February is the month that Kate and I celebrated our birthdays which falls on the same day. How coincidental is that even though we are three years apart. Ashton also celebrated his very first Chinese New Year with us and I guess he is the centre of attraction for all our visiting done this year. We also had simple steamboat reunion dinner with both side of our family at home with the inclusion of our birthday cake. My brother bought us a nice Lemon and Yuzu cheesecake from Cat and the Fiddle and it was super delicious!!! A mild tinge of sweetness mired in some Vitamin C. I guess the best birthday gift for us nowadays are all the quality time we spent together with our family.

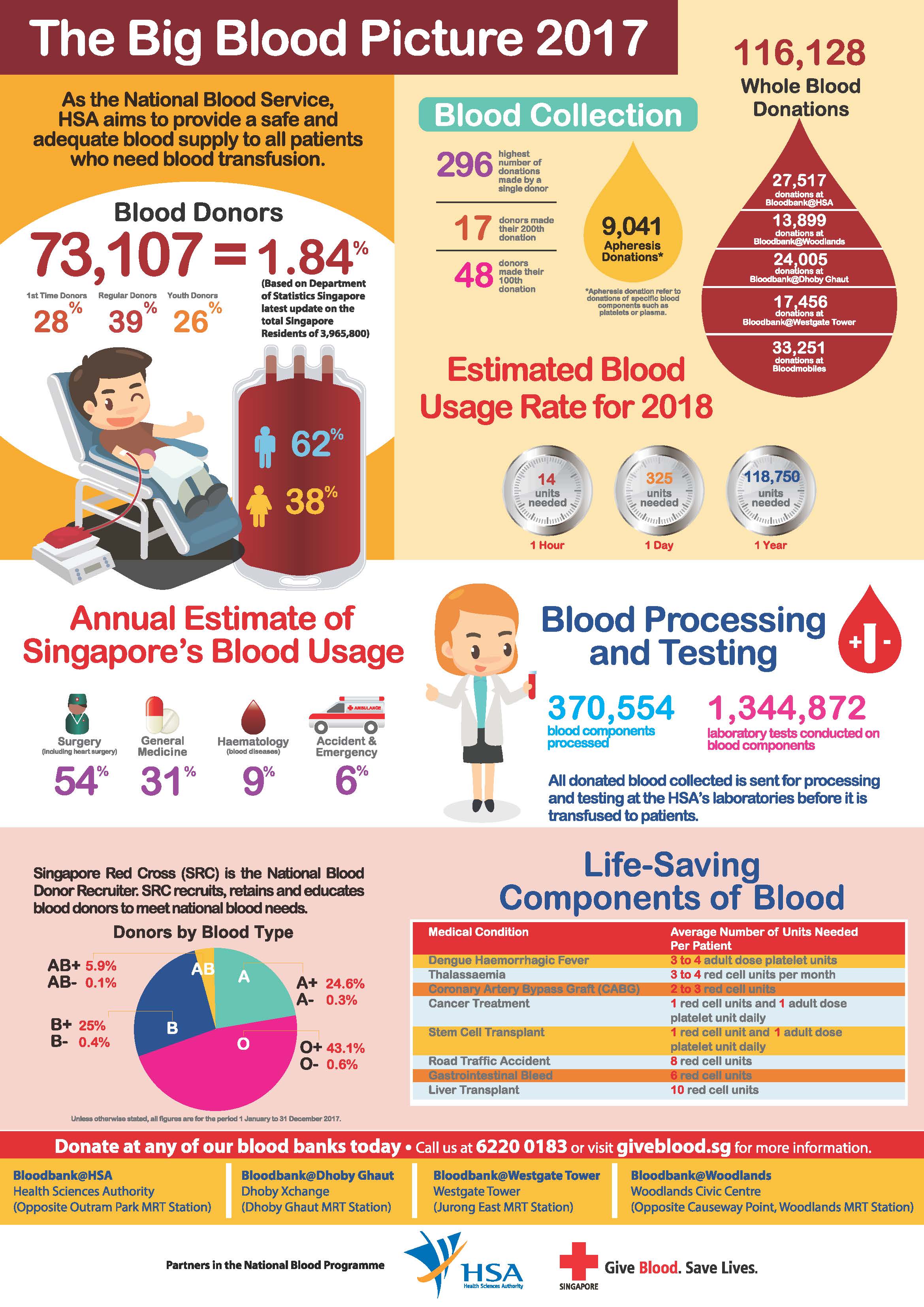

I donated blood on Valentine’s day and personally, I think that is one of life’s greatest gift. There are also some health benefits from blood donation, such as reducing the risk of heart disease and cancer and burning of calories. Also, to donate blood regularly is also an indicator of the good health of the donor.

The number of blood donors here is about 1.84% of the Singapore’s residential population. At the moment, the total number of whole blood donations are at 116,128 for 2017 which is still slightly lagging behind the estimated blood usage rate of 118,750 for 2018. I also saw a heart-warming moment during my blood donation session when a father brought his son for his first blood donation. Think I will also encourage Ashton and Ally to do the same once they turn 16 and hopefully there will be more blood donors in future to ensure adequate blood supply to all patients who needs blood transfusion in Singapore.

Recently, there was also an article about an inspirational 69 year old blood donor who had already donated 183 times during his lifetime and will continue to do so if his blood is still suitable for blood donation. I have donated more than 20 times so far and hopefully I could hit the century mark before i reach age 60.

Each unit of blood donated is typically divided into three primary components – red blood cells, plasma and platelets – and it can save up to three lives.

Fitness Update

Fitness Update

For a person who once participated in triathlons, marathons and competitive soccer, my current fitness routine is much more basic in comparison. After having a family and with two kids in toll, my fitness level has slowly fade away and only the yearly IPPT to keep my fitness in check (I had just finished my last reservist thus no more IPPT).

As I had injured my meniscus on my right knee, the main focus is to strengthen my knees and core muscles. These are the main reasons I had re-started a new minimalist fitness routine this year which is not too time consuming, low impact and manageable. In addition to that, I try to walk and climb the stairs more whenever possible just so to incorporate some form of exercise during my daily commute.

My weekly fitness routine:

1) Daily static exercise routine (every morning):

- 15 x squats

- 15 x one-legged squat for each leg

- 15 x lunges for each leg

- 30 x push ups

- 45 secs plank

2) 1 x Swimming 14 laps (using the ActiveSG free credit) and will cycle home for about 2km using the bike sharing platform (Ofo bike – currently they have a 2 months pass promotion for $1.50)

3) 1 x Staircase climbing 30 levels up and down plus static exercise on both ground and top level. (Done during lunch time in my office building)

4) 1 x 3km Slow jogging adopting the exercise method elaborated by Prof. Hiroaki Tanaka (injury-free running technique, allowing safe beginning and efficient progress. It’s the natural and gentle forefoot landing and small steps at high cadence)

Below are some of the simple things we do on weekends:

Our delicious birthday cake and Chinese New Year reunion dinner

Ally scooting around in the park while enjoying the nice scenery and fresh air.

Ally trying to simulate the lion dance done on high poles with her Lego blocks

Financial Update

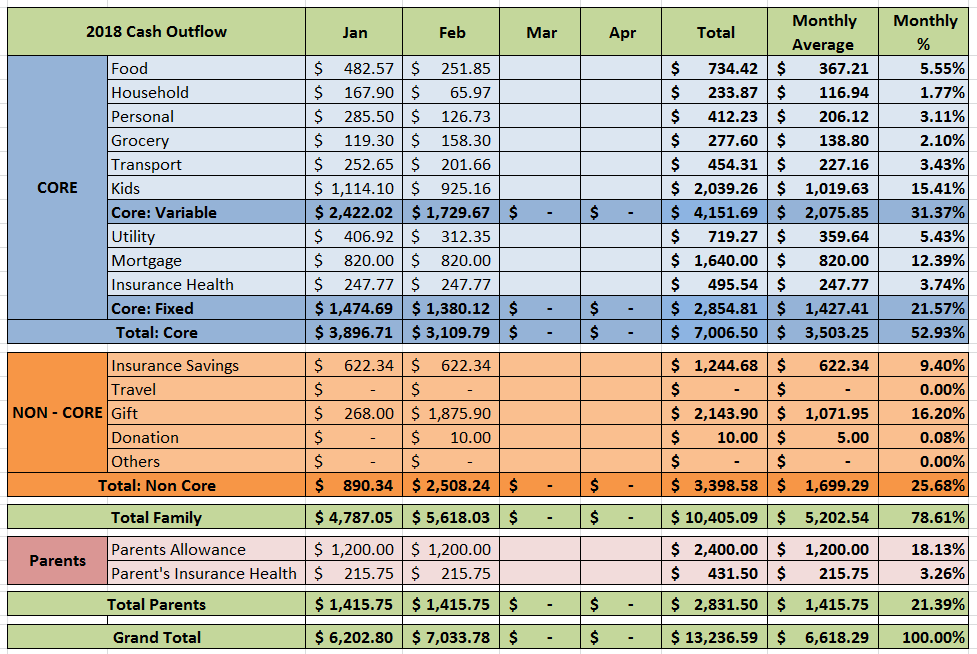

We had managed to compiled our February cash outflow and below is a snapshot:

FAMILY ($5,618.03)

Core: Variable ($1,729.67)

Food ($251.85)

$251.85- Mainly meals for the our family of four (this includes bread, snacks, and drinks, etc.)

Household ($65.97)

$27.90 – Newspaper subscription for Kate’s parents

$38.07 – Household necessities

Personal ($126.73)

$12.00 – Dave’s Haircut

$8.40 – Dental Floss

$32.86 – Almond and Jojoba Oil, Castille Soap

$7.10 – Essential Oil Roller Bottle

$63.79 – Kate’s Skincare products

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

Grocery ($158.30)

$158.30 – Mainly groceries and some other household items from the supermarket

Transport ($201.66)

$100.00 – Ezlink card reload for both of us (for bus and train rides)

$50.00 – Cab rides (plus some Grab credits top up)

$51.66 – Petrol for father-in-law’s car

Kids ($925.16)

Ally

$770.00 – Full day child care for Ally (inclusive of some optional enrichment class)

$20.00 – School excursion

$40.27 – Toddler Vitamin C syrup

Ashton

$17.50 – Baby Wipes

$7.90 – Pants

$69.49 – Baby pillows (yes I know this is expensive, might blog about this in another post)

Core: Fixed ($1,380.12)

Utility ($312.35)

$137.45 – Electrical / Gas / Water

$73.50 – Property Services and Conservancy Charges

$101.40 – Mobile / Internet

Mortgage ($820.00) – Paying using our CPF. 20 year bank loan (First 3 years fixed interest and floating on the 4th year onward pegged against the FHR9). We would like to maintain an arbitrage on this home loan as the interest is less than 2% and we might repay it in full should the interest spike up when we reach FI.

Insurance – Health ($247.77) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Non-Core ($2,508.24)

Gift ($1,875.90)

$1600 – Chinese New Year red packets for family, relatives and friends

$241.40 – Chinese New Year goodies and gifts

$34.50 – Colleague’s farewell gift

Donation ($10.00)

$10.00 – Temple donation

Insurance – Savings ($622.34) – Insurance premiums – includes savings and whole life policies (annual premiums amortized into 12 months)

PARENTS ($1,415.75)

Parents allowance ($1.200.00) – We will maintain this as long as both of us are still employed and will adjust this lower upon reaching FI.

Insurance – Health ($215.75) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Note:

- This monthly cash outflow report is use mainly to gauge our post FI expenses

- We included Insurance Savings as part of our cash outflow until they are fully paid up. The reason is that we will most probably still be paying for them even if we reach FI. We do acknowledge that this is not an expense but it is still a cash outflow nonetheless unless we monetize the accrued cash value of the savings policies.

- For an explanation on the above new categorization, you could refer here

- For 2017 cash outflow full analysis, please click here

FI target family cash outflow (excluding parents) = $5,000 per month (core $3,500 and non-core $1,500)

Family ($5,618.03):

Core ($3,109.79) – This month we managed to keep our core family expenses close to $3,100 which is almost $700 (20%) lower than the previous month. We are spending lesser in almost all categories except groceries as we are cooking more at home and spending more time in free outdoor activities. Our two top expenses are mortgage $820 and childcare $770 which made up almost 50% of our core family expenses. We hope that we could maintain our core expenses at this level of close to $3,000 throughout this year.

Non-core ($2,508.24) – The huge spike of almost $1,800 is mainly due to Chinese New Year celebration which is an one-off thing. We are exploring ways to keep this yearly expense at below $1,000 from next year onward as nowadays our family overhead just increase with the arrival of Ashton. We probably got to be more prudent in this area.

Parents ($1,415.75):

We are looking into topping up our parents retirement account under the CPF Life scheme (Government Annuity plan ) so that we could significantly reduce this monthly parents allowance component which takes up almost 20% of our overall cash outflow. We hope we could work something out before we reach FI.

Grand Total ($7,033.78)

We spent about almost $800 (13%) more as compared to last month which is mainly due to the Chinese new year spending of almost $1,800 (comparable to last year). If we were to exclude that, our grand total should be closer to $5,200 which is close to our FI target monthly expenditure of $5,000. With this new cash outflow layout, we could better segregate our core family expenses away from non-core ones and parents allowances. This will provide a better picture on how much we are spending as a family unit.

How was February like for you?

Hi, I have a question – I’m married into a Taiwanese family but I’m a white American. The idea to me of simultaneously supporting children and parents is overwhelming. I was always taught to support my children and myself only. Now I’m facing the need to potentially contribute to (not support) my husband’s parents and I admit it is hard. Not that I don’t love them but I feel like I’m pulled financially in two directions and I can resent how this may compromise our life, our children’s options, and maybe our retirement. That said, we haven’t done anything yet so I can be overestimating in my fear. How do you manage? I assume some of it is knowing that would be the responsibility but for me it isn’t culturally engrained.

I also agree with you that we should take up the responsibility to support ourselves and not relying on our kids. But I guess this is kind of an Asian culture like my parents were quite poor when they first started their own family. Thus, they gave the best to us but didn’t think too much about their own retirement. But nowadays we seem to be doing better with higher income as compared to their time. Thus, we need to support our kids and parents plus build our own retirement funds by being prudent in our spending. We must strike a balance between these three components. I guess this supporting parents thing should end by our generation as I don’t expect my kids to support us. For me, I put in some money on income generating asset and annuities to make sure they are helping me to support our parents rather than relying on our income. I guess that is more sustainable in the long run.

Hello,

Im amazed by how much your family spends on food in total (<400?). How do you attain this as food in one of my largest expenses! Do you pack food to work?

Cheers,

Cupcake

It helps a lot that I am on maternity leave and don’t eat out hence the lower cost. Also, we seldom eat out on weekends nowadays because of the two young ones and we eat in a lot more.