April is the month where we celebrated my father’s 65th birthday. It is a milestone achieved in a way, as he will also be receiving his first CPF payout. He is currently working part time as a private hire driver and most likely would not require the payouts for his monthly expenses except for overseas travels. Almost a decade ago, I had helped them to build a dividend-focused portfolio which should be able to further secure their retirement years.

This however, has never been that easy. Especially since my father had made many financial mistakes in his younger days, when my siblings and I were younger. Money wasn’t managed properly. And in a way, he did not know how to manage that. Living paycheck to paycheck, our household encountered quite a few financial distress situations but we are all glad and grateful for the position that we are in today.

Recently, I had met up with a friend whom I had previously featured in a post on our blog. He is an inspiring figure and planned to travel to all seven continents in the world just before the age of 35. At the beginning of this year, he managed to cover two more continents (Antarctica and South America) and will be travelling to Africa this year to watch the animal migration.

One of the more mindblowing events according to him was witnessing the breakaway of icebergs due to climate change. This phenomenal is happening on a more regular basis and it struck a chord with many of the people in the group who were witnessing it first hand.

And here’s what he has to share:

“Climate change is real. It is happening but we can do something about it. Let’s do it before it’s too late and become latent for our future generations”.

For our household, this year’s focus is very much on climate change and trying to live more sustain-ably. For a start, I had also piloted some initiatives at my workplace with the help of our company’s sustainability committee. We have pioneered a year long zero waste campaign which focuses on creating awareness on reducing waste and living sustain-ably by adjusting some of our daily habits. This included a sustainability talk to kickstart the campaign, a sustainability fair, outings and activities which include visits to the zero waste shop, beach clean-ups, landfill visit and monthly zero waste challenges. Hopefully, this will create awareness towards global warming and climate change and the realism of them all.

The experience has been overwhelming and it not only created awareness of this topic amongst my co-workers, but it also attracted like-minded people who are very passionate towards this common cause on climate change. People in the office even shared their suggestions to improve the waste issues we have. This is an extremely fulfilling process and I am glad that I had the chance to make a change, be it a small one and inspire others to do their part.

As many of you might have already heard or watched, Netflix had recently launched “Our Planet“, a documentary series narrated by Sir David Attenborough which features the effects of climate change around the world. Kate and I watched it with Ally and Ashton and despite their tender age, we felt that they had a subtle understanding of what is happening based on the narration and we as parents, will also continue to work towards educating our kids on this awareness. This is an extremely powerful documentary and we would highly recommend everyone to watch it.

Below are some of the simple activities we do on weekends

Clockwise from top left – Ashton is a natural right legger! Kate and kiddos overlooking the pond filled with turtles and feeding them, Ally having a great time at a public pool with great slides

Visit to the Jewel at Changi airport with Ally having fun in one of their indoor playground

Visit to our community farm which we saw eggplant, bananas, lady’s finger, aloe vera and papayas

Financial Update

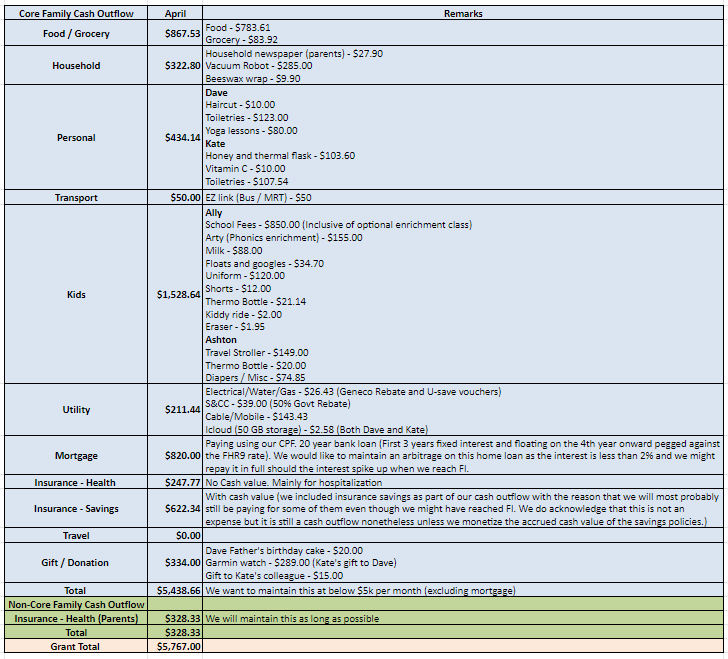

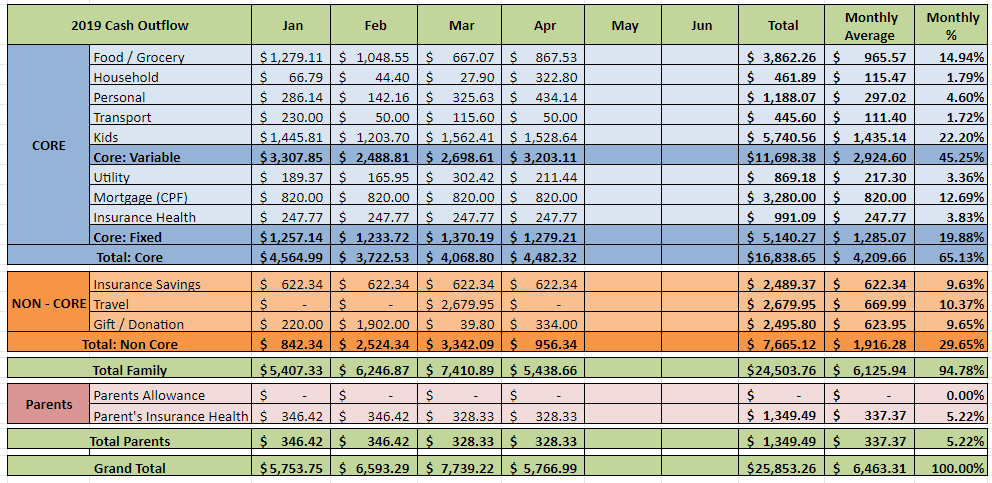

We had managed to compile our April cash outflow and below is a snapshot:

Note:

Target FI family cash outflow (excluding parents and mortgage) = $5,000 per month (core $3,500 and non-core $1,500)

Family:

Core is the variable / fixed cash outflow incurred for the month as “operational expenses”. This is the minimum to run our household comfortably and is the amount we will still be incurring even when we are not working.

Non-core is the category that includes travelling, donations/gifts, savings insurance and things that will enhance our happiness level, security and sense of purpose over the long run. Our savings insurance policies are also place here to show that these are additional savings we have and we might monetize this when our kids gets older. We think that these are important elements to move higher up on the pyramid under the Maslow’s hierarchy of needs. We want to maintain this as long as possible to have something to look forward in future.

Parents:

We finally reduce our parents allowances significantly by topping up with an initial lump sum into their retirement account (CPF Life) which will guarantee payment to them for a lifetime. This will transfer the reliance on us to give them cash allowances to CPF Life which works like an annuity. We would like to continue paying for their health insurance as long as both of us are still gainfully employed.

All insurance figures shown are amortized over 12 months.

Summary for April

Family ($5,438.66):

Core ($4,482.32)

This month our core spending is above than our target spending of $3.5k by almost $1k mainly due to kids expenses (additional $500), robot vacuum cleaner ($285) and stocking up of toiletries ($200).

Non-core ($956.34) :

This is below our target spending of $1.5k even with Kate’s purchase of a Garmin watch for Dave who is very focus on his fitness in recent months in preparation for his ACL surgery in July.

Parents ($328.33):

We are currently paying for their health insurance which should slowly creep up as they age.

Grand Total ($5,766.99)

Our overall cash outflow this month is about $5.7k. We will hit below the $5k target if we exclude our mortgage which we intend to payoff in about two years time. For the first 4 months of this year, we spend more or less the same as last year (2018 – $25.2k and 2019 – $25.8k) with a difference of $600 more this year. Next month, the spending should spike up due to another travel to Hiroshima, Japan. We shall see how this will pan out as we go along.

What was the month of April like for you?