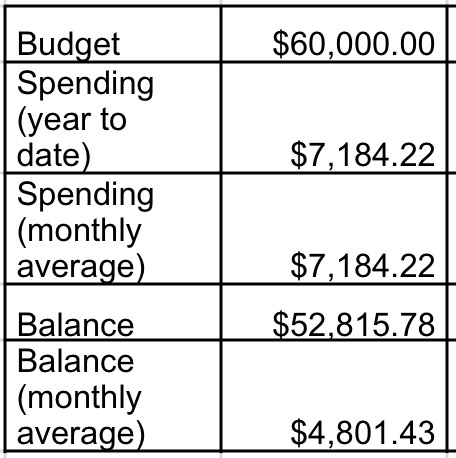

Kate recently published a post chronicling how we have decided to set a budget of $60,000 for our 2017 expenses. This excludes mortgage (we did not include mortgage as these are deducted from our CPF ). Expenditure levels differ with each household but we came up with this ballpark figure after roughly calculating some initial figures and it seems like this is also rather close to the median household expenditure level in Singapore.

This might be a bit challenging for us considering we have quite a few big ticket fixed expenditures, but we will definitely be more conscientious of our spending habits and patterns going forward.

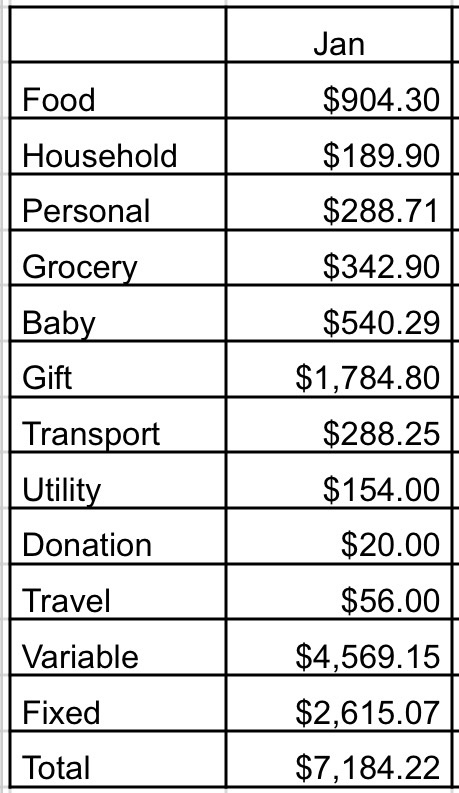

We have managed to compile the breakdown for our January 2017 expenses.

Food ($904.30)

$345.25 – Mainly meals for Kate and myself (this includes snacks, and drinks, etc.)

$559.05 – Chinese New Year reunion dinner in a restaurant

Household ($189.90)

$106.70 – Toiletries, pillow cases and towels (we got this from Takashimaya but managed to offset quite a significant portion of the cost using the vouchers that we had received as a housewarming gift) and other household products from Daiso

$83.20 – Property Taxes (for 2017)

Personal ($288.71)

$273.81 – Skincare and cosmetics (for Kate)

$14.90 – Bike bag for our foldable bikes

Grocery ($342.90)

$342.90 – mainly groceries and other household items from the supermarket

Ally ($540.29)

$40 – Miscellaneous school fees

$175 – Music classes fees

$275.60 – Milk powder (bulk purchase which should be able to last for 3-4 months)

$49.69 – Diapers, snacks and misc

Gift ($1,784.80)

$1,758 – Red packets during Chinese New Year

$26.80 – Chinese New Year Gifts

Transport ($288.25)

$170 – Ezlink card reload (for bus and train rides)

$60.04 – Petrol and parking charges during the Chinese New Year (we borrowed a car)

$58.21 – Cab rides

Utility ($154.00)

$131.40 – Mobile phone bills and Internet

$22.60 – Electric, gas and water bill (includes one time government rebate of $50)

Charity ($20)

$20 – donation to a local temple

Travel ($56)

$56 – Travel insurance for our upcoming Bali trip

Monthly Fixed Expenses ($2615.07)

$400 – Half day child care for Ally

$29.90 – Newspaper subscription

$69.00 – Property Services and Conservancy Charges

$1,200 – Parents allowance

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

$913.59 – Insurance premium (annual premiums amortised into 12 months)

Total = Total variable expenses $4569.15 + Total fixed expenses $2615.07 = $7,184.22

Note: We did not include our mortgage in this annual budgeting because we are using CPF to pay for our monthly instalments. Another reason is we will most probably be clearing off our mortgage upon reaching FI, thus this budgeting is use to gauge our post FI expenses.

This is a high spending month as it coincides with the Chinese New Year celebrations and we had a few big ticket expenses, such as the red packets as well as the reunion dinner. We should be able to normalise our spending for the month of February. Going forward, we will endeavor to share our expenses on a monthly basis and would love to hear how you manage your expenses and budgets too!

Hi,

Dropping my first comment here although I have been trawling through the archives over the past few days.

I guess you could probably shave off $2,000 if not for CNY-related expenses. It must be quite lucky to be your xiao bei as your should be very generous with the ang baos! =p

Going forward, I think it would be a great achievement if your can keep the monthly expenditure below $5,000 as there are a couple of big fixed items like parents allowance, insurance premiums and Ally’s childcare which already comes up to $2,500.

Let’s see how Feb pans out for both your household and mine!

Thanks for checking out

our blog. You probably knows us better after going through our archives. Our blog talks about minimalism, simple living, personal finance, early retirement, giving back to the society and also leading a eco-friendly lifestyle. We have been following your blog for some time and thought that it’s good to publish our monthly expenses like you to have some form of accountability. And we also want to prove to people out there that you could still have a good standard of living even without a lot of luxury items in a city like Singapore. All the savings will be put towards our portfolio building and we still have a lot to learn from you in that area. We hope to semi-retire like you in less than five years time and focus more on giving back to our society once we reach financial independence. Maybe we could discuss more about how to make this world a better place once we gain back our freedom and time. Meanwhile, we shall cheer each other on during our journeys. Wish you happy new year and have a great year ahead!