This month, we spent quite a bit on Grab credits top up where we top up $50 this week and will get to enjoy $6 discount on all rides for the whole of next week (limited to 4 redemptions per day). This promotion has been ongoing for 4 to 5 weeks and we find it very useful as we normally use the grab services at least once every weekend. We also took some short distance rides to ferry us around and pay minimal price for the service. We are not sure how long this promotion would last but it has really benefited our family a lot this month in term of costs and convenience.

As we do not forsee us on getting a car anytime soon (due to sky high vehicle prices nowadays and the rise of Grab/Uber services), all these savings really ramp up our money towards our stock portfolio. Our motivation would be to increase our annual dividends from our stock investments so that we could use that to buy a car in cash. The effect of compound interest really works wonder towards the 5th year of our 10 years financial independence plan and we could really see the exponential growth of it nowadays. The day will come soon and we might not be even considering to buy a car during then.

Throughout this minimalism journey, we are becoming more conscious towards eating, exercising and sleeping well. Thus, we spend almost $1k on health supplements this month. We also try to eat home cooked / healthy meals as much as possible and exercise at least 2 to 3 times a week. My recent medical review was good according to the doctor and he was quite surprise by the results as the current health trends are people in their 30s having high cholesterol, high blood pressure and diabetes. I was actually quite flattered by his remarks on that day and it motivates me to keep it that way til the day I become old. It also boosted my self-confidence towards a bright future with endless possibilities. I always emphasize more on health as compared to wealth and I guess it’s really paying dividends as I get older. It feels better than the monetary dividends that we are getting from our stock portfolio. I would encourage more young people not to emphasize too much on wealth at the expense of their health as I believe that wealth is nothing if we do not have the health to enjoy it.

We also renewed Ally’s music appreciation class for another 10 sessions as she really enjoys it thoroughly. She is getting better in class and is considered one of the more advance learners. We hope we could advance her to the keyboard class by the time she reaches four years old. Other than the above activity, all her other activities came with minimal cost.

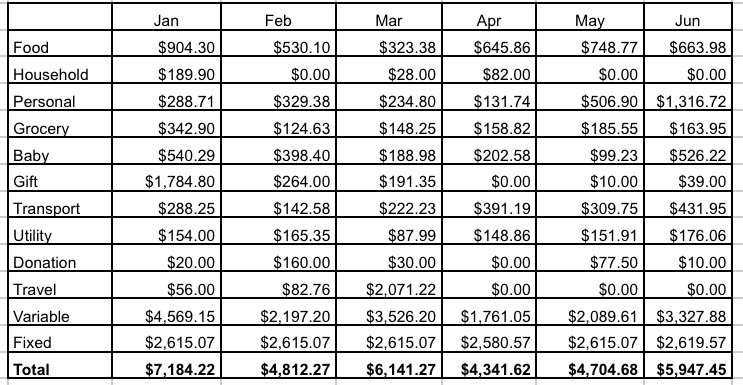

We have managed to compile the breakdown for our June 2017 expenses as below.

Food ($663.98)

$663.98 – Mainly meals for the three of us (this includes snacks, and drinks, etc.)

Personal ($1316.72)

$242.92 – Kate’s toiletries and facial care

$59.80 – Dave’s dry fit polo tees

$14.00 – Dave’s haircut

$1000 – Health supplements

Grocery ($163.95)

$163.95 – mainly groceries and other household items from the supermarket

Ally ($526.22)

$250 – music class fees (prepaid for 10 sessions)

$27.92 – swimsuit

$21.35 – story books

$137.80 – milk powder

$89.15 – snacks, toiletries and misc

Transport ($431.95)

$225 – Ezlink card reload for both of us (for bus and train rides)

$206.95 – Cab rides (plus some Grab credits top up)

Utility ($176.06)

$122.83 – Mobile phone bills and Internet

$53.23- Electric, gas and water bill

Donation ($10)

$10 – temple

Gift ($39)

$29 – Kate’s friend birthday

$10 – Dave’s colleague’s baby shower

Monthly Fixed Expenses ($2619.57)

$400 – Half day child care for Ally

$29.90 – Newspaper subscription

$73.50 – Property Services and Conservancy Charges

$1,200 – Parents allowance

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

$913.59 – Insurance premium (annual premiums amortised into 12 months)

Total Expenses = Total variable expenses $3,327.88 + Total fixed expenses $2,619.57 = $5,947.45

Note: We did not include our mortgage in this annual budgeting because we are using CPF to pay for our monthly instalments. Another reason is we will most probably be clearing off our mortgage upon reaching FI, thus this budgeting is use to gauge our post FI expenses.

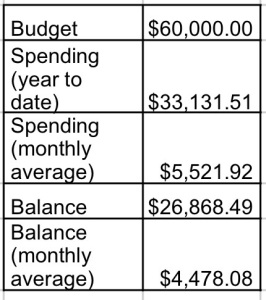

This month, the purchase of the health supplements which is a one off item ramp up our expenses. Otherwise, this month we should be spending within our monthly average. Time really flies and this month is the half way mark of 2017. Our expenses for 6 months stands at $33,131.51 which is almost 10% more than the 6 month target budget of $30k. These are mainly due to Chinese New Year in the month of January where we spend additional $2k and the month of March where we spend additional $1k for our Bali trip. We are fairly confident that we should be able to stick close to our budget of $60k unless there are other unexpected big expenses.

We are really grateful with our simple lifestyle nowadays and we hope that we could maintain this lifestyle. How was your June expenses?

hi hi, late comment here. But how do you get your utilities to $50+.

I thought I don’t use much but …mine is like 50% more than yours.

Currently we are only stay there on weekends as our daughter is still young. Anyway you have a nice blog too!