As I sat down at the recent CPF Volunteer Appreciation dinner 2025 to reflect on the journey that has brought me to where I am today, I am filled with gratitude for the financial tools and resources that have helped me navigate life’s financial challenges. One of the most significant influences has been the Central Provident Fund (CPF), a system I have benefited from and now actively promote as a volunteer. My story is one of learning, growth, and resilience, which I hope will inspire others to embrace financial literacy in their lives.

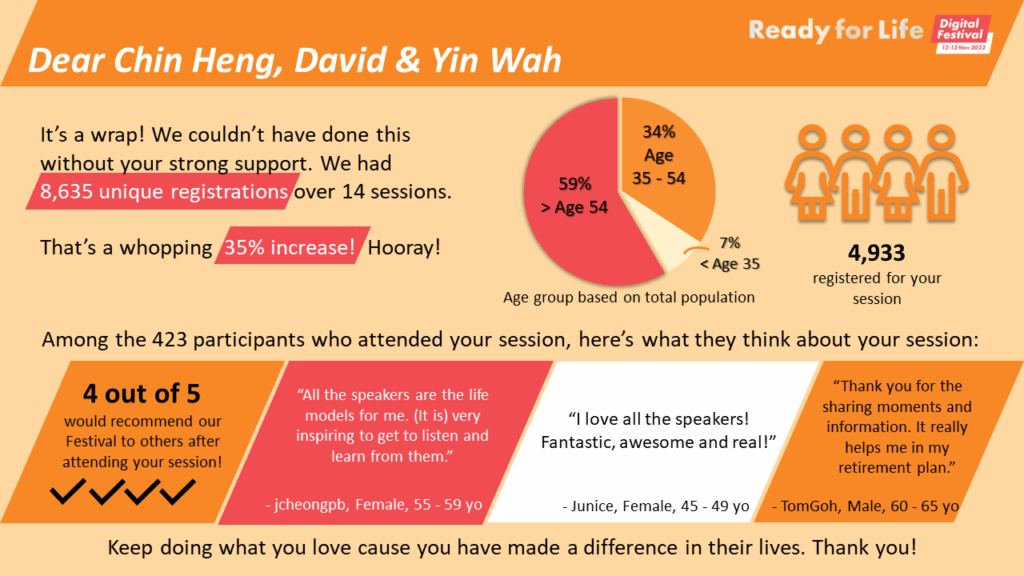

Nearly three years ago, I began volunteering for CPF. They discovered me through my blog, “Minimalist In the City,” where I first shared my experiences as a CPF speaker. The CPF system, rated as one of the best pension schemes globally by Mercer in 2024 , has provided me with a robust foundation throughout various stages of my life as well as my family’s life.

Table of Mercer CFA Institute Global Pension Index:

Singapore maintains its top position in Asia, advancing from 7th to 5th place followed by Hong Kong SAR in 25th and China 31st (https://www.mercer.com/en-sg/about/newsroom/mercer-cfa-institute-global-pension-index-2024/)

My advocacy for CPF is rooted in personal experience, as it has been a vital support during significant financial challenges in my family’s life. I began contributing to my CPF account in my teenage years, taking on part-time work from the age of 15 to help alleviate my family’s financial burdens as the eldest child. My days were filled with a mix of work, studies, and football. Those early CPF contributions proved essential when I witnessed my father using his CPF to fund both my brother’s and my education. Similarly, I was able to support my sister’s tertiary education, highlighting the profound impact CPF has had on our lives.

After joining the Airforce as a regular, my focus was on stabilizing our family finances. When my father was retrenched at 50, we faced a precarious financial situation. Fortunately, with the combined CPF OA savings of my family which includes my brother’s and myself, we made the tough decision to downsize from a 5-room HDB to a 4-room HDB. This allowed us to fully pay off our housing and prioritize being debt-free. That’s how I became a homeowner at an early age without even being married. This decision, though difficult, instilled in me the significance of financial planning and resilience.

Throughout this journey, I took personal responsibility for managing our finances meticulously. I even took on DIY home renovations to save costs, which included painting the entire house, installing electrical wiring, removing old built-in cabinets, and setting up new ones from Ikea, along with accepting pre-loved furniture from friends and family. We also started building an emergency savings fund, laying the foundation for our financial stability.

Despite the security offered by my Airforce career, my desire for financial independence led me to explore entrepreneurship. I ventured into the private sector with a variety of projects, including starting a company, purchasing a van to provide delivery services alongside my father and brother, and eventually venture into a franchise business.

My significant breakthrough occurred when a good friend approached me to start a franchise. At our peak, we operated 6 to 7 outlets, and our annual revenue exceeded the 7-figure mark. I eventually left my full-time job to dedicate myself to the business, but this period was short-lived due to differences with my partner. As the business was still in its early stages, I found myself with a 6-figure debt that took several years to repay. To restart my career as an employee, I took a maternity cover contract position in banking.

These experiences were pivotal, teaching me invaluable lessons in entrepreneurship, albeit leading to financial challenges that I overcame with persistence.

During this entrepreneurial phase, I realized the need for a backup plan. I pursued a finance degree, which equipped me with the knowledge to become a more competent investor. Building investment portfolios for myself and my parents was a turning point, leading to their comfortable retirement now (Their retirement blog post here).

I really do not know why I had so much energy during then to work full-time, run a business on the side and took night classes.

Looking back, it’s remarkable how much I was able to accomplish—with determination and a supportive partner, who is now my wife. Despite the ups and downs, our CPF savings remained intact, allowing us to invest in our marriage, create an emergency fund, and finance our first BTO apartment entirely through CPF. After being in debt for a few years, I became very risk adverse and build up our family’s finances from ground up making sure that certain financial foundations and guardrails are in place.

As a family, we have embraced a minimalist lifestyle, consciously keeping our expenses low while avoiding lifestyle inflation and prioritizing financial stability through active money management, including budgeting and tracking our expenses. For the first seven years of my elder daughter’s life, we made a conscious effort to live without a car to bolster our financial reserves, ensuring that our future remained secure. This minimalist approach inspired us to start our blog. We dedicated ourselves to designing our first home to be well-furnished, functional, and easy to maintain, all without the need for a helper.

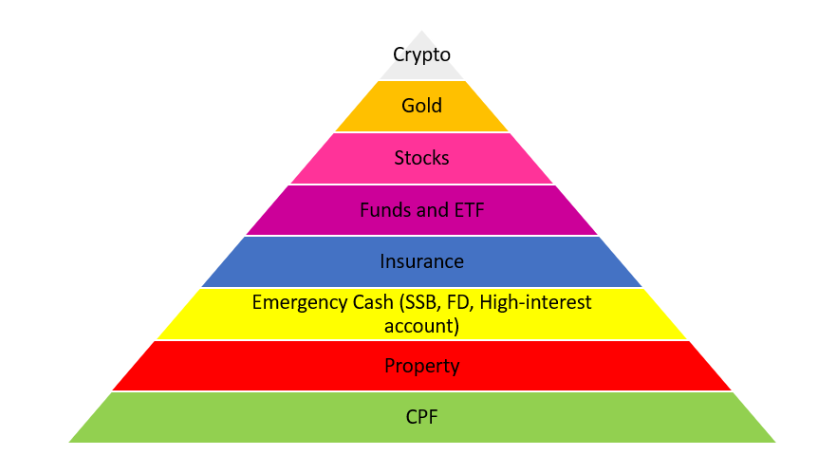

In just over a decade since I restarted my life from my business exit, we have achieved several financial independence milestones, including reaching our CPF Full Retirement Sum through strategic top-ups and establishing a multi-layered financial foundation (as outlined below). With this security, we feel empowered to pursue careers and endeavors that align with our values. You can read more about our plans for Life 2.0 in this post here.

Today, I am a certified financial planner dedicated to helping others build their financial futures with CPF as a foundation and safety net. I leverage my personal experiences to guide clients in establishing strong financial safeguards before expanding their portfolios.

CPF has been a reliable ally throughout my journey, supporting me during financial challenges and enabling my current role as both a volunteer and fee-based financial coach. Through my volunteer work with CPF, I aim to empower others to harness the benefits of financial literacy, transforming challenges into opportunities. Together, we can create a future where financial security and independence are within reach for everyone. My ultimate goal is to ensure that you experience growth in financial security and find comfort in it from a mental perspective, rather than simply pursuing material wealth, which often contradicts societal expectations.

Hi David, reading your personal story (from entrepreneurial success to debt, to self-employment and financial independence) is very inspiring. Thanks for sharing your story!

Thank you, Richard, for reading my blog! I’m sharing my personal story in the hope of encouraging others during tough times. I believe that independence is more about mindset and expectations than about wealth itself. Many wealthy people remain caught in the constant race for more. That’s why I advocate for minimalism which is to encourage people to be content with what they already have and live a fulfilling life, rather than always craving for more.