We took a 6 months sabbatical from blogging and it came at a time where we needed a break. We thought it would be good to give our readers a short update on our lives.

So below are the updates for our Minimalist in the City household in 2019.

Health

I had my ACL surgery back in July and have been attending physio sessions frequently. My current condition is about 80% pre-surgery. The progress has been gradual but definitely improving. I have been able to shave my 2.4 km run timing from 17 mins to 13 mins recently and managed to run the 3.5 km – the longest distance that I have been able to run post surgery. Both Kate and I have been attending yoga classes regularly and started to ramp up our exercise frequencies to about 3 to 4 times a week. In addition, we hope to work towards a more ideal physique by being more mindful on our food intake.

Travels (Hong Kong, Hiroshima, Krabi)

Ally starts to look like a season traveler and is becoming more independent on her trips. So far she has been to Hong Kong twice, Japan (Hiroshima, Fukuoka), Malaysia (Penang), Indonesia (Bali) and Thailand (Krabi). As Ashton is also growing fast, he starts to better appreciate all these travels with us and our aim this year is to travel more. Both Ally and Ashton love beach escapades Ally which is great as there are many beautiful options within Southeast Asia, which is also very suitable for urbanites like us, when we need to escape city life. In addition, these holidays tend to be rather affordable. There are also plenty of opportunities to mingle with wildlife, natural landscapes and allow our kids to gain an appreciation of other culture and differences .

Kids

Both kids are growing up fast and we really cherish our time with them. They seem to be enjoying school and indeed learning a lot.

Ally joined a one day educational camp at SEA Aquarium and she really enjoyed herself thoroughly seeing the sea animals as they swam past our tent.

Kids curious about the animals in the zoo

Our Finances

Stock Market

The stock market seems to be trending sideways since last year and the general sentiment is that the current bull market might be slowing down. We do feel that the current market is overvalued and will only dip into the market opportunistically if there is a correction on certain sectors. As most people are boasting about their gains last year, we remain cautiously skeptical about the current market valuation even though we did made significant gains last year by re-balancing our portfolio with very little cash injection. Most of our cash were piling up in our warchest in the form of Singapore Savings Bonds and high interest savings account. On the psychology front, investors seem to be close to euphoric mood and that is one of the important ingredient towards the build up of the next potential downturn as the bull market approaches the 12th year anniversary mark. We shall see how this will pan out.

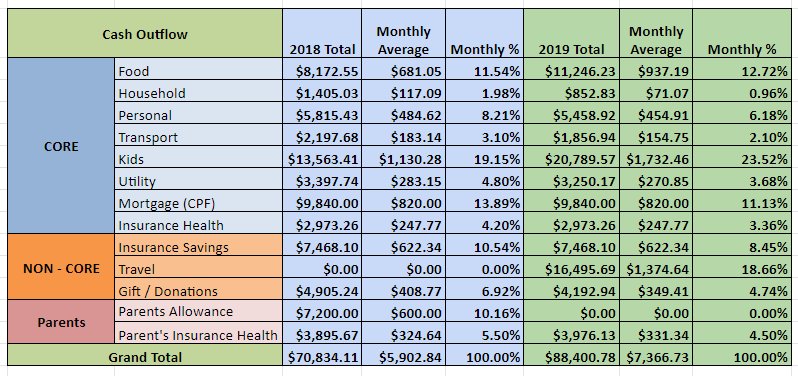

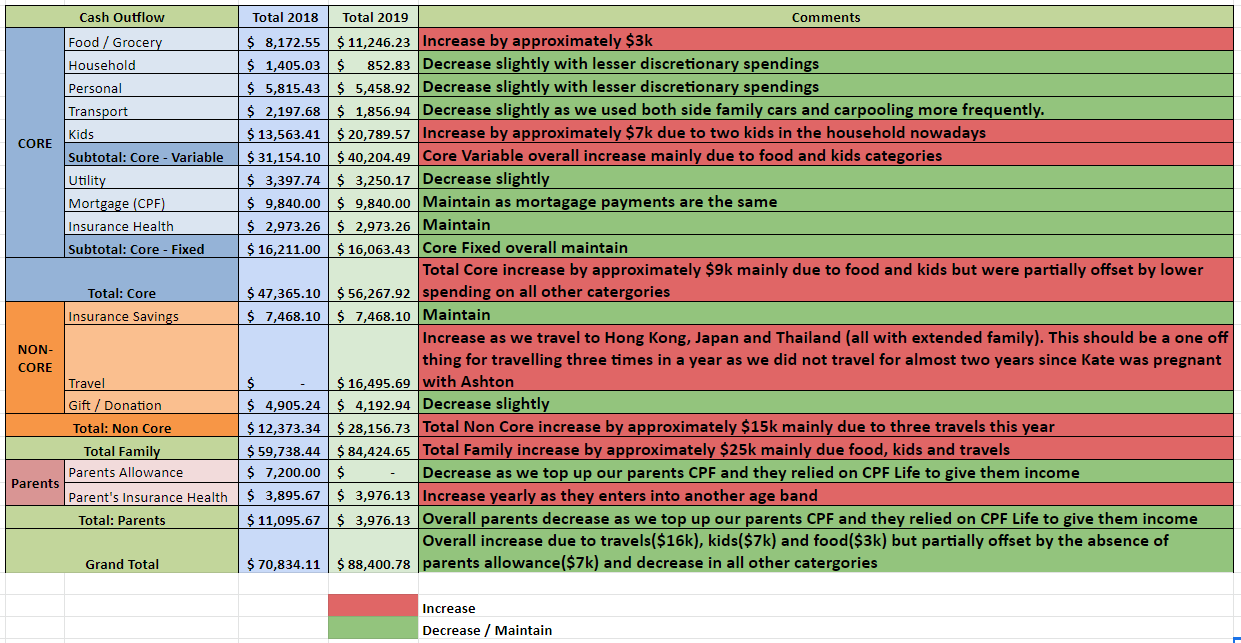

2019 Expenses

For 2019, our top 3 cash outflows are:

1. Kids – $20,789.57 (23.52%)

Not surprisingly, the kids category took the top spot where there is an increase of approximately $7k after the inclusion of Ashton into our family. We anticipate that this would trend upwards this year as both of them will be in childcare and starting to attend some enrichment classes . But we also foresee that this will slightly taper off after Alexis enter primary school next year.

2. Travel – $16,495.69 (18.66%)

As we haven’t been travelling since Kate conceived Ashton in 2017, we ramped up our travels with our extended family to Hong Kong, Hiroshima, Japan and Krabi, Thailand last year. This should be an one-off travelling spree with our extended family and we will aim to do just one to two travels a year with just the four of us on our next travel.

3. Food / Grocery – $11,246.23 (12.72%)

We spent quite a bit on food last year with Kate back to full time work for the whole of last year and Ashton eating more as he grows. We also dine outside with extended family frequently as we do not really scrimp on quality food for special occasions.

Summary for 2019

Family ($84,424.65)

Our total family cash outflow increase by almost $25k mainly due to travels and kids. The $16k travel expenses should be an one-off event which allows our parents and siblings to spend quality time together as a family.

Parents ($3,976.13)

This was greatly reduced as we topped up our parents CPF which will allow them to draw a monthly allowance from CPF Life which works like an annuity. So basically we front-loaded our parents allowances so that we do not have to pay them cash anymore as they will be relying on their CPF Life. But we will still be paying for their health insurance which should slowly increase year after year.

Overall ($88,400.78)

Overall total cash outflow increased by almost $17k mainly due to travelling. If we were to exclude travelling last year, our overall cash outflow will be $71,905.09 which is pretty close to $70,834.11 in year 2018 where we did not travel at all.

- As some of might have noticed that we included our savings insurance $7,468.10 as part of our cash outflow and the reason is we still need to pay this even though we might have reached FI. Some of these savings insurance policies will slowly taper off as we aged.

- We retained our bank mortgage of $9,840.00 because of the low interest rate that we managed to secured two years back. Even though we could have fully repay our mortgage in full anytime, we want to maintain an arbitrage with the low interest rate environment.

If we were to exclude our non-core categories like savings insurance, travels, gifts/donations plus fully pay off our mortgage to operate our household minimally, our operational expenses should be around the region of $50k for our family of four. This is consider quite reasonable in Singapore context. If our portfolio’s dividend could support our operational expenses at this level, we might be able to supplement our travels and other non-core cash outflow simply just by doing freelance or part time work. As most people perception of FIRE is to have enough money not to work for the rest of our lives, our thinking is that we will continue to work but probably cut down our working hours by half when we reach FI. This will keep our minds active, maintain our social circle, work on our passion projects and of course at the same time, spend more time with our kids and family. We reckon this will constitute to our ideal perception of a more balance life where we spend time on things that matters to us most.

What about you? What are your money goals for 2020?

Do stay tune and hope you have a great year ahead!