December is the month that we hosted a baby shower for our son, Ashton. I’m also clearing most of my annual leaves so as to take a breather from work and also spend some quality time with the family.

As we were pretty busy with a newborn this month, we didn’t really have time to blog. In addition, Kate and Ally both had fallen ill and it was pretty tiring for us to manage. Going forward, we might not be posting as frequently but will still try to aim for at least 2 posts a month. As per our earlier post where we shared our reflections for 2017, we would continue our journey towards a minimalist lifestyle as a family and hope to share those snippets with our readers.

Ally’s favorite sea animal is the manta ray after we went to our local SEA Aquarium in December. We even watched some videos and borrowed some books on manta rays from our local library. Now she knows what a manta ray eats, how it swims and how it breathes. She is so fascinated about it in one of the videos that she said she want to go to Churaumi Aquarium in Okinawa (which is one of the most impressive aquarium in the world) Probably that might be our next potential family trip when Ashton is slightly older.

Below is a picture the Churaumi Aquarium, Okinawa

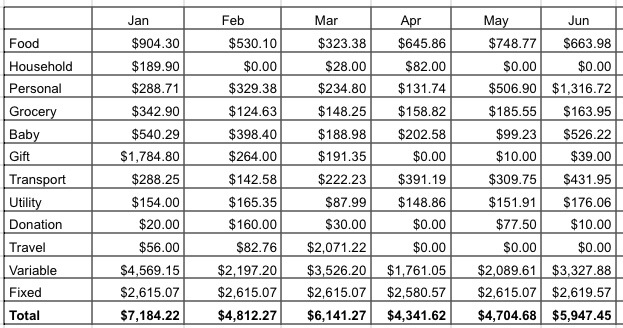

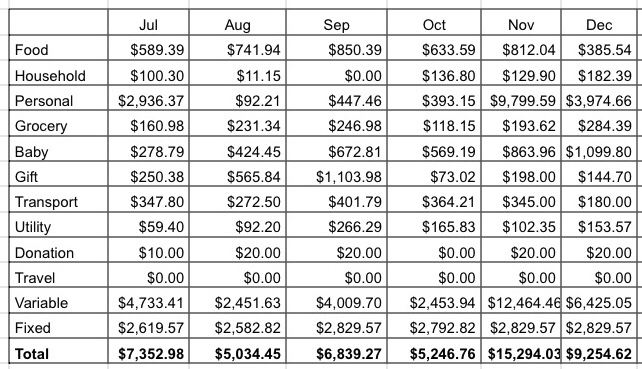

We had finally managed to compile our December expenses and below is a snapshot of how our Dec expenditure profile is like:

Food ($385.54)

$385.54 – Mainly meals for the three of us (this includes bread, snacks, and drinks, etc.)

Home ($182.39)

$38.00 – Repair of toilet door (I seriously didn’t think we would start to incur home repair fees so early on.)

$144.39 – Household necessities

Personal ($14.00)

$14.00 – Dave’s haircut

Personal – Pregnancy related ($3,960.66)

$2950.00 – Confinement Lady

$570.00 – Post Natal Massage

$15.50 – Nursefeeding wear

$136.06 – Confinement and health supplements

$229.00 – Pregnancy related consultation (excluding claims and other payments by Medisave).

$60.10 – TCM – (Traditional Chinese Medicine for Kate when she had fell sick)

Grocery ($284.39)

$284.39 – Mainly groceries and other household items from the supermarket

Ally ($20.00)

$20.00 – Childcare year end performance photos

Ashton ($1079.80)

$616.32 – Baby Shower Buffet

$92.04 – Baby clothes

$53.55 – Sterilizer

$$317.89 – Formula milk, toiletries and misc

Gift ($144.70)

$116.00 – Dave’s Christmas gift for Kate 🙂

$28.70 – Christmas gifts and cards

Transport ($180.00)

$80.00 – Ezlink card reload for both of us (for bus and train rides)

$100.00 – Cab rides (plus some Grab credits top up)

Utility ($153.57)

$153.57 – Mobile phone bills, Internet & Utility bills

Donation ($20.00)

$20.00 – Children’s Charity for Christmas

Monthly Fixed Expenses ($2829.52)

$610 – Full day child care for Ally (inclusive of some optional enrichment class)

$29.90 – Newspaper subscription

$73.50 – Property Services and Conservancy Charges

$1,200 – Parents allowance

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

$913.59 – Insurance premiums – includes savings, whole life, hospital and surgical, home insurance (annual premiums amortized into 12 months)

Total Expenses = Total variable expenses $6,425.05 + Total fixed expenses $2,829.57 = $9,254.62

Note:

- This monthly expense report is use mainly to gauge our post FI expenses

- We included whole life and savings insurance as part of our expenses until they are full paid up. The reason is that we will most probably be still paying for them even though we reach FI.

- Our insurance also includes our parents’ health insurance

- We did not include our mortgage in this annual budgeting because we are using CPF to pay for our monthly instalments. Another reason is that we will most probably be clearing off our mortgage upon reaching FI.

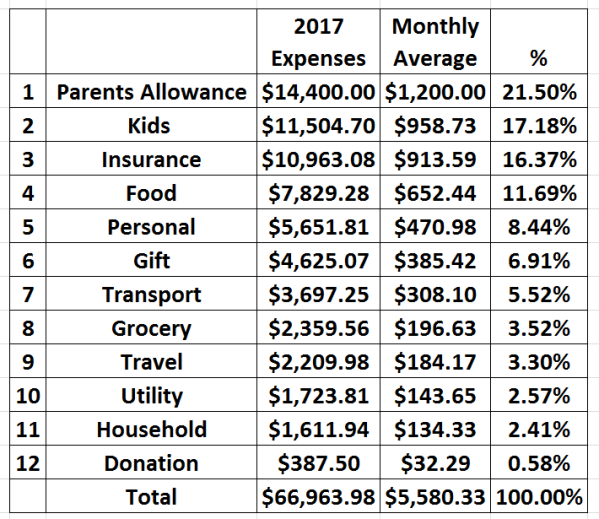

Analysis of 2017 expenses

Total Expenses 2017 = $50,009.28 (Variable) + $32,144.34 (Fixed) = $82,153.62

Pregnancy related expenses = $15,189.64.

Total Expenses 2017 (excluding pregnancy related expenses) = $66,963.98 (Exceeded Budget of $60k by 11.6%)

When we first budgeted for this year, we did not really factor in the pregnancy expenses and Kate’s pregnancy came along only after we had worked out the 2017 budget. Hence, we had excluded pregnancy expenses in this full year expense analysis. Nevertheless, we had exceeded our budget of $60,000 set at the start of last year by $6,963.98 (11.6%) which we would consider reasonable since there were a few things that were pretty unexpected along the way. Below is a breakdown of our expenses (excluding pregnancy related expenses).

The biggest chunk of our expenses came out to be our parents allowance ($14,400 – 21.50%). This could be a lesser chunk for many families but for us, we would like to maintain this as long as we are still employed. We might bring this figure down upon reaching FI. We are also paying for their health insurance ($2,580) shared with our siblings. If we were to exclude these two components, our overall expenses will be about closer to $50,000 annually or $4,165 per month for a family with kids. We will also need to include our mortgage of $820 per month which will add our overall expenses at $4,985 per month. This will better reflect our expenses as a family and Kate also previously blogged about this in a separate post.

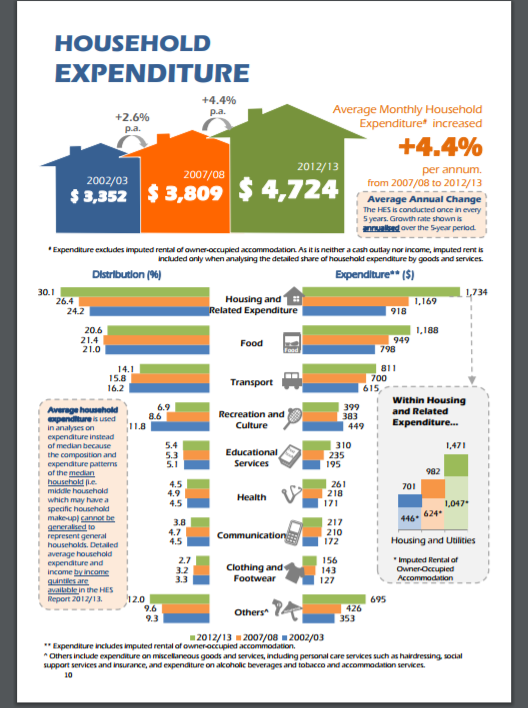

The Singapore’s Average Monthly Household Expenditure survey shows that a typical household spends about $4,724 for year 2012/13 (The next survey 2017/18 should be out some time this year). If we were to factor in annual inflation of 2% to correctly reflect the 2017 estimated figure, the figure would be around $5,215 (note that this does not include parents allowance nor their corresponding health insurance).

Overall core family expenses = $4,985 per month (exclude parent’s allowances and their health insurance)

Average Monthly Household Expenditure = $5,215 per month (estimated)

In conclusion, we spend much lesser than what a typical Singapore household would have spend. That shows that we going towards the right direction of spending lesser.

Source: http://www.singstat.gov.sg/docs/default-source/default-document-library/statistics/visualising_data/highlights-of-household-expenditure-survey-20122013.pdf

For now, we have decided not to set any budget for 2018 but will like to maintain our Overall core family expenses at below the estimated Average Monthly Household Expenditure of $5,215 per month (estimated). Having said that, we would still share our monthly expenses update to provide a glimpse of our expenditure and spending patterns. We will also display our expenses differently to better reflect our core family expenses.

We hope that this will provide a reference of how a household expenditure pattern for a family with kids living in Singapore. We do not intent for this to be some sort of competition or comparison but we are trying to showcase our minimalist lifestyle by not spending more to enhance our happiness. We are also not scrimping and saving to the core. We are seeking to strike a nice balance between spending, saving and happiness.

As for now, we are still trying to get use to our new addition to our family and enjoy our journey as a minimalist family. Do stay tune and hope you have a great year ahead!

What about you? What are your money goals for 2018?

Thanks for the share, Dave! Puts into perspective many challenges that I may have to face if I plan to start a family.

It’s really quite a challenge when you start a family and you try to implement minimalism into your family. But it’s a challenge we would like to take up to lead a more meaningful life. Hope it helps!

haha yeah! I’m just searching for the right partner who share the same goals and values. It’s tough!

I’m lucky to have Kate on the same page. All the best for your search.

Hi Dave, congrats on your second baby. I think your blog gives inspiration to many out there who are afraid of starting a family because of the costs involved… but of course having kids is not about the $$$. Just wondering if pregnancy expenses of $15k a norm? As I am not sure about the costs involved.. does it include everything including hospitalisation? $66k is quite decent for a family of three.. did you include mortgage inside? Oh, I forgot, you pay your mortgage with CPF… correct me if I am wrong.. I think $11.5k a year for raising one child is pretty decent 🙂

Thanks for reading our blog! I guess our pregnancy related expenses is definitely not on the low side but I guess its average. Bulk of it goes to hospital /doctor fees about $8k and confinement lady for $3k. We did not really try to budget for this. We just get what is needed and nothing more. And yes, we are paying our mortgage using CPF. We will try to display our expenses a bit differently next year to reflect our core family expenses as describe in the post. This is to let people have a better idea on how much you need to start a family. Hope our expense post helps you in your planning to start a family.