The hot question that a lot of people might be asking themselves is “How much money do you need to retire?” or “What is the magic number to retirement?”.

Basically, it just refers to “How much money you need to not have to work again for the rest of your life“. A lot of financial advisers might tell you that you need at least a million dollars in order to retire comfortably in Singapore but to me, how much money you need in order to stop working is just a formula of how much you spend and save which are inter-related. These are the 2 important factors that will determine how many years you need to work, save and invest before you could stop working forever.

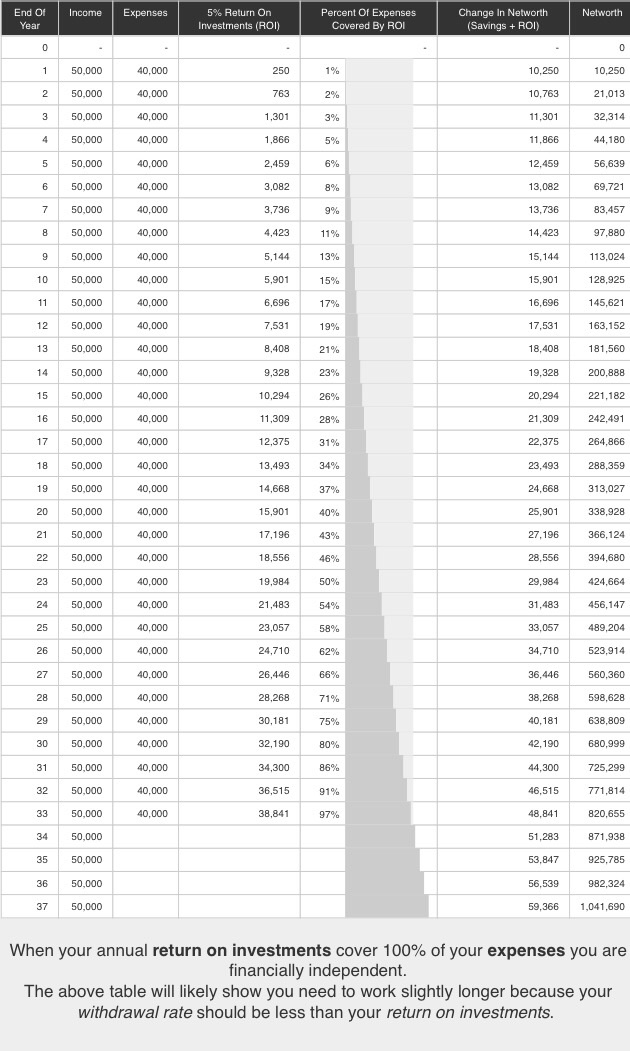

Networthify.com (recommended by an early retirement guru Mr Money Mustache who retired at age 30) is a web portal which allows you to calculate the number of years you need to work before you reach FI (financial independence) depending on your savings rate. FI in this case means your equity portfolio yearly return is enough to cover all your yearly expenses. Let’s take a look at the below example for a better understanding.

Assumptions:

1) Annual income = $50k

2) Savings rate = 20% (saving rate higher than majority of the people around the world according to this global report on savings rate according to country)

3) Invest the 20% yearly in an index fund with 5% return per annum and let the magic of compounding do the rest of the work (S&P 500 historical returns from 1926 to 2011 stands at more than 10%, so we are just taking half of that for this example)

4) Safe withdrawal rate of 4% (simply the rate you could safely withdraw from your portfolio every year that ensures you have a high probability of never running out of money)

Above are screenshots from networthify.com for the purpose of this example

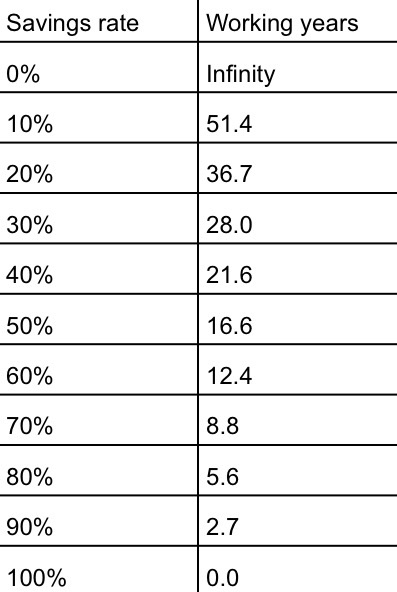

Based on the above computation at 20% savings rate, you will need to work slightly lesser than 37 years before you could retire. Of course this could be shortened if you could improve your yearly ROI to more than 5%. But we want to keep this example realistic by keeping it conservative. That means that for someone who started working after graduating from university at age 23 (an average figure), that person could only retire at age 60 which is almost close to the statutory retirement age in most developed countries provided they could invest diligently as per above example.

According to the table above, things do get exciting once you could increase your savings rate to 50% of your income. With all the same assumptions as per above example, you might be on track to reach financial independence in slightly less than 17 years when you are about 40 years old. That sounds more reasonable and not as far fetched for those seeking early retirement. But to reach a savings rate of 50%, you might need to cut out certain big ticket expenditure such as owning a condominium, branded goods, expensive travels and luxury cars.

Hypothetically, a person living a simple lifestyle with no debt and fully paid up house might incur yearly expenses of $24,000 and thus, he only needs $600,000 in his portfolio to last him almost perpetually based on 4% safe withdrawal rate. So the higher your expenses, the bigger the portfolio you need. Thus, the key to this early retirement plan is your expenses.

It all boils down to what kind of lifestyle you seek and how much you are willing to give up in order to achieve early retirement. You might think that you could not survive with only $24k per year and think that you depriving yourself. There are people out there who have already achieved early retirement and leads a very fulfilling life. Green with envy? With a minimalist lifestyle, we might be able to get there. So can you.