March is the month where we tagged along for Kate’s business trip to Hong Kong. Dave’s family came along as well and we all had a great time there. We visited Hong Kong Disneyland and thoroughly enjoyed ourselves! Both adults and kids! We all had a fun time there. It is quite possible that we will make another trip up there again in the near future. The rest of the few days there, we were just slowly exploring Hong Kong city via the different transport mode like ferry, trams and trains which the kids love.

Just before our Hong Kong trip, we also went to Disney on Ice and Ally went crazy when Elsa, the character from Frozen made its appearance. The kids enjoyed the whole show with great singing, dancing and performance by the various Disney characters. Ally could confidently named most of the Disney characters and to be honest, even we were pretty surprised by her level of “knowledge” of the stories, and songs etc.

Below are some of the simple activities we do on weekends

Hong Kong Trip photos

Financial Update

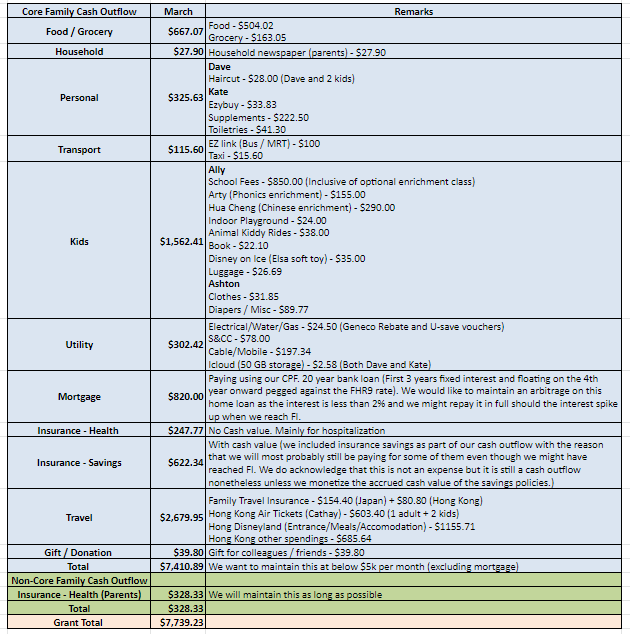

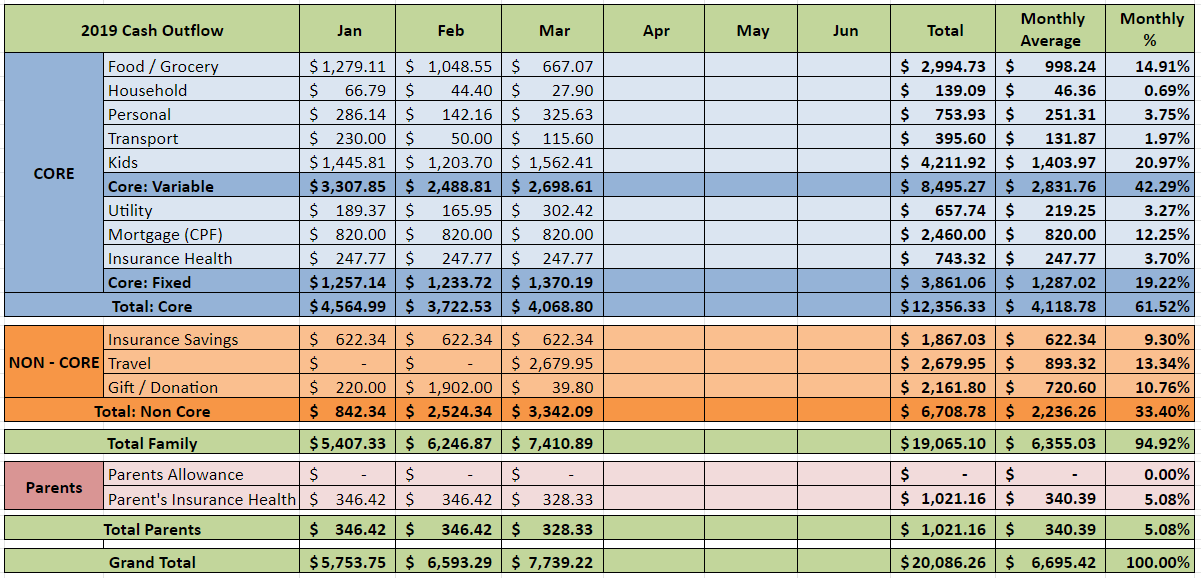

We had managed to compile our March cash outflow and below is a snapshot:

Note:

Target FI family cash outflow (excluding parents and mortgage) = $5,000 per month (core $3,500 and non-core $1,500)

Family:

Core is the variable / fixed cash outflow incurred for the month as “operational expenses”. This is the minimum to run our household comfortably and is the amount we will still be incurring even when we are not working.

Non-core is the category that includes travelling, donations/gifts, savings insurance and things that will enhance our happiness level, security and sense of purpose over the long run. Our savings insurance policies are also place here to show that these are additional savings we have and we might monetize this when our kids gets older. We think that these are important elements to move higher up on the pyramid under the Maslow’s hierarchy of needs. We want to maintain this as long as possible to have something to look forward in future.

Parents:

We finally reduce our parents allowances significantly by topping up with an initial lump sum into their retirement account (CPF Life) which will guarantee payment to them for a lifetime. This will transfer the reliance on us to give them cash allowances to CPF Life which works like an annuity. We would like to continue paying for their health insurance as long as both of us are still gainfully employed.

All insurance figures shown are amortized over 12 months.

Summary for March

Family ($7,410.89):

Core ($4,068.80)

This month our core spending is slightly above our target spending of $3.5k mainly due to Ally’s enrichment class quarterly payment and bulk purchase of supplements. We also changed our electricity supplier to Geneco with fixed rate for the next 2 years and will probably reap in 30% savings as compared to current electricity tariff rates.

Non-core ($3,342.09) :

Our first overseas trip this year as the whole family tag along for Kate’s business trip. This also bumps up the cash outflow in this category where travel is one of our main priority this year.

Parents ($328.33):

We are currently paying for their health insurance which should slowly creep up as they age.

Grand Total ($7,739.22)

Our overall cash outflow this month is about $7.7k with the Hong Kong trip which cost us $2.6k. But I guess this is money well spent for our first trip this year and we are already looking forward to our next trip in May. We spend about $19.3k for the 1st quarter of last year and in comparison this year we just spend slightly more at $20k mainly due to the Hong Kong trip and increase in kids expenditure. This is offset by the absence of parents allowances when we topped up our parents CPF Life account last year. Most of our travelling should be mostly done by the first half of this year thus its expected that the first half spending to be more than our second half. We shall see how this will turn out.

What was the month of March like for you?

Nice, you’re averaging ~$6,000 excluding holiday expenses. Guess you live in HDB and don’t own a car.

Lots of expenses on kids at this stage. Strangely those expenses could well be lesser when they grow up to schooling age. But other expenses start to increase in turn – e.g. electrical bill, mobile phone, food, households, etc.

Thanks for popping by! We are still trying to balance out the kids expenses thus I expect it to go down when both of them attend primary school. But of course, you still got to think about their swimming, enrichment, piano classes etc. Guess overall it will still go down and we shall keep you guys updated.