Times flies, and we are already past the halfway mark of 2019. As I embrace slow living the past few weeks, it was definitely quite an experience, as I became more aware of my environment, more conscious about minute things happening around me, and most importantly, myself. Something which I would probably share in a separate blogpost.

As some of you who might have guessed, I am involved in the Corporate Social Responsibility (CSR) committee at my workplace. It has been an amazing experience to be involved in these CSR initiatives with like-minded individuals, and I am glad that I am in this platform which allows me to meet all the wonderful, passionate people individuals from social enterprise, non-profit organizations.

For these initiatives, I would try to reach out to colleagues who share the same strong views on these causes and they in turn, have been extremely supportive in these activities. It is extremely heartening to gain support from them and motivated me to continue. But of course, not everything is smooth sailing, as we face many roadblocks along the way.

On a personal note, we had a fun time in June.

It has been a while since we last stepped into Singapore Science Centre. I believe Kate and I were last there when we were in primary or secondary school? Anyway, we decided to bring Ally and Ashton to the Science Centre for the first time. The kids were obviously very excited but the place has since changed a lot since (based on my memory of that place). There are a lot of exhibits, and different areas (Kidstop, special exhibits, etc.). You will most likely need an entire day if you wish to visit all the attractions. We bought a multiple area access pass where we could visit the science exhibits, Dino quest exhibition, Butterfly park, Kids Stop and Omni theatre.

The science center is a great place for kids because not only is it highly educational, it offers a wide range of activities which keeps them highly occupied. We will definitely be back again. Below are some of the photos during of our visit.

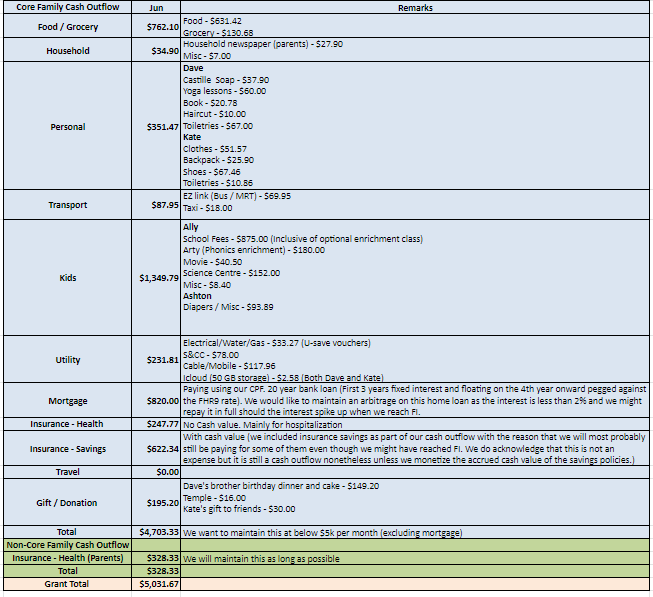

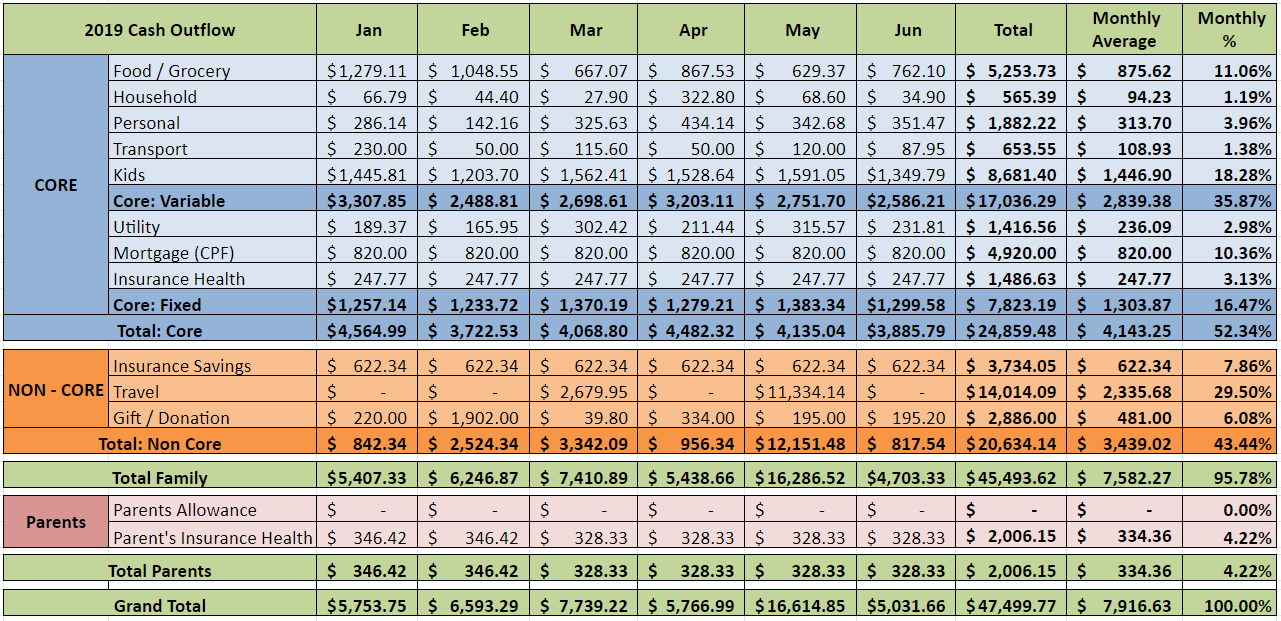

We had managed to compile our June Cash outflow and below is a snapshot:

Note:

Target FI family cash outflow (excluding parents and mortgage) = $5,000 per month (core $3,500 and non-core $1,500)

Family:

Core is the variable / fixed cash outflow incurred for the month as “operational expenses”. This is the minimum to run our household comfortably and is the amount we will still be incurring even when we are not working.

Non-core is the category that includes travelling, donations/gifts, savings insurance and things that will enhance our happiness level, security and sense of purpose over the long run. Our savings insurance policies are also place here to show that these are additional savings we have and we might monetize this when our kids gets older. We think that these are important elements to move higher up on the pyramid under the Maslow’s hierarchy of needs. We want to maintain this as long as possible to have something to look forward in future.

Parents:

We finally reduce our parents allowances significantly by topping up with an initial lump sum into their retirement account (CPF Life) which will guarantee payment to them for a lifetime. This will transfer the reliance on us to give them cash allowances to CPF Life which works like an annuity. We would like to continue paying for their health insurance as long as both of us are still gainfully employed.

All insurance figures shown are amortized over 12 months.

Summary for June

Family ($4,703.33):

Core ($3,885.79)

This category is at our second lowest cash outflow this year as we are at the halfway mark of 2019. For the first 6 months of 2019, we spend an average of $4,143.25 per month for this category which is higher than the average of $3,680.11 for the same period last year. I will attribute this increase mainly due to Kate going back to work (food and transport) and the additional enrichment classes for Ally. If we were to exclude our monthly mortgage payment of $820, this year average will come down to approximately $3.3k which is still slightly below our FI target of $3.5k for our family core cash outflow which is also the minimum to run our household comfortably. We are pretty consistent so far and should be able to maintain this til end of the year.

Non-core ($817,54) :

This category is at the lowest this year with just one birthday celebration for Dave’s brother. We did all of our travelling during the first half as Dave is preparing for his ACL surgery in the second half of this year. Thus, our cash outflow for this particular category should not fluctuate too much during the second half of this year.

Parents ($328.33):

We are currently paying for their health insurance which should slowly creep up as they age.

Grand Total ($5,031.66)

Our overall cash outflow this month is at the lowest this year and we hope to maintain it this way til the end of the year. We should be able to maintain our overall cash outflow at around this level for the rest of 2019 as we already did all of our travelling this year. The second half should be a period of rest and recovery for Dave as he strive to gain back his fitness after the surgery.

What was the month of June like for you?

Good read on budgeting.

I realized that there is NIL for parents allowance which is common among Singaporean, for both me and my wife, parental allowance is already around 1,000+ so this can be quite substantial if it is included in the family expenses budgeting. I included since I expect to give my parents the allowance till they leave earth. Additionally, I am paying for their health insurance as well.

But if your parents do not need you to give any allowances now and in the future when they are retired, then I think your budgeting makes total sense. Of course, I envy you as well since the savings from parental allowance can be very substantial towards building a bigger savings/investments.

Thanks for dropping by. If you followed our earlier posts, we used to provide them about $1200 monthly but stopped since last year after we topped up quite a significant amount into their CPF. In fact, the parents’ allowance was the largest portion of our expenditure, and we also invested quite a good amount in their health insurance, considering their age.

The CPF top up allowed us to transfer the reliance of us giving them cash to CPF life which will guarantee their payment for life. I think this is a better way going forward and we still continue to pay for their health insurance.