheless as it allows them to envision the things that they could potentially look forward to as they work towards their goal of pursuing FIRE.

I will be taking a two-week break from work in August to spend some quality time with Kate and the buds before Kate heads back to work soon. We will not be travelling out of town and but it’s a good opportunity to experience life with the kids if both of us are not working. This might be similar to our post – FI lifestyle and we will share the experience in our next month update.

Fitness Update

For the month of July, I tried to run 5.6 km weekly and clocked an average pace of 5 mins per km which is almost back to my former average speed. But recently after a soccer session, I felt some pain on my left knee, thus I rested for one week before I resumed my fitness routine. This may be due to over reliance on my left knee while playing soccer which helped to compensate for the weakness of my right knee. I really need to change my style of playing and lower the competitiveness in my normal game should I want to prolong my soccer activity. Will be visiting the doctor soon to get a referral for specialist treatment.

My weekly fitness routine:

1) Daily static exercise routine (5 times a week):

1. 20 x squats

2. 20 x one-legged squats for each leg

3. 20 x lunges for each leg

4. 30 x push ups

5. 45 secs plank

2) 1 x Swimming 20 laps (1 km) (using the ActiveSG free credit) and will cycle home for about 2 km using the bike sharing platform (Ofo bike)

3) 1 x Staircase climbing 30 levels up and down plus static exercise on both ground and top level. (Done during lunch time in my office building)

4) 1 x 5.6 km run (average 5 mins / km pace)

5) Using the Great Eastern Get Great app, I’m currently trying to average 8000 steps daily and redeem vouchers.

Family

Ally enjoying the neighborhood park playground and feeding the fishes at the pond.

Financial Update

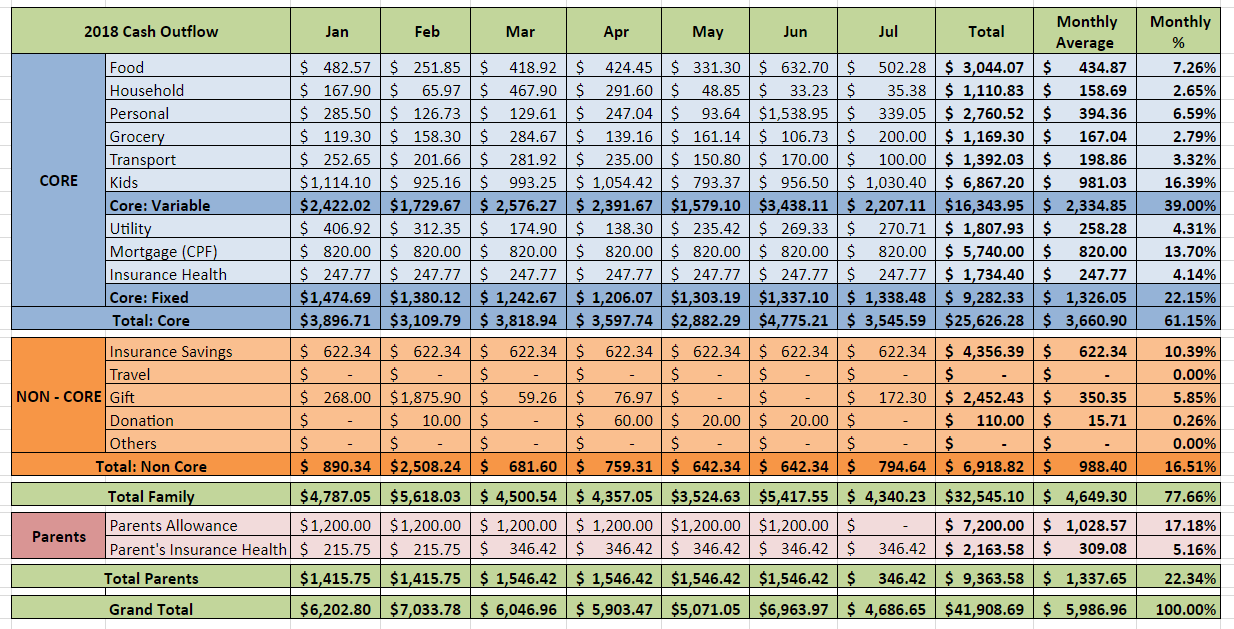

We had managed to compile our July cash outflow and below is a snapshot:

FAMILY ($4,340.23)

Core: Variable ($2,207.11)

Food ($502.28)

$502.28 – Meals for our family of four (this includes bread, snacks, and drinks, etc.)

Household ($35.38)

$27.90 – Newspaper subscription for Kate’s parents

$7.48 – Seat Cushion

Personal ($339.05)

$80.00 – Dave’s soccer boots

$18.70 – Dave’s sling bag (Gift from Kate)

$237.79 – Kate’s skincare and toiletries

$2.56 – iCloud 50 GB storage (monthly fees for Dave and Kate)

Groceries ($200.00)

$200.00 – Mainly groceries and some other household items from the supermarket

Transport ($100.00)

$100.00 – Ezlink card reload for both of us (for bus and train rides)

Kids ($1,030.40)

Ally

$850.00 – Full day child care for Ally (inclusive of some optional enrichment class)

$26.35 – Cough syrup

$42.35 – TCM consultaion

$5.80 – Sticker book

$30.00 – Milk Powder

$2.00 – Underwear

Ashton

$73.90 – Diapers

Core: Fixed ($1,338.48)

Utility ($270.71)

$91.31 – Electrical/Water/Gas

$78.00 – Property Services and Conservancy Charges

$101.40 – Mobile / Internet

Mortgage ($820.00) – Paying using our CPF. 20 year bank loan (First 3 years fixed interest and floating on the 4th year onward pegged against the FHR9 rate). We would like to maintain an arbitrage on this home loan as the interest is less than 2% and we might repay it in full should the interest spike up when we reach FI.

Insurance – Health ($247.77) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Non-Core ($794.64)

Gifts ($172.30) – Red packet to mother, gift to friend and funeral

Insurance – Savings ($622.34) – Insurance premiums – includes savings and whole life policies (annual premiums amortized into 12 months)

PARENTS ($346.42)

Insurance – Health ($346.42) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Note:

– This monthly cash outflow report is use mainly to gauge our post FI expenses

We included Insurance Savings as part of our cash outflow until they are fully paid up. The reason is that we will most probably still be paying for them even if we reach FI. We do acknowledge that this is not an expense but it is still a cash outflow nonetheless unless we monetize the accrued cash value of the savings policies.

– For an explanation on the above new categorization, you could refer here

– For our 2017 cash outflow full analysis, please click here

FI target family cash outflow (excluding parents) = $5,000 per month (core $3,500 and non-core $1,500)

Summary

Family ($4,340.23):

Core ($3,545.59) :

This month our family core cash outflow is almost similar to our monthly average of $3.6k for this year and we hope to maintain it this way.

Non-core ($794.64) :

This category is slightly higher with some gifts to Kate’s mother, friends and also some token for the funeral of a good friend.

Parents ($346.42):

We finally reduce our parents allowances significantly by topping up with an initial lump sum into their retirement account (CPF Life) which will guarantee payment to them for a lifetime This will transfer the reliance on us to give them cash allowances to CPF Life which works like an annuity. So we are now only paying for their health insurance which should slowly creep up as they age.

Grand Total ($4,686.65)

We spend about $4.6k based on the overall cash outflow this month and it is also the lowest so far this year. This is mainly due to the initial lump sum top up to our parents retirement account. We are really happy with this move and we are cruising towards FI in less than 2 years time. So looking forward to it!

What was the month of July like for you?

Wow, FIRE in 2 years time.

Definitely a source of inspiration for me!

I am also looking to start my own family a few years down the road and hope to keep to a minimalist lifestyle. If you don’t mind sharing, how much passive income are you looking to have by the time both of you decide to quit in 2 years?

Thanks for reading our blog. We are looking more into FI than RE. For a start, enough to cover our monthly expenses.

I see.

Just curious. Do you have more stocks in REITs more than anything else?

A combination of blue chips and reits.

Thank u!