I’ve finally settled back into my routines and resumed blogging after an extended school holiday break with our Europe trip. While I’m focusing on posting less frequently on my blog and more on LinkedIn these days, I’m grateful to kick off my first blog post of the year with reflections on 2024.

As 2024 comes to a close, I believe it’s a great opportunity to gather my thoughts from the past year and highlight some key takeaways as we step into 2025.

Health

In 2023, I shared my struggles with a knee injury, but last year I committed to an exercise routine and intermittent fasting, successfully reducing my weight from 85kg to 74kg with a body fat percentage around 11%. However, I found maintaining this routine challenging, particularly in the second half of the year, so I adjusted my workouts to ensure I sustained a manageable level of activity with my usual daily 10k steps as a base while prioritizing my diet and sleep.

I’ve also been working on regulating my mood by spending more time in nature and reducing screen time. Embracing nature walks has become a yearly highlight, allowing me to silence my devices and engage in mindfulness. These walks help me appreciate the simpler aspects of life and cultivate gratitude for what I have.

After experiencing jet lag from a recent family trip to Europe, I’ve come to value our daily routines even more, especially as school reopens.

Family

Last year marked two exciting family travel adventures: our first multi-day road trip to Malaysia and our inaugural family trip to Europe.

In planning these trips, I involved my kids to teach them about logistics and contingency planning, like preparing for bad weather or identifying alternative attractions. They’ve become adept with geography, using Google Maps and understanding travel logistics.

Inspired by Die With Zero: Getting All You Can from Your Money and Your Life book by Bill Perkins, I’m prioritizing creating memorable experiences with my family. With my kids turning 11 and 8 this year, they’re more capable of retaining cherished memories. Looking back at our family photos fills me with gratitude for all the fun we shared this past year. As they grow up and pursue their paths, it’s vital to build memorable experiences together now.

You can explore our new travelogue segment here—I’m still catching up on documenting our travels!

Work

As a financial coach, I’m delighted to expand financial literacy through various online platforms, including LinkedIn, my blog, and collaborations with organizations like The Financial Coconut, CPF, and iFast TV. My mission is to guide individuals toward financial independence, enabling them to retire 5 – 10 years earlier than the statutory retirement age. Rather than encouraging early retirement, I advocate for financial independence, emphasizing the freedom to choose how to spend your time on work that matters to you.

On the educational front, Kate started on her two-year master’s program, while I aim to complete my Certified Financial Planner (CFP) certification by 2025. Our work is increasingly meaningful, allowing us to engage in roles that positively impact our community without the immediate pressure to retire early. This level of financial independence helps us maintain balance in our lives—volunteering and managing our work, family, health, and home sustainably.

Financial

Our family expenses were similar to the previous year, primarily due to travel, children’s needs, insurance, and Kate’s master’s degree. Our overall net worth increased thanks to rising US equities, although we’ve stopped adding to those positions. Instead, we have bolstered the stable portion of our portfolio with cash, bonds, and CPF, steadily growing. While our REITs performed flattish, we still received reasonable dividends, which we’ll reserve for future opportunities after ensuring our emergency funds are intact.

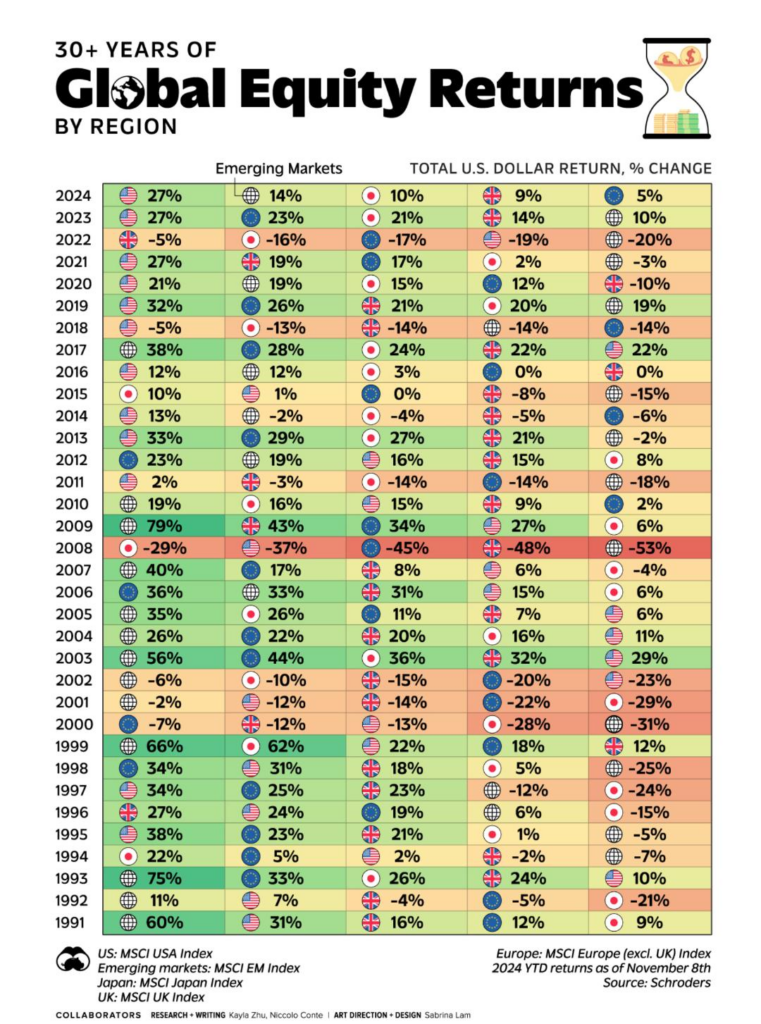

Following two years of significant gains in US and global equities (refer below) since the 2022 interest rate hikes, the current economic uncertainties don’t compel us to invest further just yet. We are gradually de-risking our portfolio to position ourselves for potential market corrections or mortgage repayment.

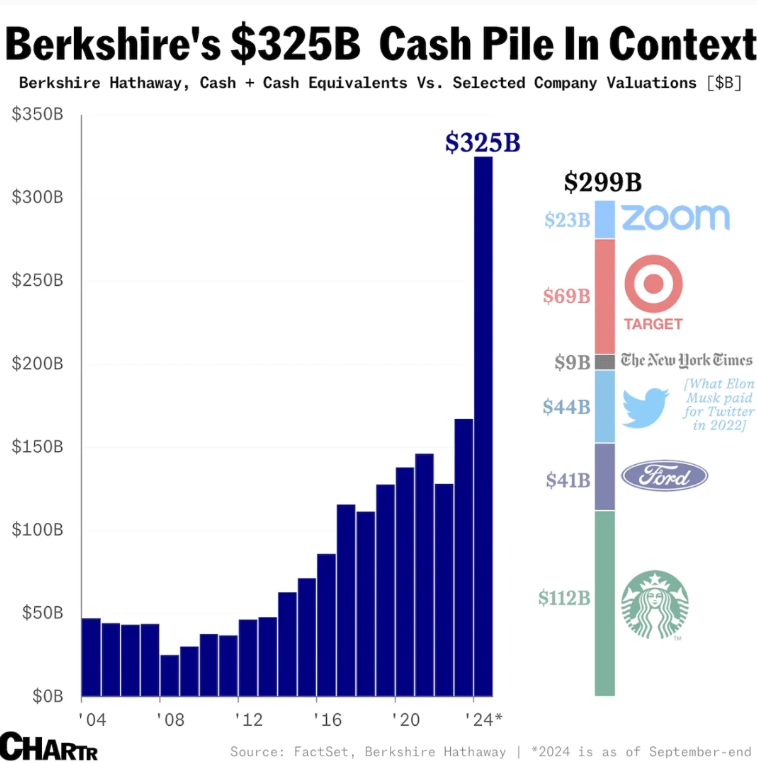

I drew inspiration from Warren Buffett’s cash reserve approach with Berkshire, now at a record high of $325 billion (about 28% of total assets), but I do believe it’s essential to consider individual wealth stages before mirroring such strategies. Early this year, we allocated some funds toward gold as a hedge against uncertainties, resulting in some comfortable paper gains that will contribute to our strategic allocation away from equities and bonds. Given the ongoing geopolitical issues and market volatility, we’re cautious about chasing returns and remain committed to diversifying our wealth across asset classes.

Establishing a cash buffer empowers us to “Be greedy when others are fearful”, a philosophy reinforced by reading The Great Depression: A Diary by Benjamin Roth, which illustrated the missed opportunities during that era due to financial constraints like no income or even cash. Many were unable to capitalize on favorable conditions while valuable assets were drastically undervalued, serving as a reminder of the importance of financial preparedness.

Final Thoughts

Last year was truly memorable for our family, especially with our maiden trip to Europe as a family. Moving forward, we plan to scale back on travel, aiming to reduce the frequency of our lengthy trips. Our goal is to have one major trip each year, complemented by shorter road trips to Malaysia or exploring Southeast Asia to better geo-arbitrage with our stronger SGD. We’ve already scheduled a trip to Melbourne for the June holidays and are considering a year-end getaway to Thailand with our extended family.

To enrich our leisure time, we intend to increase our visits to the library, making it an essential part of our family activities. We also aspire to incorporate more nature walks and park outings into our routine or maybe do some island hopping at Pulau Ubin, Lazarus, Sister’s , Kusu or St John Island. By fostering healthier habits that include regular exercise and proper sleep, we plan to actively utilize our Mandai annual pass to enjoy all the attractions with the newest wildlife park opening early this year. Our overarching aim is to spend less on paid leisure and pursue a more sustainable and healthier lifestyle.

This year, as we focus on reducing our mortgage and renewing our car’s COE, we’ll need to cut back on our overall spending. We plan to decrease our dining out budget, prepare healthier meals at home, set a smaller travel budget, and enforce a shopping ban except for essential replacements due to wear and tear. While some may perceive this as deprivation, it’s worth considering that we often have an abundance of unused items. Many clothes go unworn in our wardrobes, shoes remain untouched in their boxes, books sit unread on shelves, and a significant amount of food expires in our kitchens only to be discarded. Sounds familiar! Embracing this ban can help us recognize and appreciate what we already have.

Embracing minimalism has lightened our lives, allowing us to pursue our passions without the pressure of others’ expectations. Living on our own terms is a true blessing, and we hope to continue this way for the rest of our lives.

Minimalism isn’t about achieving perfection or easy living—it’s about embracing simplicity and imperfections.

Wishing all our readers a Happy New Year filled with joy and fulfillment!

Sharing some of our past reflections below: