January is the month where we start a new year and reflect on our previous year as mentioned in Kate’s post. Last year, we spent a lot of bonding time with our two precious kids and Asher also turned one last November. Kate, with her one year sabbatical over, is back at work and adjusting well to the new environment . With Chinese New Year in early February, we are looking forward to plenty of gatherings with families and friends.

Blogging had slowed down since last year as its difficult to find pockets of personal time once you have two young kids. We are conscientiously cutting down our screen time and focusing more on spending quality time with our kids and each other. We also thought about taking a blogging sabbatical similar to fellow blogger, Thomas from 15HWW as we are currently juggling quite a bit right now. But we do find value in our monthly updates thus we will still continue to do it but in a simplified form.

Our focus for this year will include travelling (something which we didn’t get to do last year), sustainable living and health and wellness. On the financial front, we will probably still invest if there are pockets of opportunities and also building up our war chest.

Below are some of the simple activities we do on weekends:

Visit to Gardens by the Bay to see Chinese New Year decorations and Ally saw a rainbow. Ally’s very first movie with Daddy and she enjoyed the whole experience.

Ally getting better with her steering and braking skills on her new bike.

Touring a new public library at North Point City and we really enjoy the comfort of our new age library.

Financial Update

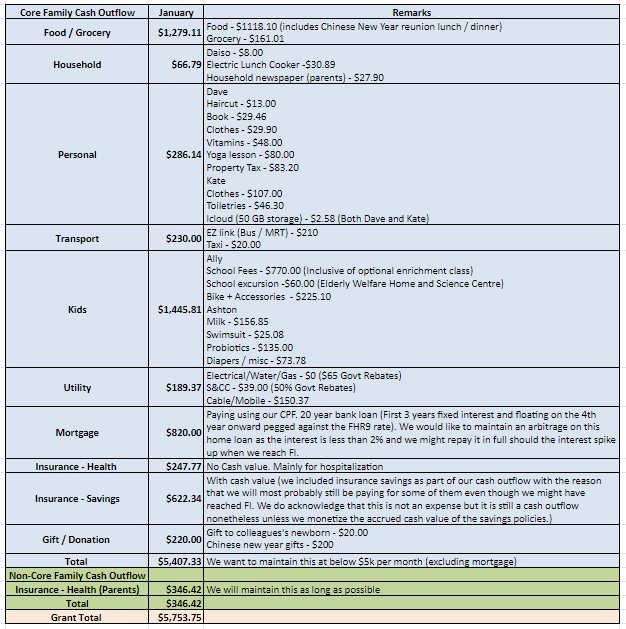

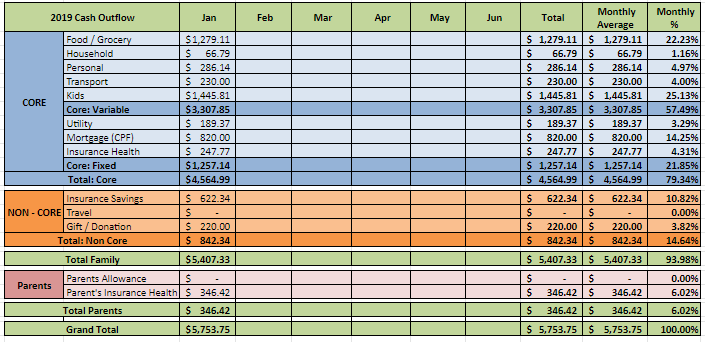

We had managed to compile our January cash outflow and below is a snapshot:

Note:

Target FI family cash outflow (excluding parents and mortgage) = $5,000 per month (core $3,500 and non-core $1,500)

Family:

Core is the variable / fixed cash outflow incurred for the month as “operational expenses”. This is the minimum to run our household comfortably and is the amount we will still be incurring even when we are not working.

Non-core is the category that includes travelling, donations/gifts, savings insurance and things that will enhance our happiness level, security and sense of purpose over the long run. Our savings insurance policies are also place here to show that these are additional savings we have and we might monetize this when our kids gets older. We think that these are important elements to move higher up on the pyramid under the Maslow’s hierarchy of needs. We want to maintain this as long as possible to have something to look forward in future.

Parents:

We finally reduce our parents allowances significantly by topping up with an initial lump sum into their retirement account (CPF Life) which will guarantee payment to them for a lifetime. This will transfer the reliance on us to give them cash allowances to CPF Life which works like an annuity. We would like to continue paying for their health insurance as long as both of us are still gainfully employed.

All insurance figures shown are amortized over 12 months.

Summary for January

Family ($5,407.33):

Core ($4,564.99)

This month we spend quite a bit on food as we had an early lunar new year dinner with family and relatives which is a yearly affair. We also bought a bike for Ally who started to cycle with trainer wheels. We hope she could cycle with us along park connectors soon with Ashton in a child seat.

Non-core ($842.34) :

We bought some Chinese New Year gifts for family and relatives.

Parents ($346.42):

We are currently paying for their health insurance which should slowly creep up as they age.

Grand Total ($5,753.75)

Our overall cash outflow this month is about $5.8k and if we were to exclude our mortgage, our spending should be close to $5k which is close to our FI target spending. Next month, a spike in overall spending should be anticipated due to Chinese New Year.

What was the month of January like for you?

Hi Dave,

I realise that you do not have a domestic helper! How do you manage that??

Cheers,

Naro

Hi Naro, we relied on grandparents from both side and ourselves. Ally is in childcare thus its easier. The only challenging part is Ashton but he will also be going childcare this year soon. Housework all done by ourselves.

Now I understand why ppl say that it takes a village to raise a family. The family support system is very important.

Respect your family that you can handle the household chores and the kids without helper. Its very tiring.

Cheers,

Naro

It really takes a village to raise kids comfortably and its tiring indeed. But you will feel great satisfaction and appreciate your family more. We believe that we should do our own household chores so that you will appreciate all the things in your house.