February is the month where we celebrated Chinese New Year and our birthdays – both Kate and I are born in the same month. We did a gift exchange based on our personal wish list and had a simple celebration with our families. This is the 11th year we have been celebrating our birthdays together and we look forward to many good years ahead!

Since the COE has been hovering on the lower tail end, for the past few months, we have been toying the idea of getting a car. Ultimately, we still have not made the move to purchase. Despite a lower COE, the cost of car ownership in Singapore is still rather significant, and especially so if you compare it with the rest of the world. One of the main reasons is due to the fact that our parents on both sides of our respective families also own a car and sometimes, we could just borrow the car from them to use for a day or two (usually just on weekends). Otherwise, we actually take public transport pretty often, be it the trains or buses and even taxis. Generally, we find it a hassle to drive on weekends as the roads are simply too jammed pack. Don’t even get me started on parking…. Also, with ride-hailing apps, it has also gotten a lot more convenient to get around these days and we enjoy being chauffeured around from point to point without the need to park and retrieve your car. And on a green note, we would like to reduce our carbon footprint and support a car-lite society.

On a separate note, a few of my colleagues raised their concerns with regards to the rising interest rate for their mortgage as they are paying few hundred dollars extra each month as compared to just a year ago. It is likely that the interest rates will continue to trend upwards. We had also received updates that the interest rate for FHR9 has risen from 0.25% to 1.35% which would have potentially brought our mortgage interest rate close to 3% should we had not fixed our interest rates for the first three years. So we are not fretting about the interest rate. At least for now. By the end of next year, we should have set aside enough money to fully pay off our loan should we choose not to re-finance our home mortgage.

At the same time, with Kate back at work and Asher getting bigger, we are finally planning for an overseas trip!

In fact, we will be heading to Hong Kong end of March due to Kate’s work commitments as we thought it would be a great opportunity to bring the kids along and visit Disneyland!

Separately, we are also planning another trip in May and the cover picture provides a snapshot of where we are heading to. Anyone wants to take a guess?

Below are some of the simple activities we do on weekends:

Visit to zerowaste shop and experimenting to use own tupperware and utensils for takeaway lunch at work.

Ally having fun!

Ally’s flower finally bloom!

Financial Update

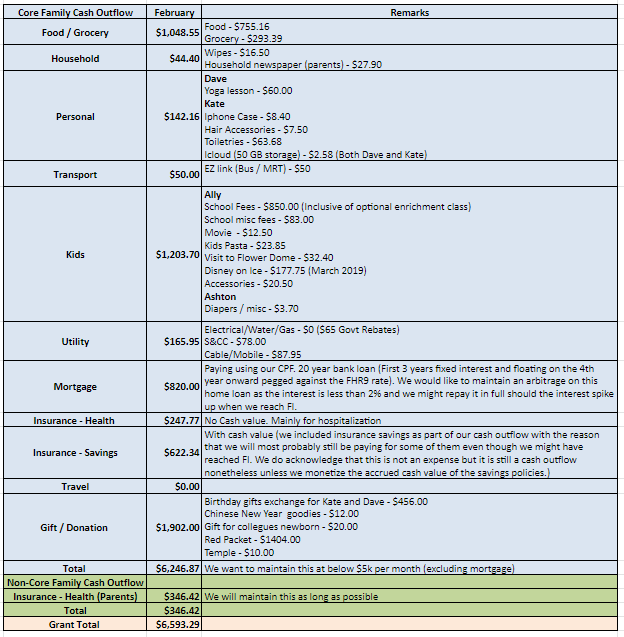

We had managed to compile our February cash outflow and below is a snapshot:

Note:

Target FI family cash outflow (excluding parents and mortgage) = $5,000 per month (core $3,500 and non-core $1,500)

Family:

Core is the variable / fixed cash outflow incurred for the month as “operational expenses”. This is the minimum to run our household comfortably and is the amount we will still be incurring even when we are not working.

Non-core is the category that includes travelling, donations/gifts, savings insurance and things that will enhance our happiness level, security and sense of purpose over the long run. Our savings insurance policies are also place here to show that these are additional savings we have and we might monetize this when our kids gets older. We think that these are important elements to move higher up on the pyramid under the Maslow’s hierarchy of needs. We want to maintain this as long as possible to have something to look forward in future.

Parents:

We finally reduce our parents allowances significantly by topping up with an initial lump sum into their retirement account (CPF Life) which will guarantee payment to them for a lifetime. This will transfer the reliance on us to give them cash allowances to CPF Life which works like an annuity. We would like to continue paying for their health insurance as long as both of us are still gainfully employed.

All insurance figures shown are amortized over 12 months.

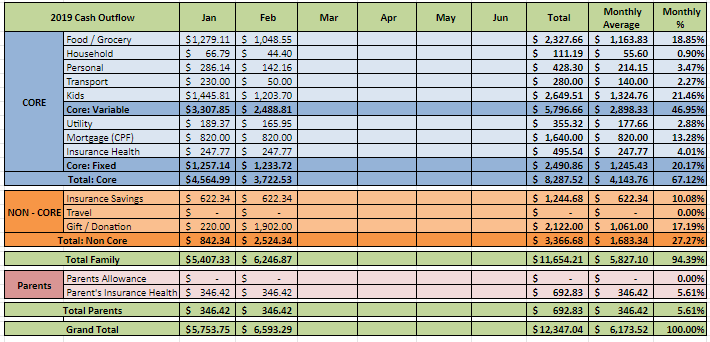

Summary for February

Family ($6,246.87):

Core ($3,722.53)

This month we spend quite a bit on food and groceries as we celebrated Chinese New Year. This category is close to our target FI target of $3.5k which we hope to maintain throughout this year.

Non-core ($2,524.34) :

We also spend quite a bit on red packets and gifts as we celebrated Chinese New Year. Kate and I also did a gift exchange as we share the same birthday on the same day of this month.

Parents ($346.42):

We are currently paying for their health insurance which should slowly creep up as they age.

Grand Total ($6,593.29)

Our overall cash outflow this month is about $6.6k and if we were to exclude our mortgage and Chinese New Year related cash outflow, our spending should be close to $3.9k which is way below our FI target spending. We hope to maintain our spending level like last year with no big cash outflow except for travels. We shall see how this year will turn out.

What was the month of February like for you?

Japan Hiroshima prefecture?

Enjoy your hols!!!

Spot on! But majority of the time, we will be in Shikoku!