On 4th July, Americans celebrated Independence Day.

A little historical snippet of this day – back on July 4, 1776, the Second Continental Congress unanimously adopted the Declaration of Independence to announce the separation of the colony from the Kingdom of Great Britain. In a way, it was kind of similar to Singapore becoming an independent city state back in 1965. Its all about gaining certain level of independence and freedom.

In my first encounter with the word “Independent“, back then, as a kid, it meant being able to commute to school by myself. As the eldest of the 3 kids in my family, I always strive to reduce my dependence on allowances from my parents who were hustling hard to provide for the family. Thus, I started working much younger than my peers, and it did felt good that I did not need to rely on them for allowance, and that also provided some role modelling for my younger siblings. I bought my first mobile phone (yes the good old days!) for myself when I was 16 and it felt good that I was able to finance purchases with the money that I had earned myself.

What about the term “Financial Independence”? A quick search would yield several results and various definitions. However, by and large, this term is use to describe the situation of amassing sufficient wealth to live a life of comfort without the need to work. There are two variables in the above definition. How do you define comfort and work?

“In a recent TD Ameritrade survey of young Americans ages 15–29, 57% of respondents judged themselves to be financially independent by virtue of being able to meet their financial obligations without financial help from parents, grandparents, or others.”

So in between the two extremes as above, your own definition of financial independence might be somewhere in between them. In truth, financial independence can mean very different things to different people.

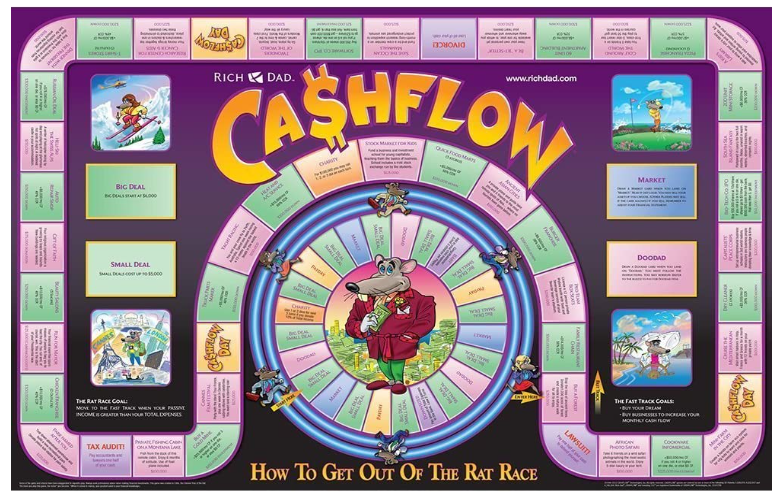

When I was introduced to Rich Dad Poor Dad, that was my first encounter with the word “Financial Freedom.” I started playing the Rich Dad Poor Dad Cashflow Game many years back, I was intrigued that most of the players who had chosen the high-paying professions like a doctor or lawyer did not manage to exit the Rat Race faster than a humble profession like a teacher or mechanic. That changed my entire mindset and what the game had taught me is that it’s not really the income that matters. It was really about exerting control over money, not the other way round.

What happens often is that when income increases, correspondingly, lifestyle inflation happens. This might include a bigger mortgage, bigger cars, lavish vacations, prestigious club memberships, fine dining options, etc. Essentially, It is not about how much you make, but what you do with it.

This, or the concept of it, to me, it’s like belief or religion. A lot of my views and perspectives are circled around the cornerstone of that. It shaped the way on how I craft our financial strategy for our family.

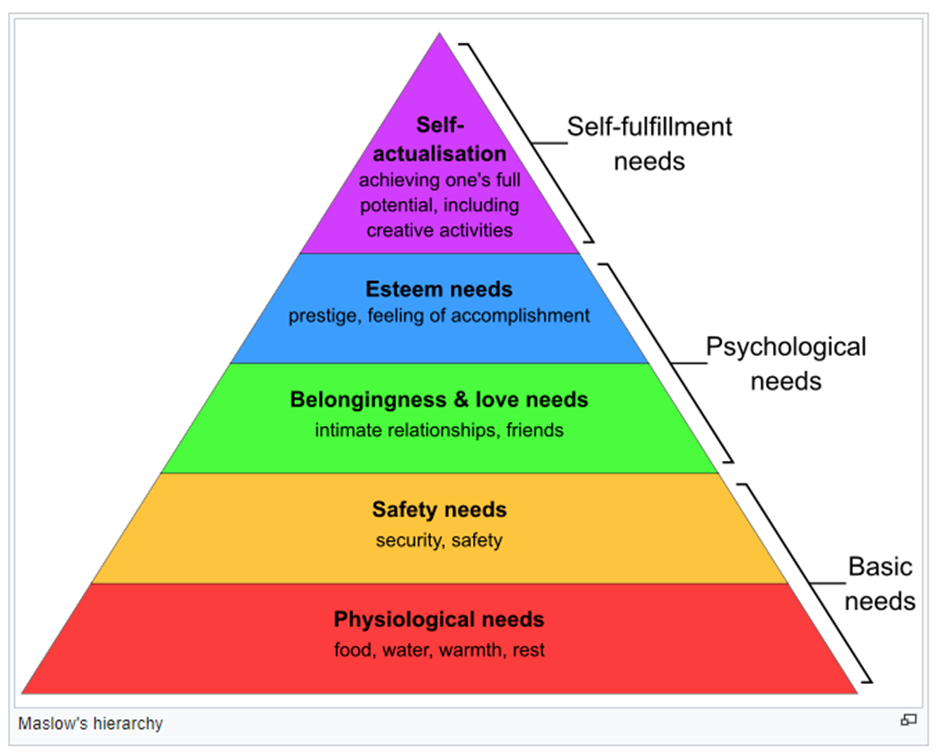

So how do we live a life that is fit for purpose for us as a family unit? Here, I’ll be introducing the Maslow hierarchy of needs – which you might be familiar with. If not, you can refer to the table below. According to Maslow, we humans, have a tiered layer of “needs”, starting with the basic level, and moving on the psychological level before reaching the self-fulfillment level. This might seem rather straightforward but the key is, it differs with everyone. What is considered a “roof over the head” would be different for everyone. For some, it might be a big house in the suburb, for others it might be a small HDB unit at the north of Singapore. You get the flow. Basically, what is considered “basic” is different for everyone and it is important for us to think about what we are seeking at each phase. The self-awareness is important.

As you slowly manage to move up the hierarchy, you might then achieve the final level, “self actualisation”.

I am humbled that over the past few years, I have had the opportunity to connect with many “Self-Actualised” individuals – many of whom are finding a lot of meaning, and the purpose in the work that they do, and also gelled in with their core values. Many of these individuals might not be considered rich and wealthy by mainstream societal standards. But they are self actualising and get connected to the work that they do.

It is not challenging to move up the Maslow’s pyramid. How do we actually self-actualise? Aside from the self-awareness of knowing yourself, strengths, personality, and what you really want to do, a huge part is also making sure that the lower tiers are covered. If to us, our basic idea of a place to stay is a upscale condo, then we will be spending more resources trying to achieve that and leaving less time and energy to explore what we can do up the ladder.

I am fortunate that both Kate and myself are “self-actualising” after executing our recent “Great Resignation“. We are into our passion roles that has a lot of meaning, and purpose, and creates positive impact for the society.

But we could have never achieved that if we have not changed our mindsets and how we view our concept of money, including how much we need, and the sort of lifestyle that we want to lead.

And the best part of it, it is not difficult to achieve. It requires some calibration, but it is not impossible.

And that I hope, serves as some inspiration for you.

Define your own Financial Independence Day!