January is the month that we start managing baby Ashton on our own without the help of the confinement lady. The days are long but before we realised, he is already 2 months old. I guess we are coping better this time round as we are more physically and mentally prepared as compared to our experience with Ally then. Nowadays, our activities revolve around our two kids and I guess there will be little personal time for at least the next two years.

We also do not forsee any travel for this year as it is not easy handling an infant and an active toddler together. We toyed with the idea of a staycation but Kate thinks that staying at our minimalist home itself feels pretty much like a staycation itself and we probably shouldn’t spend a few hundred bucks just for that. We shall see.

Fitness Update

I talked about starting a new fitness regime in my last post as I have gained quite a bit of weight. My fitness target this year is to cut back on my weight to about 78 kg (currently around 82 kg) and reducing my waistline correspondingly. As my meniscus is slightly damage, I had to give up playing soccer. My current goal is to maintain my basic fitness. I will also be focusing more on strengthening my knees, back and core muscles. The intensity of the exercises will gradually increase with each passing month. In terms of food intake, I’m quite discipline in this respect but probably will be cutting down on junk food / snacks. My ultimate goal is to be fit enough to go hiking at beautiful places like Patagonia’s National Park Torres Del Paine.

Patagonia Torres Del Paine National Park Chile

Patagonia Torres Del Paine National Park Chile

My weekly fitness routine:

1) Daily static exercise rouine:

- 10 x squats

- 10 x one-legged squat for each leg

- 10 x lunges for each leg

- 20 x push ups

- 30 secs plank

2) Swim 12 laps once a week (using the ActiveSG free credit balance of $80)

3) Staircase climbing 30 levels up and down or slow jogging 3km

Below are some of the simple things we do on weekends:

Dave’s home cooked dinner for a family of three. Love this kind of one pot meal (Pork and dumpling macaroni with mixed vegetable) as they are easy to prepare, healthy and quick to whip up.

Ally’s first time at the bowling alley. Taught her how the game works and she shouted out confidently that she wants to hit all the ten pins with her bowling ball (perhaps when she can finally lift up the ball, she can try to challenge it then.)

Ally showing Ashton how to complete a 100 pieces world map jigsaw puzzle while teaching him the different countries and animals.

Ally doing a Run-Bike-Climb triathlon. We are still teaching her how to pedal a bike.

Financial Update

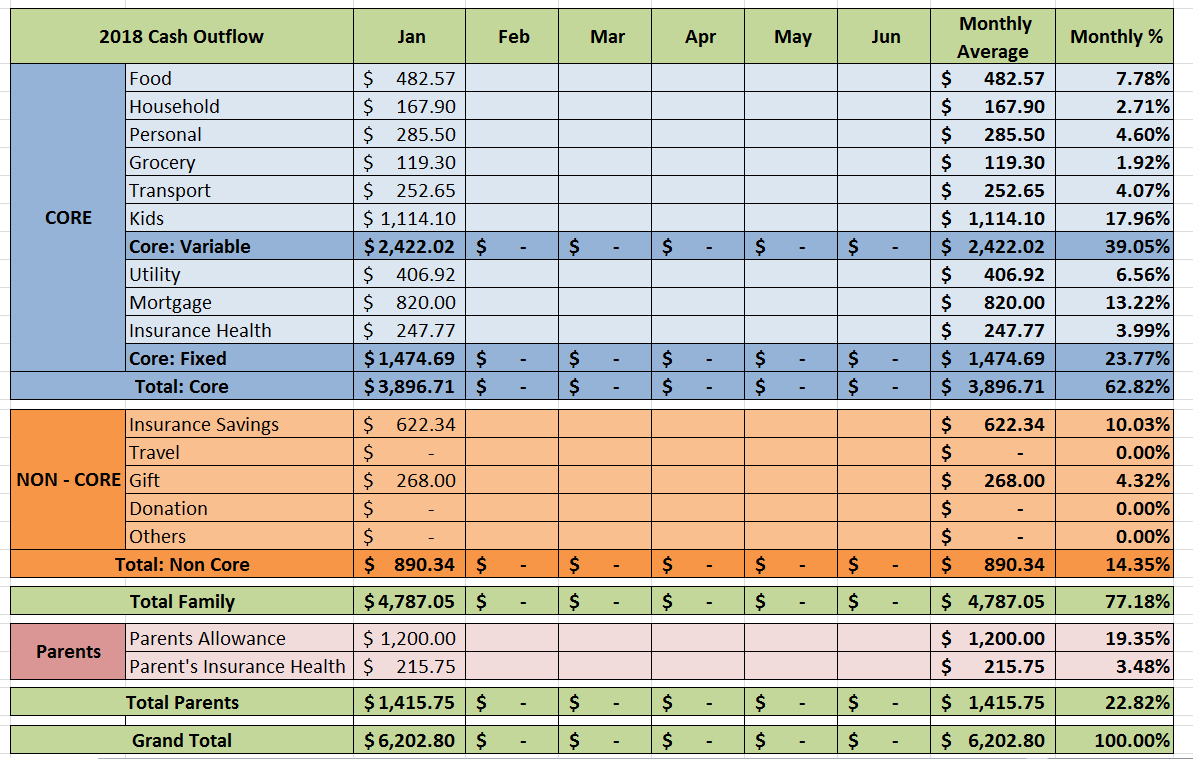

We had managed to compiled our January cash outflow and below is a snapshot:

FAMILY ($4,787.05)

Core: Variable ($2,422.02)

Food ($482.57)

$482.57 – Mainly meals for the our family of four (this includes bread, snacks, and drinks, etc.)

Household ($167.90)

$27.90 – Newspaper subscription

$56.80 – Household necessities

$83.20 – Property Taxes

Personal ($285.50)

$16.00 – Dave’s swimming cap

$90.00 – Kate’s lymphatic breast massage – breastfeeding woes!!! Blocked ducts 🙁

$25.35 – Personal necessities

$28.80 – Liveup membership (Redmart and lazada)

$119.80 – Cordless phone and Hair dryer

$2.97 – iPhone charging cable

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

Grocery ($119.30)

$119.30 – Mainly groceries and some other household items from the supermarket

Transport ($252.65)

$50.00 – Ezlink card reload for both of us (for bus and train rides)

$202.65 – Cab rides (plus some Grab credits top up)

Ally ($987.70)

$770 – Full day child care for Ally (inclusive of some optional enrichment class)

$144 – Additional deposit for fees increase plus some school related misc expenses

$28.00 – School excursion

$13.90 – Water bottle

$31.80 – Formula milk

Ashton ($126.40)

$51.90 – Formula Milk

$74.50 – Diapers

Core: Fixed ($1,474.69)

Utility ($406.92)

$140.48 – Electrical / Gas / Water

$36.75 – Property Services and Conservancy Charges (0.5 month govt rebate)

$229.69 – Mobile / Internet (Include some prepayments)

Mortgage ($820.00) – Paying using our CPF. 20 year bank loan (First 3 years fixed interest and floating on the 4th year onward pegged against the FHR9). We would like to maintain an arbitrage on this home loan as the interest is less than 2% and we might repay it in full should the interest spike up when we reach FI.

Insurance – Health ($247.77) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Non-Core ($890.34)

Gift ($268.00)

$20.00 – Colleague’s farewell gift

$248.00 – Mobile phone for Kate’s mum (Her christmas present to her mum)

Insurance – Savings ($622.34) – Insurance premiums – includes savings and whole life policies (annual premiums amortized into 12 months)

PARENTS ($1,415.75)

Parents allowance ($1.200) – We will maintain this as long as both of us are still employed and will adjust this lower upon reaching FI.

Insurance – Health ($215.75) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Grand Total = Total Family $4,787.05 + Total Parents $1,415.75 = $6,202.80

* We included savings insurance as part of our cash outflow until they are fully paid up. The reason is that we will most probably still be paying for them even if we reach FI. We do acknowledge that this is not an expense but it is still a cash outflow nonetheless unless we monetize the accrued cash value of the savings policies.

We have revamped our cash outflow layout and list down the two main categories as below:

Family:

Core expenses are the variable / fixed cash outflow incurred for the month as “operational expenses”. This is the bare minimum to run our household comfortably and is the amount we will still be incurring even when we are not working.

Of course we could further reduce this with our minimalist lifestyle by cutting back on childcare ($770) and fully pay off our mortgage ($820). This will further reduce our Family Core cash outflow by 40% whereby we could operate our family within $2,500.

Non-core is the category that includes travelling, donations/gifts, savings insurance and things that will enhance our happiness level, security and sense of purpose over the long run. Our savings insurance policies here to show that these are additional savings we have and we might monetize this when our kids gets older. We think that these are important elements to move higher up on the pyramid under the Maslow’s hierarchy of needs. We want to maintain this as long as possible to have something to look forward in future.

Parents:

This is the category we would like to maintain as long as both of us are gainfully employed. We would like to continue giving until we reach FI but we might adjust the figure.

We hope that this new cash flow layout will provide a better glimpse of how a family cash outflow is like. We are not setting any budget this year but we would like to keep our family cash outflow excluding parents at $5k and below.

How was January like for you?

Nice home. Nice tracker.

Thanks for reading our blog and hope you find the information useful.

Parents allowance. Is it both you and wife parents ? Not judging anything. Just curious how much the amount distributed to how many headcounts.

Its for both side.

Is a big portion on your monthly expenses however I think this is really well spend. Respect. 🙂

It’s about 1/4 of our overall. Hope to maintain it.