November is the month that we celebrated Ashton’s first birthday and it was not that long ago when he first arrived into our family. It also marks the first month that Kate goes back to work after a long hiatus. We hosted a birthday celebration party for Ashton at our home with our family and close friends. Our guests also enjoyed the space and it was a good and cozy gathering.

Recently, my brother also bought an apartment and remodelled his place with the minimalist concept as core. I am glad that I was able to introduce him to this minimalist lifestyle and he really see the benefits of adapting to this new lifestyle. My parents are also slowly appreciating and adapting to minimalism and I’m pretty impressed by their ability to adapt at their age. Below are some snippets of his new home:

We had decluttered our house towards the end of the year and we gave away quite a bit of the kiddos’ old toys and clothes to local charities. Decluttering seems to be a much easier and manageable process when you do it more often, and also when you are a more conscious consumer. One of the most common questions that we get is how we manage the toys at our place, especially with two young kids. For us, we typically try to get rid of the old ones before we get new ones. We also try to limit the space for them to store their toys as there are limited storage space allocated for their toys. Interestingly so, a study also mentioned that a child typically only plays an average of 12 toys out of 238 toys they own. This is about 5% of the toys which is quite an astonishing figure that should bring attention to the adults that a child does not really need that much toys at all.

Many parents had also share with us that their children quickly got bored of their toys which in fact, is pretty common. In the article on “16 Experiences to give your kids (instead of more stuff)“, the author also explains:

“Boredom actually helps to promote happier, more creative kids who are ultimately better problem solvers. When our children are allowed to use their own creativity with unstructured play, they find ways to amuse themselves — even if it means simply daydreaming.”

Especially for this year, we have also tried focusing on providing them with experiential gifts and activities, and often organizes outdoor trips including to the zoo, beach, aquarium, amongst others. Many of these activities also involved our extended families, and they were activities which everyone of us thoroughly enjoyed, regardless of age. Having say that, we are not negating gifting toys to kids, but perhaps in a way, we are trying to be more conscious with physical gifts. This also forces us, as parents to be more creative in our approach in entertaining our children and realigns our focus in participating in events together as a family. We are actually in control of our children and how they live their life to a large degree. With the holiday season coming up, we hope that this would provide some food for thought for parents.

On a more intriguing note, Kate and I were debating really hard this year whether we should be getting a Christmas tree. We made one for Ally last year, or rather she helped made one and it was a pretty fun experience for us. Coincidentally, our kind neighbor decided to give us theirs as they were planning of getting rid of it. Such sharing of resources within the community is also one aspect of encouraging continuous sustainability, as resources are not wasted, but reused and recycled in other respects. This is also a great aspect of community living, and we certainly hope to see more of such sharing mindset being cultivated (which seems to be getting more popular these days!)

Fitness Update

Recently, I tore my right knee ACL (Anterior Cruciate Ligament) during a soccer friendly game. Although these days, I play mainly recreational soccer on a not-so-frequent-basis. I was just ten minutes into the game when I felt a loud snap in my knee and realised something was wrong. The very next day, I was referred to an orthopedic surgeon who felt that my condition warranted an MRI scan immediately. My worse fear came true when he showed me the results of the scan — it was a complete tear of my right ACL. In case you were wondering, it was also the same injury that had prematurely ended Michael Owen’s 2006 World Cup campaign. The orthopedic gave me two options: physiotherapy or surgery.

I was really down the initial days but after having chat with a couple of friends who are also physiotherapists themselves, they explained my condition and in fact, it seems like there were many athletes who were still able to function professionally despite their ACL tear. My friends advised against surgery if I will not be engaging in sports that requires a lot of knee twisting motions. And also, they were very positive that I could still run, cycle and trek even without undergoing the surgery. A couple of research on the internet also featured other individuals with similar encounters that that was settling in a way.

I opted for physiotherapy and the therapist had initially thought that mine was just a partial ACL tear by doing a initial assessment of my right knee movements. She was really surprised when I showed her my MRI scan. Perhaps my yoga sessions had helped to strengthen my knee muscles which in turn created a strong fitness base. I have been diligently following through the physio exercises and according to my therapist, am on track to go back to slow jogging before Christmas. Hopefully the improvements will also mean that surgery won’t be a necessity.

My weekly fitness routine – Post ACL tear

(To strengthen my glutes, quadriceps, hamstrings and calves):

1) Daily static exercise routine (4 sets of each exercise for both legs):

1. 12 x Front supported single leg squat

2. 12 x Tip-toe front supported leg squat

3. 12 x Split squat

4. 12 x Standing single leg raise

2) 1 x Staircase climbing 30 levels up and down plus static exercise on both ground and top level. (Done during lunch time in my office building)

3) 1 x 3 km brisk walk (average 8 – 9 mins / km pace)

4) 1 x Yoga Lesson

5) Using the Great Eastern Get Great app and enrolling in the National Steps Challenge , I’m currently trying to average 10,000 steps daily and redeem vouchers.

Family

Below are some of the simple activities we do on weekends:

Visit to our neighborhood park where our kids saw the lotus flowers, dragonflies, rare bird species and pond.

Clockwise: Ally wearing PJ Mask, Ally planting project at her pre-school and the siblings rare occasion watching cartoon together

Financial Update

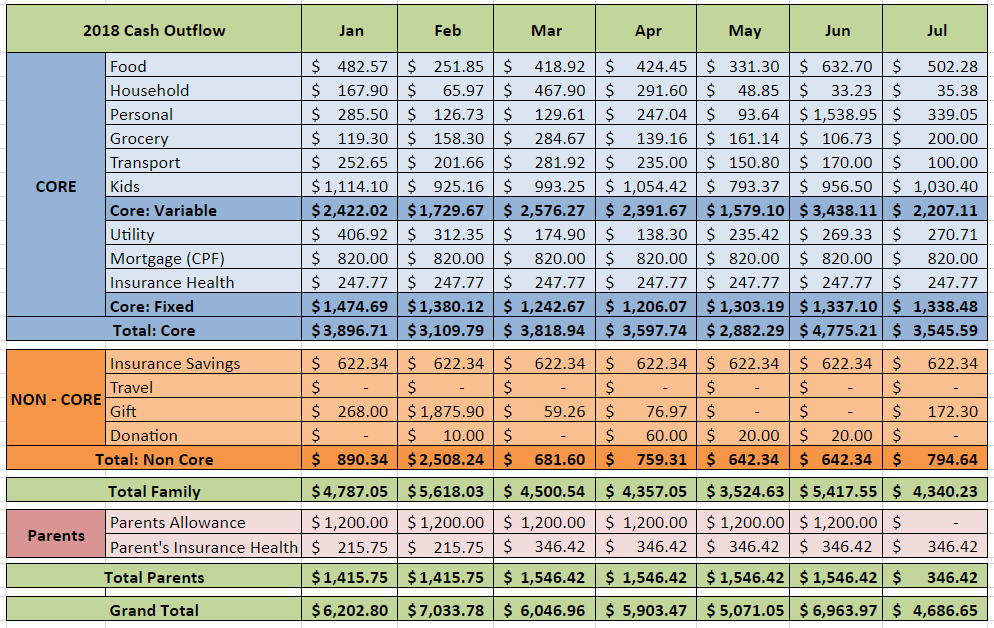

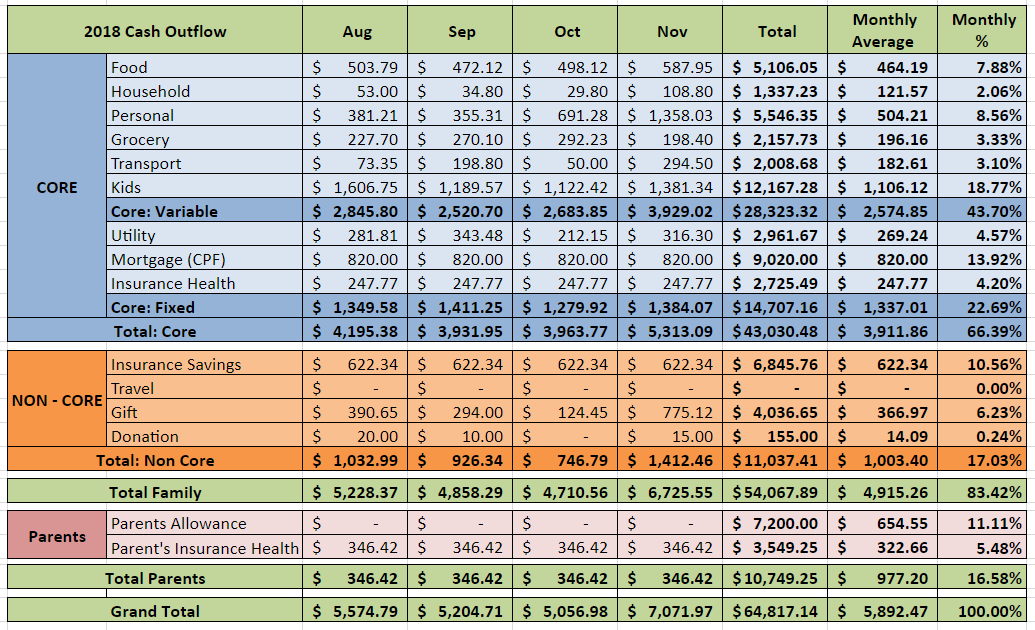

We had managed to compile our November cash outflow and below is a snapshot:

FAMILY ($6,725.55)

Core: Variable ($3,929.02)

Food ($587.95)

$587.95 – Meals for our family of four (this includes snacks and drinks, etc.)

Household ($108.80)

$27.90 – Newspaper subscription for Kate’s parents

$80.90 – Household necessities

Personal ($1,358.03)

$10.00 – Dave’s haircut

$11.00 – Dave’s futsal session

$19.90 – Dave’s swimming goggles

$87.80 – Dave’s Toiletries

$879.00 – Dave’s mobile phone

$49.00 – Kate’s Hair brush

$169.27 – Kate’s Skincare and Toiletries

$129.50 – Kate’s clothes and shoes

$2.56 – iCloud 50 GB storage (monthly fees for Dave and Kate)

Groceries ($198.40)

$292.23 – Mainly groceries and some other household items from the supermarket

Transport ($294.50)

$230.00 – Ezlink card reload for both of us (for bus and train rides)

$64.50 – Cab rides

Kids ($1,381.34)

Ally

$850.00 – Full day child care for Ally (inclusive of some optional enrichment class)

$235.00 – Arty Learning Feb 2019 course fees (4 sessions + deposit)

$55.10 – Activity books

$16.90 – Water Bottle

Ashton

$16.50 – Kids Amaze (indoor playground)

$45.00 – Train rides (10 rides)

$10.00 – Clothes

$152.84 – Diapers / misc

Core: Fixed ($1,384.02)

Utility ($316.30)

$130.52- Electrical/Water/Gas

$78.00 – Property Services and Conservancy Charges

$107.78 – Mobile / Internet

Mortgage ($820.00) – Paying using our CPF. 20 year bank loan (First 3 years fixed interest and floating on the 4th year onward pegged against the FHR9 rate). We would like to maintain an arbitrage on this home loan as the interest is less than 2% and we might repay it in full should the interest spike up when we reach FI.

Insurance – Health ($247.77) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Non-Core ($1,412.46)

Gifts ($775.12)

$707.42- Asher’s birthday celebration (Buffet lunch + cake)

$29.80 – Dave’s colleague farewell gift

$37.90 – Christmas gift

Gifts ($15.00)

$15.00 – Temple and charity

Insurance – Savings ($622.34) – Insurance premiums – includes savings and whole life policies (annual premiums amortized into 12 months)

PARENTS ($346.42)

Insurance – Health ($346.42) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Note:

Note:

– This monthly cash outflow report is use mainly to gauge our post FI expenses

– We included Insurance Savings as part of our cash outflow until they are fully paid up. The reason is that we will most probably still be paying for them even if we reach FI. We do acknowledge that this is not an expense but it is still a cash outflow nonetheless unless we monetize the accrued cash value of the savings policies.

– For an explanation on the above new categorization, you could refer here

– For our 2017 cash outflow full analysis, please click here

FI target family cash outflow (excluding parents) = $5,000 per month (core $3,500 and non-core $1,500)

Summary

Family ($6,725.55):

Core ($5,313.09)

This month our family core cash outflow is the highest this year mainly due to my purchase of the new mobile phone (Kate’s early Christmas gift) to finally replace my almost 4.5 years old mobile phone. We also prepaid for Ally’s new art enrichment class which will start next year. With Kate going back to work, our transportation costs also went up.

Non-core ($1,412.26) :

This category is also above average due to Ashton 1st birthday celebration.

Parents ($346.42):

We finally reduce our parents allowances significantly by topping up with an initial lump sum into their retirement account (CPF Life) which will guarantee payment to them for a lifetime. This will transfer the reliance on us to give them cash allowances to CPF Life which works like an annuity. So we are now only paying for their health insurance which should slowly creep up as they age.

Grand Total ($7,071.97)

We spend about $7 k based on the overall cash outflow this month and it is also our highest spending for this year mainly due to Ashton’s birthday celebration and the purchase of my new mobile phone. For the month of December, we expect some feasting which will spike up our cash outflow towards the end of the year.

What was the month of November like for you?

Hi, would like to know which charities do you donate babies/children things to? I have some milk powder which i would like to donate. Thank you. 🙂

Maybe you can try this link https://honeykidsasia.com/charity-singapore-donation/

how much screen time do you allow your children?

We do not have an iPad thus their screen time is an average of 1-2 hours on days that we allow them to watch TV. There are no screen time on most of the days as we prefer to engage them in outdoor activities or do art and craft activities at home.