Kate and my birthday both falls on the same day in February (what are the odds, even though I’m slightly older). Thus, we have been celebrating our birthdays together ever since we knew each other nine years ago. This year, we celebrated our birthday with a simple Chinese restaurant lunch and a family trip to the S.E.A aquarium. Nowadays, I guess the best thing we could celebrate our birthdays as a minimalist family is to spend more quality time together. It’s really a privilege to watch Ally grow up day by day and I guess she is the greatest gift ever bestow to us.

During this month, we also attended an interesting talk hosted by 6 Kids and a Pop-Up Camper. They are the famous Singapore family of 8 who spend 6 months travelling in USA on a pop up camper van. This couple who were former teachers have 6 kids age 3, 6, 9, 11, 13 and 15 years old. It is quite rare for Singaporean family to spend 6 months travelling especially with the education schedule in Singapore. Their kids are able to follow this dream because they are all homeschool by their mother, Sue Ong (who was the one who initiated for this trip when her husband decided to take a break from work).

We think that this is an inspiring story to show Singaporeans that it is possible to break away from the norm and we aspire to be like them.

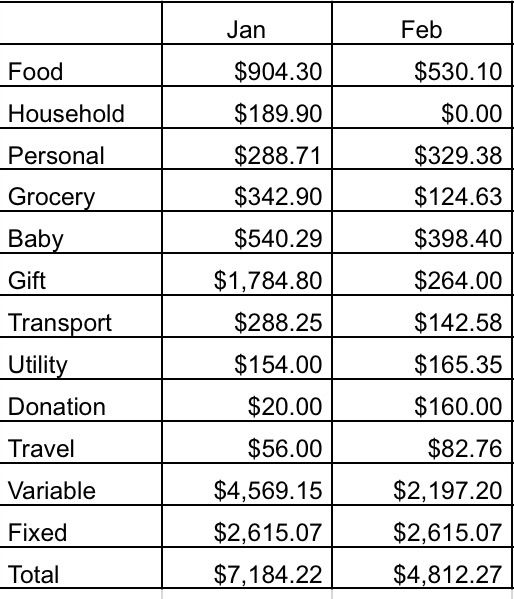

We have managed to compile the breakdown for our February 2017 expenses as below.

Food ($530.10)

$476.19 – Mainly meals for Kate and myself (this includes snacks, and drinks, etc.)

$53.91 – Simple birthday lunch for two of us and Ally

Personal ($329.38)

$187.38 – Skincare and cosmetics (for Kate)

$55 – Book purchase – 6 Kids and a Pop-Up Camper

$60 – Trip to SEA Aquarium for our birthdays

$12 – Dave’s haircut

$10 – Dave’s Futsal session with colleagues

$5 – Chinese New Year lottery

Grocery ($124.63)

$124.63 – mainly groceries and other household items from the supermarket

Ally ($398.40)

$28 – School excursion to watch a play at the esplanade

$250 – Music classes fees (prepaid for 10 sessions)

$37.80 – Milk powder (used up our $100 cash voucher to purchase milk powder on promotion)

$82.60 – Diapers, snacks and misc

Gift ($264)

$244 – Kate’s gift for Dave ( working clothes and pants)

$20 – Dave’s red packet for colleagues’s daughter one year old birthday

Transport ($142.58)

$88- Ezlink card reload (for bus and train rides)

$54.58 – Cab rides

Utility ($165.35)

$101.40 – Mobile phone bills and Internet

$63.95 – Electric, gas and water bill

Charity ($160)

$100 – food distribution to elderly (annual event)

$50 – colleague raising funds for her friend’s daughter who is suffering from a rare illness

$10 – donation to a local temple

Travel ($82.76)

$82.76 – Travel insurance for our upcoming Bali trip in March (for Dave’s family)

Monthly Fixed Expenses ($2615.07)

$400 – Half day child care for Ally

$29.90 – Newspaper subscription

$69.00 – Property Services and Conservancy Charges

$1,200 – Parents allowance

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

$913.59 – Insurance premium (annual premiums amortised into 12 months)

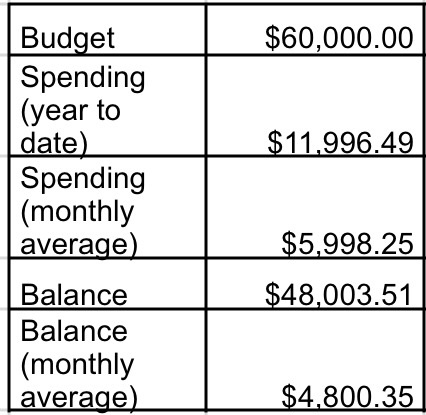

Total = Total variable expenses $2197.20+ Total fixed expenses $2615.07 = $4,812.27

Note: We did not include our mortgage in this annual budgeting because we are using CPF to pay for our monthly instalments. Another reason is we will most probably be clearing off our mortgage upon reaching FI, thus this budgeting is use to gauge our post FI expenses.

This month we managed to keep our expenses slightly below our monthly budget of $5000. As Feb is a shorter month, we really need to really streamline on unnecessary expenses going forward. Hopefully, this will be the likely monthly average for the rest of the months this year except those months when we might be traveling.

Next month, we have a family trip to Bali so expect our expenses to be higher for next month. So how are your expenses this month?