This month we have a couple of birthday celebrations with our immediate family members and Ally ‘s early birthday celebration. We ate out for Kate’s father birthday and celebrated my mum, my grandma and Ally’s birthdays together where we feasted at home with home cooked food courtesy of Kate’s wonderful culinary skills. Everybody enjoys eating and chilling out at our minimalist home. Nowadays, we tend to organize most of our birthdays at home whereby we don’t have to spend a lot on food but we get to eat very nice home cook food or we could just order from Deliveroo . Dining out requires booking or queuing, travel to and fro from restaurant, usually more expensive, the lack of privacy and its usually noisy with the crowds. The conversations coupled with laughter within the comfort and warmth of our home draws us closer to each other. I would recommend people to celebrate birthdays at their home which is more cost efficient yet it does not lack any element of a joyous event. Creating a cost efficient lifestyle might be the key towards our financial independence journey.

Yes, our girl is turning 3 soon in Sept and time really flies. Its really a pleasure to see her grow up day by day. As she really enjoys playing jigsaw puzzle, we bought her a 100-pieces world map jigsaw puzzle for her birthday. Even though its meant for 5 years old and above, we think its really educational and meaningful as we could teach her names of animals or buildings of which country they represent. We wish that we could arouse her curiosity about this world and she could become a world traveler in future.

We believe in spending more time outdoor as kids are fascinated by anything they see. All these simple activities might teach her how to appreciate the simpler things in life. Just to share some of Ally’s outdoor activities with pictures as below.

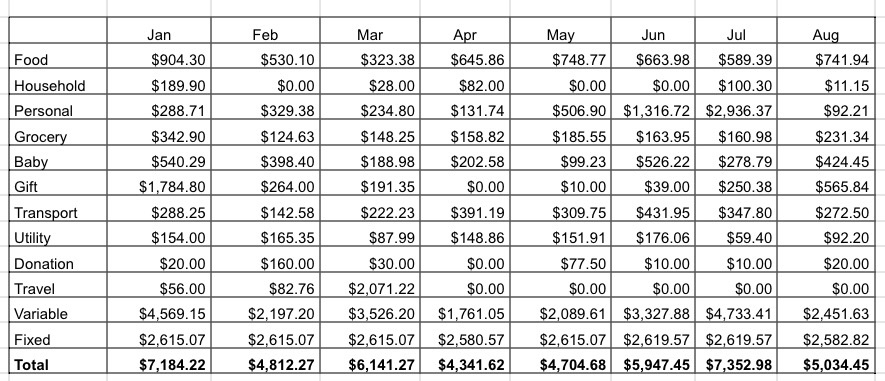

We managed to compile the breakdown for our August 2017 expenses as below.

Food ($741.94)

$741.94 – Mainly meals for the three of us (this includes snacks, and drinks, etc.)

Household ($11.15)

$7.40 – disposables plates for gathering at our place

$3.75 – household stuff from Japan Home

Personal ($92.21)

$32.21 – Kate’s toiletries and facial care

$36.00 – Kate’s supplements

$12.00 – Dave’s haircut

$12.00 – Dave’s AHM running event (5km team run)

Grocery ($231.34)

$231.34 – mainly groceries and other household items from the supermarket

Ally ($424.45)

$25.00 – School excursion to Hay Dairies Goat Farm

$30.00 – World Map jigsaw puzzle from ELC (Ally’s early birthday gift)

$129.00 – Milk Powder

$240.45 – Vitamins and probiotics

Gift ($565.84)

$118.65 – Kate’s father birthday

$92.00 – Kate’s friend birthday

$29.70 – Ally’s teachers day gift

$125.49 – Christmas gifts from Taobao

$200 – Dave’s red packet for Grandma’s birthday

Transport ($272.50)

$200 – Ezlink card reload for both of us (for bus and train rides)

$72.50 – Cab rides (plus some Grab credits top up)

Utility ($92.20)

$54.40 – Mobile phone bills and Internet

$37.80 – Electric, gas and water bill (government partial rebate)

Donation ($20)

$20 – temple

Monthly Fixed Expenses ($2582.82)

$400 – Half day child care for Ally

$29.90 – Newspaper subscription

$36.75 – Property Services and Conservancy Charges (Includes government 50% rebate)

$1,200 – Parents allowance

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

$913.59 – Insurance premiums includes savings, whole life, hospital and surgical, home insurance (annual premiums amortized into 12 months)

Total Expenses = Total variable expenses $2,451.63 + Total fixed expenses $2,582.82 = $5,034.45

Note: We did not include our mortgage in this annual budgeting because we are using CPF to pay for our monthly instalments. Another reason is we will most probably be clearing off our mortgage upon reaching FI, thus this budgeting is use to gauge our post FI expenses.

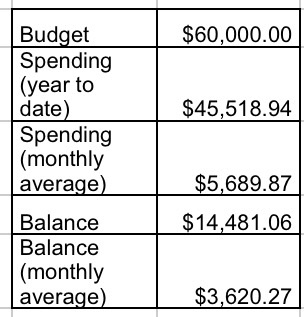

We are really please to be spending close to our monthly average of $5k even though we have multiple birthday celebrations this month. We are now left with the last 4 months to work with and i doubt we could stay within our annual budget of $60k this year but its a good reference towards our future setting of our annual budget. Hopefully we could stay within 5 – 10% of our annual budget this year.

We are really grateful with our simple lifestyle nowadays and we hope that we could maintain this lifestyle. How was your August expenses?

You’ve done an amazing job in savings Dave. I’m envious, because it must take a lot of willpower I sadly don’t have! Congratulations on doing so well with the mortgage too!

Thanks! Actually we can still do better but I guess having a bit of free play on the budget is good. We kept the mortgage as the interest is very low and we intend to clear it when we reach FI if required. I believe everyone can do it.

Hi may I know what kind of app do u used to keep track of your expenses? Thanks

Hi Cynthia, I’m using the money journal lite. It’s pretty easy to use and can export under excel file. There may be other apps available that might be better but this works fine for us. Give it a try!

How come your insurance premiums so high? Are they savings or what? If savings then shouldnt classify as expense.

Hi Lucas,

Thanks for pointing that out as majority of it are savings plan. We classified that as our expenses for now as long as we have not finish paying the premiums. Because these are all cash outflow from our cash account on a monthly or annual basis.

So so pleased to come across your website! I thought the FIRE scene was somewhat muted in Singapore so it really makes me happy to find like-minded folks on the little red dot 🙂

We have just started blogging about our journey a few weeks ago based out of Singapore 🙂

Hi Ms Kokonut, nice to meet you here and it’s nice to see another couple who are on the same journey as us! Like what you said, there’s not that many of us around 😛

I found your website “again” while searching for minimalists in Singapore. Figured I’ve been following you anyways. 🙂 I’m really glad to see your budgeting here because we are moving to Singapore in a few months and I was wondering if we can get by with 6k (that is, if I can’t find a job straight away. This is my husband’s salary) After seeing your post, I think I’ll manage with something around 5k too, after the initial expenses. Thanks a lot!

Hi Pelin, thanks for revisiting our blog. You can definitely get by with less than $5k a month in Singapore but you need to consider your rental fees too as rental here is not cheap. Our expenses are meant for family of three thus with inclusion of family commitments. Therefore, if there are just two of you, you should be able to stay within your budget even if you are not a minimalist. Enjoy your stay here in Singapore!