This month we went for our family trip to Bali where we booked a very nice villa surrounded by padi fields (via Air BNB). This is a really meaningful trip as this is the first time I brought my parents and my grandma overseas (including Ally, its 4 generations together in one trip!). As my grandma is already in her eighties, it’s not easy to convince her to come with us. Everyone enjoyed this trip thoroughly and it’s very satisfying to know that my grandma would also like to join us for our future family trips.

Here are some of the pictures from the trip:

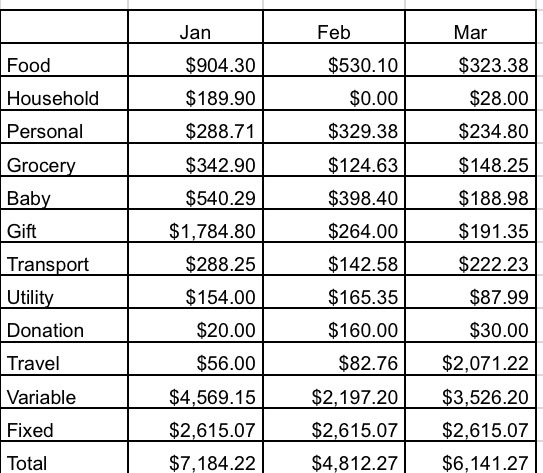

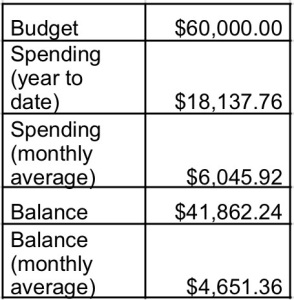

We have managed to compile the breakdown for our March 2017 expenses as below.

Food ($323.38)

$323.38 – Mainly meals for Kate and myself (this includes snacks, and drinks, etc.)

Household ($28.00)

$28.00 – purchases from Daiso

Personal ($234.80)

$96.80 – Toiletries and health supplements

$50 – CPF talk organized by financial bloggers

$78.00 – 2 x three-fold single mattress (for guests who might stay over at our place)

$10.00 – 2 x iPhone charger cables

Grocery ($148.25)

$148.25 – mainly groceries and other household items from the supermarket

Ally ($188.98)

$52.70 – Milk powder

$136.28 – Diapers, snacks, toiletries and misc

Gift ($191.35)

$191.35 – Shopping cart from Amazon, mainly gifts and other miscellaneous

Transport ($222.23)

$120 – Ezlink card reload for both of us (for bus and train rides)

$102.23 – Cab rides

Utility ($87.99)

$54.40 – Mobile phone bills and Internet (redeem $5 rebate for Starhub bills)

$33.59 – Electric, gas and water bill

Donation ($30)

$30 – donation to a local temple

Travel ($2071.22)

$2071.22 – Bali trip (for Dave’s family for 6 adults and one kid)

Monthly Fixed Expenses ($2615.07)

$400 – Half day child care for Ally

$29.90 – Newspaper subscription

$69.00 – Property Services and Conservancy Charges

$1,200 – Parents allowance

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

$913.59 – Insurance premium (annual premiums amortised into 12 months)

Total = Total variable expenses $3,526.20 + Total fixed expenses $2,615.07 = $6,141.27

Note: We did not include our mortgage in this annual budgeting because we are using CPF to pay for our monthly instalments. Another reason is we will most probably be clearing off our mortgage upon reaching FI, thus this budgeting is use to gauge our post FI expenses.

If we exclude our Bali trip, our expenses should be around $4.2k which is much lower than our budgeted $5k per month. This is mainly due to streamlining of expenses on all catergories this month (which you could see by comparing the expenses categories in the table above). It will be interesting to see how this “streamlining” works out for our expenses for the rest of the year.

So stay tune!

Wow! Thanks for sharing this in detail. Having a child really increases a household’s expense, but I’m sure it’s entirely worth it yeah?

Yes, having a child does increase the cost but we also streamline some of our expenses to cater for those increases. Leading a minimalist lifestyle does help in this different phase of our lives.