This month is the month where we pay our yearly income tax and it is also the month where most people will have their cash outflow. On a side note, for folks based in the US, the 2017 tax bill could affect you due to the 2017 tax reform legislation. For us, I think the tax rate of 20 – 22% in Singapore is still manageable as compared to developed countries like Japan, Netherlands or France where their individual tax rate are 50% and above. Some might argue though, that they have some kind of pension plan awaiting their citizens once they reach retirement age. Experts debated for many years if such a pension plan is sustainable in the long run without the governments running out of money to pay all retirees in a greying population context around the world.

Whereas in Singapore, we have to rely on our CPF for retirement, housing needs and medical care. We have an above 90% home ownership which is rank second only behind Romania and the most efficient healthcare in the world thus I guess our CPF system should be working relatively well. So what about our retirement account? To me personally, i think that our CPF retirement account will only be good enough for our basic retirement needs when you reach your retirement age. Thus, i think everyone should do some form of diversification on your retirement plan by supplementing it with your stock portfolio dividend income or rental properties for example.

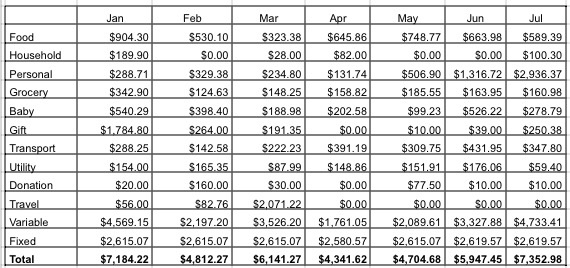

We have managed to compile the breakdown for our July 2017 expenses as below.

Food ($589.39)

$589.39 – Mainly meals for the three of us (this includes snacks, and drinks, etc.)

Household ($100.30)

$82.70 – mattress protectors

$17.60 – household stuff from Japan Home

Personal ($2936.37)

$61.44 – Kate’s toiletries and facial care

$223.49 – Kate’s shoes and clothes

$83.80 – Health supplement

$110.62 – Misc stuff

$2,457.02 – Combined Income Tax (2016)

Grocery ($160.98)

$160.98 – mainly groceries and other household items from the supermarket

Ally ($278.79)

$70.50 – thermometer

$208.29 – snacks, toiletries and misc

Transport ($347.80)

$250 – Ezlink card reload for both of us (for bus and train rides)

$97.80 – Cab rides (plus some Grab credits top up)

Utility ($59.40)

$59.40 – Mobile phone bills and Internet

$0 – Electric, gas and water bill (government rebate $65)

Donation ($10)

$10 – temple

Gift ($250.38)

$229.50 – Kate’s mother birthday

$20.88 – Kate’s friend for Hari Raya

Monthly Fixed Expenses ($2619.57)

$400 – Half day child care for Ally

$29.90 – Newspaper subscription

$73.50 – Property Services and Conservancy Charges

$1,200 – Parents allowance

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

$913.59 – Insurance premium (annual premiums amortised into 12 months)

Total Expenses = Total variable expenses $4,733.41 + Total fixed expenses $2,619.57 = $7,352.98

Note: We did not include our mortgage in this annual budgeting because we are using CPF to pay for our monthly instalments. Another reason is we will most probably be clearing off our mortgage upon reaching FI, thus this budgeting is use to gauge our post FI expenses.

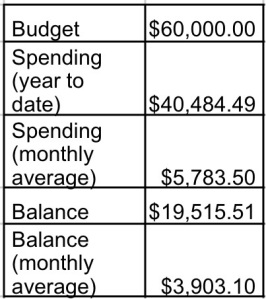

The payment of our income tax adds up to a total of $2,457.02 which bumps up our July expenses. Otherwise, this month we should be spending within our monthly average of $5k. As you can see from our expenses so far for the past 7 months that we dont really spend a lot of money on entertainment as we love outdoor activities. This really help us to save a lot of money and channel all these savings towards our ultimate goal of financial freedom. This is the first time we are setting an annual budget and i would be happy if we could stick within 5 – 10% tolerance of our targeted budget of $60k. Setting a budget and recording your expenses raise our awareness of all the frivolous spendings that might prevent you from reaching your financial goals. Thus I would recommend everyone who has a clear financial objective to record your expenses as you never know what could be hindering you.

We are really grateful with our simple lifestyle nowadays and we hope that we could maintain this lifestyle. How was your July expenses?