Frankly speaking, when I was first invited as a panel speaker for this CPF Webinar, I didn’t realize that I will be going down to their office physically until I received their email just one week prior. I initially thought that I will just be doing my sharing over Zoom as that is what most people are doing since the pandemic started. I guess life is slowly getting back to the old norm. As an introvert innately, I do face the challenge of being on the screen and speaking publicly. But as a strong advocate towards financial literacy, I garnered the courage to show up at their office at the end of the day.

I have the privilege to share a bit about my own personal financial journey (for my full life story, you can listen to this podcast), how minimalism made an impact in my life and why CPF forms a solid foundation of my financial house. As a financial coach and blogger, I would think that the topic of CPF is at the heart of all Singaporeans and I have the obligation to share how CPF will form part of my client’s overall financial plan. Reason being that employees forms a large part of our Singapore workforce who will be auto-enrolled in this national scheme when they started working. I understand there might still be a diminishing group of people who might shun CPF for taking away their personal money. But as I think most of us can’t really escape from this system, why not make the best out of it. Before any debate starts, we need to know the original mission of why CPF is form (as screenshot below) and how real people around us benefitted from it.

Other than being a CPF volunteer to learn more about this national scheme, I’m also part of the 1M65 telegram group founded by Mr Loo Cheng Chuan who championed this 1M65 movement. It is a strategy that capitalises on topping up your CPF balances and parking your savings within CPF Special Account (SA) and MediSave Account( MA) to allow for it to earn an attractive interest rate of 4% p.a to reach a million dollars as a couple by 65 years old. I might not be that extreme in this particular movement but CPF does offer a good way to diversify and mitigate my risks in my overall asset allocation.

In this webinar, I shared about my parents who does not have any savings when my dad was retrenched in his 50s. Fast forward today in their 60s, they are in the position to actually stop working completely just by relying on CPF Life and their dividend portfolio but they choose to work part time just to stay engage. I also shared about how I thought that I lost everything when saddled with a 6 figure debt from the exit from my franchise business. But on hindsight, my CPF was still there which allows me to apply for a BTO flat few years down the road and eventually allows me to achieve FRS at the age of 40 through top-ups.

I had a conversation with my ex-colleague who just turned 55 recently and after setting aside her FRS, she does have some money to withdraw out. While working as a property agent in her 40s, she did make good money in her early days. But some bad financial decisions made her buried in debt and downgraded her property in the last few years. That led her to ask for personal loans from her friends to ride through that tough period of time. But luckily before she became a property agent, she did accumulated some CPF during her corporate life as an employee. She also topped up her CPF as a property agent to make sure she have this financial safety net in place which on hindsight was her saving grace. The very first thing she did when she was eligible to withdraw the surplus from her CPF after setting aside FRS was to repay some of these personal loans from her friends. One of her good friend didn’t expected it but was really grateful when my friend actually did it. She is really grateful for this financial safety net which offers her a chance to have his basic retirement needs settled.

The cases above probably illustrates the importance of having this CPF financial safety net in place which kind of bailout people at the end of the day. This might just be a tip of an iceberg of people who unavoidably will make some bad financial decisions during their lifetime including myself.

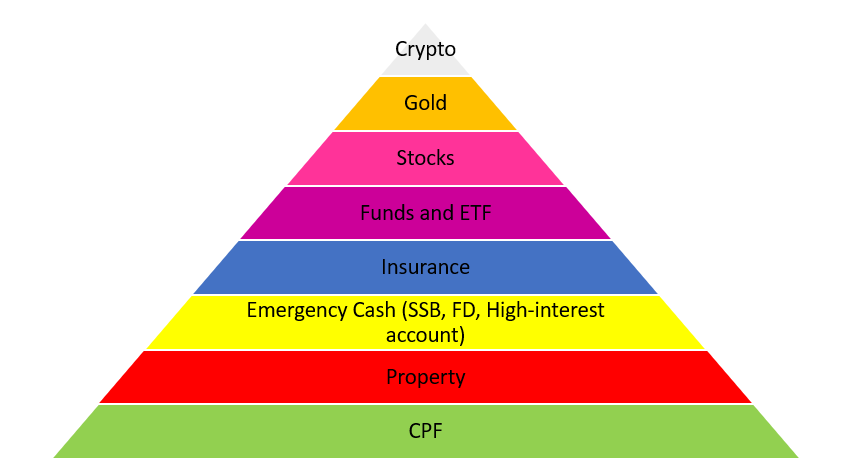

That is why I shared about having the CPF as the solid foundation for our financial house which is illustrated in the pyramid as above (this pyramid might differ from people to people depending on their risk profile). So the general idea is to build your way up starting with CPF, property and emergency cash before you start to increase your risk with the other asset classes. This might be a good guide for anyone who wants to solidify their financial house.

There are definitely pros and cons in each of the asset class listed in the pyramid and not everyone might be comfortable with all of them. But do take the time to study those that you are comfortable with and start building your financial house. Do note that CPF Life will only cover your basic needs at age 65 which might not be sufficient towards your ideal retirement needs. For those who are seeking to have more or reach financial independence earlier, you might want to explore the other asset classes which requires you to take on more risks. But all these could be mitigated by having a longer time horizon and appropriate asset allocation that fits your risk profile.

Share with me your thoughts and I really hope that this will be useful to you.