June is the month where the World Cup fever comes raging coupled with all the sleepless night (although it has already been pretty much sleepless on most nights with Ashton). Kate is also quite a soccer fanatic herself so I am glad that we got to spend some quality time together as a couple over soccer, which especially helps since the bulk of the matches are after their sleeping hours.

I can still vividly remember the first time I watched World Cup in 1990, when I was still in primary school. That triggered my love for soccer and I have been playing this beautiful game ever since. It helps a lot that most of the matches scheduled during this World Cup are rather “friendly” to our timezone (except the 2 am ones) so we could manage to catch most of the matches. And oh boy, there were quite a lot of exciting ones aren’t there?

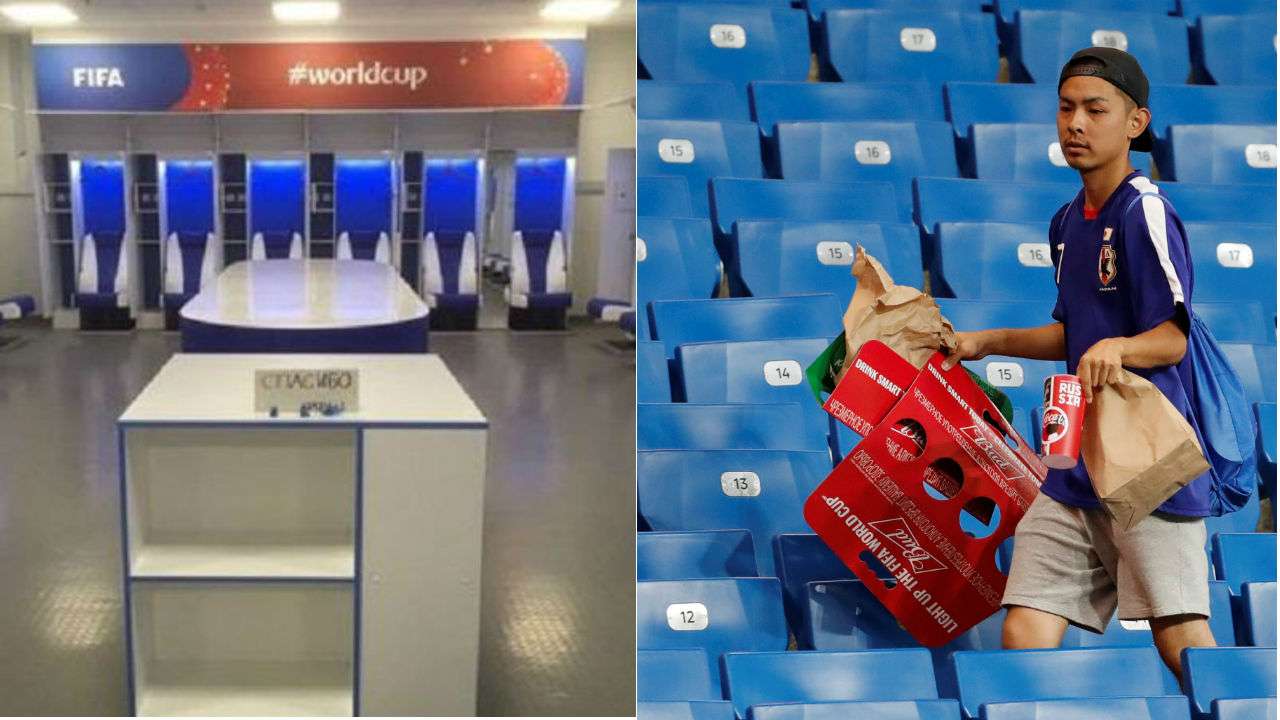

Japan was the only Asian team which made it past the group stages but eventually bowed out because of a resurgent Belgium team. Japan was stunned (and devastated) no doubt, considering the flow of the match but the amazing thing was that they pick themselves up at the end to thank their die-hard fans at the stadium. As they left the dressing room, it was left spotless with a thank you note written in Russian. The Japanese fans also did their usual clean up at the spectators stand. They might have lost the match but they never lost their identity nor dignity and following that, gained many fans around the world with their exemplary actions on civic-mindedness.

I love sports since I was a child and I think that they are a great activity for building a person’s character. Engaging in team sports taught me about perseverance, discipline, humility, teamwork and sportsmanship, and I hope for both my kids to participate in them in one way or another and along the way, hone up their character and pick up good values.

Fitness Update

For the month of June, I run 5.6 km weekly and clocked an average pace of 5 mins per km which is almost back to my former average speed. But recently, I needed to focus more on my stretching due to a recurring tightness in the right calf. My knees are getting stronger and I will be continuing with the current routine to rebuild my fitness before participating in running events again.

My weekly fitness routine:

1) Daily static exercise routine (5 times a week):

1. 20 x squats

2. 20 x one-legged squats for each leg

3. 20 x lunges for each leg

4. 30 x push ups

5. 45 secs plank

2) 1 x Swimming 20 laps (1 km) (using the ActiveSG free credit) and will cycle home for about 2 km using the bike sharing platform (Ofo bike)

3) 1 x Staircase climbing 30 levels up and down plus static exercise on both ground and top level. (Done during lunch time in my office building)

4) 1 x 5.6 km run (average 5 mins / km pace)

5) Using the Great Eastern Get Great app, I’m currently trying to average 8000 steps daily and redeem vouchers.

Family

We also did quite a few fun activities together, with extended family, including visits to Gardens by the Bay.

Family trip to Gardens by the Bay

Ally’s first time at the running track where she completed 4 laps while Kate only managed to run 2 laps only. We also brought her to watch her favourite Dora show at one of the local shopping malls during the school holiday

Ally’s trip to the park and fed some fresh water turtle with bread crumbs

Books from the library where she learnt more about the life cycles of Turtles and Frogs. She was also fascinated by the library’s automated book return system.

Financial Update

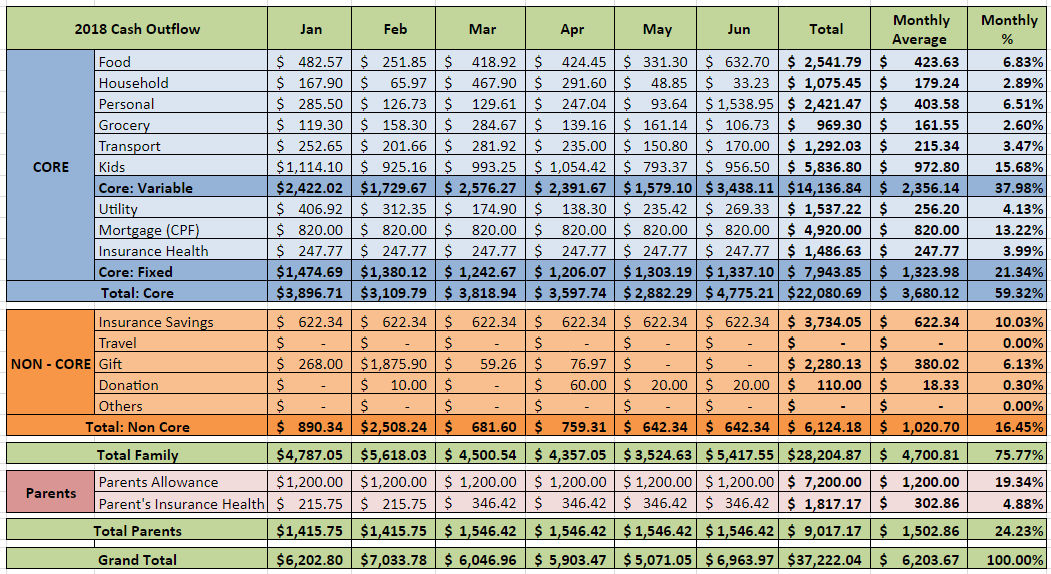

We had managed to compile our June cash outflow and below is a snapshot:

FAMILY ($5,417.55)

Core: Variable ($3,438.11)

Food ($632.70)

$632.70 – Meals for our family of four (this includes bread, snacks, and drinks, etc.)

Household ($33.23)

$27.90 – Newspaper subscription for Kate’s parents

$5.33 – Fan Protector

Personal ($1538.95)

$1323.59 – Laptop

$55.80 – Family trip to Gardens by the Bay

$7.50 – Cap (for Kate as the weather is pretty warm and we do quite a bit of outdoor activities these days)

$60.50 – Skincare and toiletries

$89.00 – Shoes (a new pair of sneakers for Kate since her old one was starting to give way)

$2.56 – iCloud 50 GB storage (monthly fees for Dave and Kate)

Groceries ($106.73)

$106.73 – Mainly groceries and some other household items from the supermarket

Transport ($170.00)

$120.00 – Ezlink card reload for both of us (for bus and train rides)

$50.00 – Cab rides

Kids ($956.50)

Ally

$850.00 – Full day child care for Ally (inclusive of some optional enrichment class)

$72.00 – Chickenpox vaccination

$29.90 – Clothing

$18.80 – Fever patch and hair accessories

Ashton

$7.90 – Cotton Wool

$50.00 – Diapers

Core: Fixed ($1,337.10)

Utility ($235.42)

$94.43 – Electrical/Water/Gas

$73.50 – Property Services and Conservancy Charges

$96.40 – Mobile / Internet

Mortgage ($820.00) – Paying using our CPF. 20 year bank loan (First 3 years fixed interest and floating on the 4th year onward pegged against the FHR9 rate). We would like to maintain an arbitrage on this home loan as the interest is less than 2% and we might repay it in full should the interest spike up when we reach FI.

Insurance – Health ($247.77) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Non-Core ($642.34)

Donation ($20.00) – Donations to Temple

Insurance – Savings ($622.34) – Insurance premiums – includes savings and whole life policies (annual premiums amortized into 12 months)

PARENTS ($1,546.42)

Parents allowance ($1,200.00) – We will maintain this as long as both of us are still employed and will adjust this lower upon reaching FI.

Insurance – Health ($346.42) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Note:

– This monthly cash outflow report is use mainly to gauge our post FI expenses

We included Insurance Savings as part of our cash outflow until they are fully paid up. The reason is that we will most probably still be paying for them even if we reach FI. We do acknowledge that this is not an expense but it is still a cash outflow nonetheless unless we monetize the accrued cash value of the savings policies.

– For an explanation on the above new categorization, you could refer here

– For our 2017 cash outflow full analysis, please click here

FI target family cash outflow (excluding parents) = $5,000 per month (core $3,500 and non-core $1,500)

Summary

Family ($5,417.55):

Core ($4,775.21) :

This month our family core cash outflow is almost $1k higher than our monthly average of $3.6k for this year and it is also the highest so far this year. This is mainly due to our purchase of a new laptop to replace our old one so that we could continue to blog with ease. If we were to exclude this purchase, our family core cash outflow should be closer to $3.4k which is slightly below our monthly average of $3.6k for this year.

Non-core ($642.34) :

This category remains consistent with some donations to the temple.

Parents ($1,546.42):

We had contacted CPF and they came up with some suggestions in regards to topping up our parent’s CPF account. This move will greatly reduce this component which is the highest and takes up almost 20% of our total cash outflow. We should have an update on this very soon.

Grand Total ($6,963.97)

We spend about $5.4k based on the family cash outflow this month and it is also one of the highest so far this year.

We had reached the half year point of this year and we spend about $37,222.04 YTD which is approximately about $6,203.67 per month. If we were to exclude the parents component $9,017.17 ( $1,502.86 per month), our family cash outflow should be close to $28,204.81 ( $4,700.81 per month). We are currently exploring ways to top up our parents CPF to significantly reduce the parents allowance component which will lower our magic number towards FI. As Kate has been on sabbatical for almost eight months, our FI plan has taken a backseat during this period of time. But this is all worth it with Kate spending quality time with our two kids and well rested before starting work soon.

What was the month of June like for you?

Hi, I’m new to your blog but really enjoying it, especially your monthly updates and Friday Reads.

Question for your monthly updates, I noticed you did not mention anything about income tax. Would that be considered a fixed core item?

Thank you.

Thanks for following our blog. The income tax is normally a one time expense and our country do give good tax rebates for having kids.