March is the month that our little baby, Ashton turns 4 months old. With his bubbly expressions and chubby face, everyone seems to think that he is the cutest baby around (Daddy pride here speaking). Ally also loves her baby brother a lot and even proclaimed numerous times that she will introduce her brother to her classmates when Ashton starts school. As for me and Kate, we feel really bless to have him as a new addition to our family.

Work

As for work, this is probably the time where most employees are looking forward to their bonuses and increments. I managed to get a decent bonus (if compared to the rest of my counterparts) and was also promoted. While most people were happily discussing on how they would spend their bonuse, for the Minimalist in the city household, we were looking at the various allocations into investments and savings.

Finance

The recent Singapore Savings Bond issuance looks pretty attractive with an effective interest rate of 2.31% per annum (assuming that you hold it for 10 years). This is a really good risk free return backed by the Singapore government and we have also subscribed to some for the April allocation. The stock market has also been quite volatile recently due to the US – China trade war and with another two projected federal reserve rate hikes this year, interest rates are highly like to go up.

This would also mean that for most home owners who have their mortgage loans pegged against the SIBOR, they could be paying higher installment going forward. We had recently re-financed our HDB loan to a FHR Bank loan last year and we had managed to secure a fix interest rate for the first 3 years. During this 3 years, we are also setting aside some additional cash and CPF to cover our entire mortgage. Should the interest rate spike up after 3 years, it is likely that we will pay off our mortgage in full.

Fitness Update

I do feel that my overall knee strength has improved since I started this new fitness regime 3 months ago, and I have experienced less pain on my right knee nowadays. At the same time, I am also exploring physiotherapy treatment (likely to start in the month of April) and hopefully it would help with the recovery phase. I am hopeful that I will be able to regain back my former fitness and engage more actively in sports again, and perhaps one day, to climb Mt Kilimanjaro (Its one of the seven summits and it is the highest mountain in the African Continent)

My weekly minimalist fitness routine:

1) Daily static exercise routine (5 times a week):

- 20 x squats

- 20 x one-legged squats for each leg

- 20 x lunges for each leg

- 30 x push ups

- 45 secs plank

2) 1 x Swimming 16 laps (800m) (using the ActiveSG free credit) and will cycle home for about 2km using the bike sharing platform (Ofo bike – currently they have a 2 months pass promotion for $1.50)

3) 1 x Staircase climbing 30 levels up and down plus static exercise on both ground and top level. (Done during lunch time in my office building)

4) 1 x 4km (25 – 30 mins) Slow jogging adopting the exercise method elaborated by Prof. Hiroaki Tanaka (injury-free running technique, allowing safe beginning and efficient progress. It’s the natural and gentle forefoot landing and small steps at high cadence)

5) Using the Iphone Health app, I’m currently trying to average 7000 – 8000 steps daily. (I started doing this after I saw my father lost 5kg within two months after averaging more than 10,000 steps daily!)

My experience with bike sharing service has been pleasant so far and love their slogan

“Share more, Consume less“

Below are some of the simple things we do on weekends:

Our weekend trips to our neighborhood park

Our visit to Kranji Countryside (Frog and fish farms)

Our visit to Hay Dairies (Goat farm)

Another of Kate’s simple yet delicious dinner

Financial Update

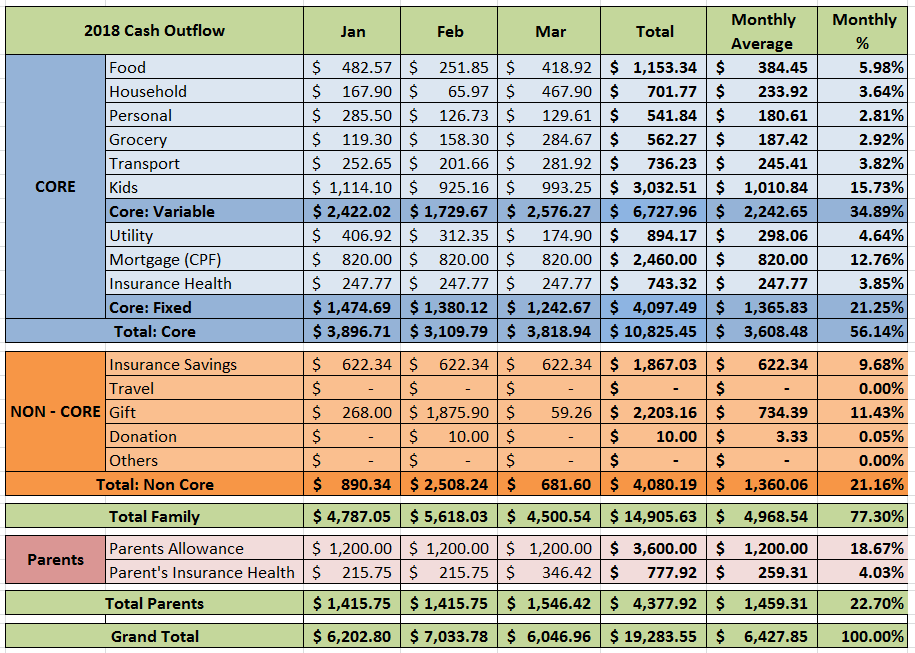

We had managed to compiled our March cash outflow and below is a snapshot:

FAMILY ($4,500.54)

Core: Variable ($2,576.27)

Food ($418.92)

$418.92 – Mainly meals for our family of four (this includes bread, snacks, and drinks, etc.)

Household ($467.90)

$27.90 – Newspaper subscription for Kate’s parents

$41.00 – Household necessities

$399.00 – Tiger Induction Rice Cooker

Personal ($129.61)

$69.90 – Dave’s walking shoes

$10.00 – Kate’s haircut

$47.13 – Kate’s Skincare products

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

Grocery ($284.67)

$284.67 – Mainly groceries and some other household items from the supermarket

Transport ($281.92)

$50.00 – Ezlink card reload for both of us (for bus and train rides)

$160.85 – Cab rides (plus some Grab credits top up)

$71.07 – Petrol and coupons for father-in-law’s car

Kids ($993.25)

Ally

$770.00 – Full day child care for Ally (inclusive of some optional enrichment class)

$25.00 – School excursion

$5.00 – Haircut

$6.25 – Baby Vicks

$2.00 – Printed photos for a school project

Ashton

$95.00 – Vaccination

$90.00 – Diapers

Core: Fixed ($1,242.67)

Utility ($174.90)

$73.50 – Property Services and Conservancy Charges

$101.40 – Mobile / Internet

Mortgage ($820.00) – Paying using our CPF. 20 year bank loan (First 3 years fixed interest and floating on the 4th year onward pegged against the FHR9). We would like to maintain an arbitrage on this home loan as the interest is less than 2% and we might repay it in full should the interest spike up when we reach FI.

Insurance – Health ($247.77) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Non-Core ($681.60)

Gift ($59.26) – Baby shower gift for relative

Insurance – Savings ($622.34) – Insurance premiums – includes savings and whole life policies (annual premiums amortized into 12 months)

PARENTS ($1,546.42)

Parents allowance ($1.200.00) – We will maintain this as long as both of us are still employed and will adjust this lower upon reaching FI.

Insurance – Health ($346.42) – Insurance premiums – hospitalization and outpatient (annual premiums amortized into 12 months)

Note:

- This monthly cash outflow report is use mainly to gauge our post FI expenses

- We included Insurance Savings as part of our cash outflow until they are fully paid up. The reason is that we will most probably still be paying for them even if we reach FI. We do acknowledge that this is not an expense but it is still a cash outflow nonetheless unless we monetize the accrued cash value of the savings policies.

- For an explanation on the above new categorization, you could refer here

- For our 2017 cash outflow full analysis, please click here

FI target family cash outflow (excluding parents) = $5,000 per month (core $3,500 and non-core $1,500)

Family ($4,500.54):

Core ($3,818.94) – This month we are spending quite a bit on food and groceries. Our old rice cooker’ non-stick coating of the inner layer peeled off after less than two years of usage. We thus decided to get a better one, and invested in a Tiger brand induction rice cooker for $399.00 (usual price $599.00). The item happened to be on sale when we purchased it. With our good experience with Japanese electrical products, I guess this is money well spent for a reliable and quality product (Kate’s parents owned the same one and has been using it for 5 years!). Our core family cash outflow averages about $3600 so far for the first quarter of 2018 and we hope to maintain close to our target of $3500 per month.

Non-core ($681.60) – This catergory reduced significantly for this month. We do hope to ramp this up to an average of $1500 over the long run for overseas travels when Ashton is older. We have been longing for a overseas trip since we last travelled to Bali in March last year. But from our own personal view, we think it is more practical to travel when the both kids are walking as it is also less tiring for adults and we will get to enjoy the trip as well.

Parents ($1,546.42):

There is an increase in the insurance premiums as our parents enters into the next age band. Guess this component will only go up. We are looking into topping up our parents retirement account under the CPF Life scheme (Government Annuity plan ) so that we could significantly reduce this monthly parents allowance component which takes up almost 20% of our overall cash outflow. We hope we could work something out before we reach FI.

Grand Total ($6,046.96)

Our overall cash outflow is almost $1000 lesser as compared to last month which is mainly due to Chinese new year. If you take away our parents cash outflow component, we are spending about $4,500 and this is $500 below our targeted FI expenses of $5k.

What was March like for you?