This month is where we feast as we kind of allocated more funds for food indulgence after we done most of our streamlining on all our other expense categories. We also try out Deliveroo for the first time to celebrate my father’s birthday where we lunch at the comfort of our own home. We could actually eat quality seafood without the hassle for things like paying taxes and service charge (we just need to pay for a flat delivery fee of $3.50), transportation to and fro from restaurant and also time to queue up. This might be the new way to celebrate all our birthdays going forward.

Kate and myself also started to take the private express bus from our place to office in the morning nowadays. The express bus might be pricier but it does provide us with good level of comfort and convenience. The pick up point is located at the bus stop below our home and we have our own seats throughout the whole journey.

Kate also bought a Ukelele for us to learn together as i always wanted to learn how to play a guitar. I guess an Ukelele with 4 strings should be easier to play as compared to a guitar and we shall see how the learning goes. Ally is also watching us learn as we found another family activity.

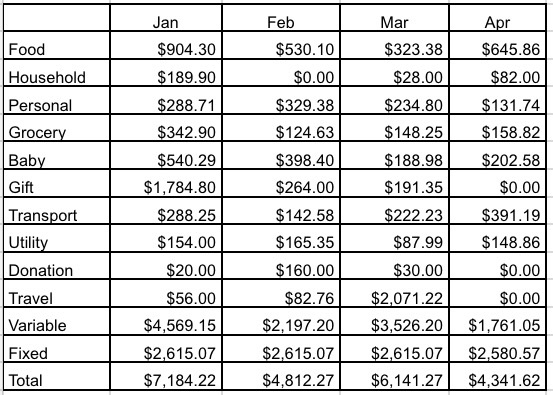

We have managed to compile the breakdown for our April 2017 expenses as below.

Food ($645.86)

$527.36 – Mainly meals for the three of us (this includes snacks, and drinks, etc.)

$118.50 – Dave’s father birthday lunch

Household ($82.00)

$43.00 – purchases from Daiso and other misc

$39.00 – Buy one get one free single bed sheet

Personal ($131.74)

$75.75 – TCM consultation for Kate’s mother

$27.49 – Bought an Ukelele via online shopping

$10.00 – Haircut for Dave

$18.50 – Other personal stuff

Grocery ($158.82)

$158.82 – mainly groceries and other household items from the supermarket

Ally ($202.58)

$202.58 – Diapers, snacks, toiletries and misc

Transport ($391.19)

$320 – Ezlink card reload for both of us (for bus and train rides)

$71.19 – Cab rides

Utility ($148.86)

$145.99 – Mobile phone bills and Internet

$2.87 – Electric, gas and water bill (one time $50 government rebate for month of April)

Monthly Fixed Expenses ($2580.57)

$400 – Half day child care for Ally

$29.90 – Newspaper subscription

$34.50 – Property Services and Conservancy Charges (one time 50% government rebate)

$1,200 – Parents allowance

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

$913.59 – Insurance premium (annual premiums amortised into 12 months)

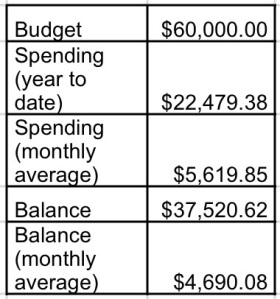

Total Expenses = Total variable expenses $1,761.05 + Total fixed expenses $2,580.57 = $4,341.62

Note: We did not include our mortgage in this annual budgeting because we are using CPF to pay for our monthly instalments. Another reason is we will most probably be clearing off our mortgage upon reaching FI, thus this budgeting is use to gauge our post FI expenses.

We incurred our lowest expenses of the year this month and we were quite surprise that we could actually pull this off as we are spending a lot more on food and transportation this month. Many people would have thought that being frugal means compromising on good food and forgoing comfort. In our case, we never felt that our frugality actually lowered our standard of living. We were just allocating all those impulse purchases into things that we felt is more important to ensure a sustainable and better life. I think this should be how our expenses would look like for the rest of the year.

I would recommend more people to record their expenses as you never know what is actually restricting you from reaching your financial goals. Challenge yourself and test your limits. You will slowly uncover that you do not need a lot of things to make you happier and at the same time you might become less reliant on money to bring you happiness.

Thank you for sharing. I’m really interested in seeing how we do. I keep a rough housekeeping diary but it’s hard to track when we are constantly in and out of one country.

Basically we just input all these expenses into an app. For your case, you might need to record it in different currency and then do a conversion at month end. You need to know what is your main objective of recording all these. For us, we did it diligently as our end goal is financial independence.