November is the month that we celebrated the birth of our son, Ashton, as announced by Kate earlier in this post. I am glad that we have a boy now to balance the gender inequality within our family (just kidding!). A girl (女) preceding a boy (子) forms the Chinese character “好“, which symbolises good fortune. We are grateful for everything we are experiencing right now and are looking forward to a bright future with lots of fun adventures with our two little ones.

Three years ago when we were preparing for Ally’s arrival, we had purchased quite a bit of baby related stuff. This was also partially because as first time parents, we didn’t quite know what to expect and tried to be as “prepared” as possible. With the prior experience, we had a better idea of what we do or do not require and tried to plan our preparation for Ashton’s arrival around that. As such, this time round, we didn’t buy a lot of stuff (since there were also some hands-me-down from Ally). Even if we did, there were quite a few which were preloved items, and have given us significant cost savings. On a side note, Seedly has compiled a list of the cost of having a baby in Singapore, and although this would vary with each family, it serves as a pretty good draft guide. Having said that, we have decided to engage a confinement lady this time round, which we didn’t do so when we had Ally and this would also inflate the cost a bit. We have yet to include in this month’s report but it would appear in December.

Similarly to what we had done with Ally, we had also opted to donate Ashton’s cord blood to the Singapore Cord Blood Bank . The more popular option would be to store them in a private blood bank but we had decided to donate it away for both Ally and Ashton for a couple of reasons. Firstly, we wanted them to do some good since they were able to be born safely into this world and donating their cord blood to help others seems to be a rather noteworthy option (donating to a public blood cord bank increases the probability of finding a stem cell match for patients which require a cord blood transfusion, offering them hope and a chance to be cured). In addition, experts also questioned the utility for family stored cord blood and as such, we thought that donating it away would be a better option.

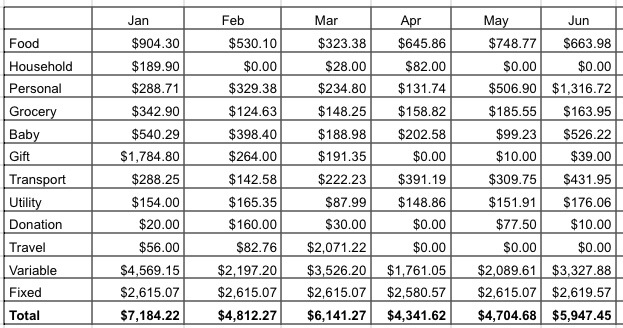

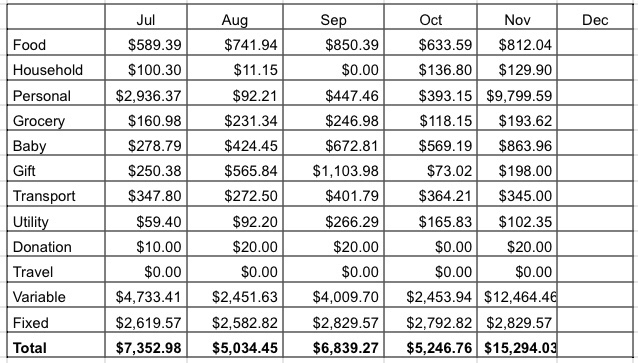

We managed to compile the breakdown for our November 2017 expenses as below.

Food ($812.04)

$812.04 – Mainly meals for the three of us (this includes snacks, and drinks, etc.)

Home ($129.90)

$24.90 – Water flask + Cup

$79.00 – Slow Cooker

$26.00 – Daiso

Personal ($131.52)

$70.00 – Kate’s toiletries and facial care

$40.90 – Kate’s and Dave’s haircut

$20.62 – Ezybuy purchases

Personal – Pregnancy related ($9,668.07)

$660.00 – Maternity insurance

$968.30 – Confinement and health supplements

$439.12 – Pregnancy related consultation (excluding claims and other payments by Medisave).

$7,600.65 – Hospital fees for delivery (excluding claims and other payments by Medisave)

Grocery ($193.62)

$193.62 – Mainly groceries and other household items from the supermarket

Ally ($695)

$10.00 – Clothes (undies)

$168.00 – Childcare year end performance (includes costume, DVD and tickets)

$451.00 – Prepayment for music lessons which will start next Jan 2018

$66.00 – Milk, snacks, toiletries and misc

Ashton ($168.96)

$42.00 – Birth Certificate registration

$19.30 – Beansprout pillow

$$107.66 – Milk, toiletries and misc

Gift ($198.00)

$114.40 – Kate’s early Christmas gift for Dave 🙂

$58.60 – Christmas gifts and cards

$25.00 – Nutrition pack for Kate’s mum

Transport ($345.00)

$170.00 – Ezlink card reload for both of us (for bus and train rides)

$118.00 – Cab rides (plus some Grab credits top up)

$57.00 – Coupons and cashcard top-up for father-in-law’s car

Utility ($102.35)

$102.35 – Mobile phone bills, Internet & Utility bills

Donation ($20.00)

$20.00 – Temple donation

Monthly Fixed Expenses ($2829.52)

$610 – Full day child care for Ally (inclusive of some optional enrichment class)

$29.90 – Newspaper subscription

$73.50 – Property Services and Conservancy Charges

$1,200 – Parents allowance

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

$913.59 – Insurance premiums – includes savings, whole life, hospital and surgical, home insurance (annual premiums amortized into 12 months)

Total Expenses = Total variable expenses $12,464.46 + Total fixed expenses $2,829.57 = $15,294.03

Note:

- This monthly expense report is use mainly to gauge our post FI expenses

- We included whole life and savings insurance as part of our expenses until they are full paid up. The reason is that we will most probably be still paying for them even though we reach FI.

- Our insurance also includes our parents’ health insurance

- We did not include our mortgage in this annual budgeting because we are using CPF to pay for our monthly instalments. Another reason is that we will most probably be clearing off our mortgage upon reaching FI.

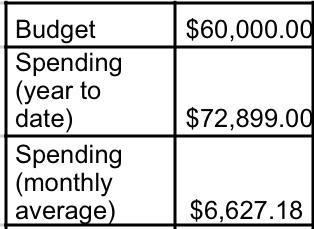

We spent about $5625.96 this month if we were to exclude pregnancy related direct expenses which amounts to around $9,668.07 (YTD pregnancy related expenses = $11,228.87). For the YTD pregnancy related expenses, these are all direct costs and we did not include any indirect costs like dining more outside due to cooking less at home, more cab rides as Kate cannot walk too far during her 3rd trimester etc, which might further inflate the overall cost. We might do a breakdown of the pregnancy costs on a later date.

We definitely busted our first budget in the biggest way possible but its really money well spent to welcome a new member to our family. If we remove the pregnancy related expenses, our YTD expenses would be $61,670.13 and average expenses per month will be $5,606.38 which is about 10% off from our budget of $60k set towards the start of the year. We will providing a more detailed analysis for the full year spending so as to get a better idea of our expenditure and spending habits.

As for now, we just want to enjoy our time with our latest family member and savour the moment.

We are really grateful with our simple lifestyle nowadays and we hope that we could maintain this lifestyle. How was your November expenses?

I love how transparent you are in breaking down your costs. I like how many different categories you have, and putting them in a spreadsheet to see each month how well you stay on track. I appreciate the insights, thank you for sharing!

Thanks! I hope this will help more people to be aware about where their money is going so that they could better plan their finances.