October is the month when we celebrated our 5th wedding Anniversary and we went for a family day out at River Safari. Ally enjoyed free admission with each accompanying adult for the month of October. This is the third time we went to River Safari with Ally and she is so excited about it that she kept on harping about seeing the Giant Pandas. As Ally just turned three last month, she is now able to better appreciate the attractions like touching a live star fish by herself. The best thing about going to River Safari is that all the attractions are sheltered, thus you could still continue to walk around the park even though it might be raining.

Our trip to River Safari also coincides with the “The Deadliest Monster” exhibit that educates how easy it is to start making small adjustments to our daily actions and make our environment a better place for wildlife and us. They collaborated with Hyflux to provide water dispensers there so that people do not use plastic bottles. They are also encouraging more people to use less plastic bags and straws.

As a minimalist family, we purchase less stuff to fill up our life. On the other hand we are also more conscientious about creating less waste. Earlier this year, I attended a talk by Zerowaste SG conducted by its very own founder Eugene Tay. It is really informative and really triggers the thought that every small action we do as an individual has an impact on our environment. Thus, I believe that we should do our part as a minimalist family to lessen our carbon footprint.

We were invited to attend an estate party organized by our Resident’s Committee (RC). We were treated with entertaining stage performances like magic shows and games, lunch buffet, balloon sculpting and colouring contest. Ally participated in the colouring contest for kids between 3 to 6 years old and managed to came in third. She was the youngest among the 3 winners and we were really proud parents on that day.

We believe in spending more time outdoor as kids are fascinated by anything they see. All these simple activities might teach her how to appreciate the simpler things in life. Just to share some of Ally’s other outdoor activities with pictures as below.

River Safari

Changi Airport / Bishan Park

Colouring Contest

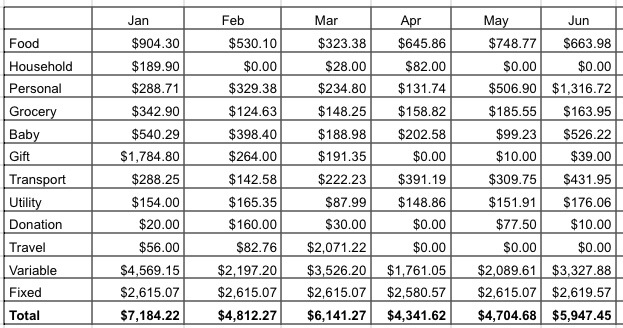

We managed to compile the breakdown for our October 2017 expenses as below.

Food ($633.59)

$633.59 – Mainly meals for the three of us (this includes snacks, and drinks, etc.)

Personal ($393.15)

$79.70 – Kate’s toiletries and facial care

$297.00 – health supplements

$10.00 – 4D (Kate shared this with some friends out of good fun)

$6.45 – Stamps

Home ($136.80)

$90.00 – bolsters, pillows, bedsheet set

$46.80 – Household Sundries

Grocery ($118.15)

$118.15 – mainly groceries and other household items from the supermarket

Ally ($569.19)

$32.80 – Indoor Playground at Polliwogs – Vivocity (inclusive of some snacks)

$102.00 – Family Trip to River Safari (Inclusive of Dave’s parents and brother)

$60.00 – Mifold (Child seat booster to be used when we use the grab service)

$10.00 – 2 pairs of pants from Fox Kids (Ally is outgrowing all her pants)

$364.39 – snacks, toiletries and misc

Gift ($73.02)

$73.02 – Kate’s gift for the opening of relative’s restaurant in KL

Transport ($364.21)

$200.00 – Ezlink card reload for both of us (for bus and train rides)

$77.60 – Cab rides (plus some Grab credits top up)

$86.61 – Drove father-in-law car over the weekend (parking and petrol)

Utility ($165.83)

$165.83 – Mobile phone bills and Internet

$0 – Electric, gas and water bill (Full Government Rebate)

Monthly Fixed Expenses ($2792.82)

$610 – Full day child care for Ally (inclusive of some optional enrichment class)

$29.90 – Newspaper subscription

$36.75 – Property Services and Conservancy Charges (Half Month Government Rebate)

$1,200 – Parents allowance

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

$913.59 – Insurance premiums – includes savings, whole life, hospital and surgical, home insurance (annual premiums amortized into 12 months)

Total Expenses = Total variable expenses $2,453.94 + Total fixed expenses $2,792.82 = $5,246.76

Note:

- This monthly expense report is use mainly to gauge our post FI expenses

- We included whole life and savings insurance as part of our expenses until they are full paid up. The reason is that we will most probably be still paying for them even though we reach FI.

- Our insurance also includes our parents’ health insurance

- We did not include our mortgage in this annual budgeting because we are using CPF to pay for our monthly instalments. Another reason is that we will most probably be clearing off our mortgage upon reaching FI.

We spent close to our average spending of $5k this month and we will most definitely be breaking our 2017 budget when we announce our expenses for next month. But this will create a good yardstick for us to plan our budget for next year. Some readers commented that our spending is similar to a typical average household spending in Singapore and it is not how a minimalist family should spend. They are right about it if they look at our monthly expenses as a whole (Kate blog about that recently too). But that is mainly due to parents allowances and their insurance premiums which takes up about 25 – 30% of our monthly budget of $5k. I will do a deeper analysis when we compile our expenses for the whole of this year.

Everyone’s financial circumstances are different, hence that might explain why some families’ expenses are higher as they might have other heavy commitments (ie. parents in nursing home, disabled siblings) where they do not have much of a choice. For us, we are trying to balance between taking care of our parents and living as a minimalist family. We have been very intentional and deliberate on all our financial decisions so far and that is what minimalism is all about. We focus more on quality over quantity and sometimes quality doesn’t come cheap.

We are really grateful with our simple lifestyle nowadays and we hope that we could maintain this lifestyle. How was your October expenses?

Hi I’d like to share how I minimise my expenditure at http://my-radical-thoughts.blogspot.com/2017/09/my-expenses.html

Thanks for sharing. It will be interesting to see another version of this when you start your family and have your own house.

With own house the loan/rental and utilities will be around $2000.

I never had the luxury of aircon growing up and even now in my whole life. So im used to fans which will save quite a bit. I could also stay with parents to save money.

I will keep renovation and furniture to a minimal.

With a kid the most expensive recurring cost will be milk powder and diapers for the first few years.

So thats another $300-$500?

Pretty well thought out. Guess you can be a minimalist too!

Hi! Would just like to ask how you keep your utilities bill so low? How much electricity, gas and water do you use a month?

We did some prepayment using credit card to enjoy some cash rebates.

I can see from your breakdown that expenses are quite well control. There is generally no luxury expenses. The expenditure for children is usually among the biggest and will get bigger as your child grows up or when second child comes along. I am amazed that you get full rebate for utilities – how to do that? By the way, I don’t see income and property tax expenses too. If you are relatively cash rich, would you want to repay your CPF loan and let government pays the interest and let it compounds for you? Now you have to pay interest to yourself. Any thoughts?

Child expenses are generally bigger when your child is in childcare but should taper off once they enter primary school. As for the utilities bill, we did some prepayment to enjoy some credit card cash rebates. Income and property taxes are only charge once a year and we already pay it off on an annual basis. If I’m cash rich, I would rather use the surplus cash to invest and earn higher returns as compared to my bank loan @ < 2% and cpf interest @ 2.5%. I would maintain an arbitrage as oppose to fully repaying the loan. The reason is we are still young and we have a long time horizon for our investments to grow.

Dave, thanks for the title. Not necessary true on the comment for children. Don’t underestimate the cost of tuition and other enrichments that you may want your child to enjoy. I agree on the part of bank loan but on the CPF loan, if I can afford I will reduce it to minimum. I have a huge CPF loan Too but I have tried to do some repayment now to reduce the principle. In my mind, using CPF loan is as good as having a 5% interest rate. You have to pay yourself the 2.5% and you lose the 2.5% from the government. However, I recognise that it is a necessary cost as housing is so expensive here that many of us canny afford without using CPF.

For the children part, I guess its more about what we want for our kids. Enjoyment doesnt necessary only comes from enrichment classes. We are definitely the minority parents who believe more about experiential learning as compared to going for all those expensive enrichment classes. Our duty is to help our kids explore what they really want rather than following the herd mentality. 2.5% paid to ourselves are still our money but just in different account as we must understand the primary purpose of cpf is to fund our retirement. That’s why we did not have a huge housing loan in the first place and we would like to maintain a small arbitrage. I understand that this is a necessary cost but try to keep it as minimal as possible so that you will not be a slave to it.

Agreed 👍

Hi Dave and Kate

Thanks for sharing. On the part where people say your expenses aren’t minimalist, my view is the minimalism movement shouldn’t be confused with the frugality movement, although there’s often a big overlap. After all, you don’t buy therefore you don’t spend therefore you are (maybe) frugal. As you said, minimalism is about buying/consuming less stuff…and you value quality over quantity…which is perfectly fair. A billionaire could be minimalist and buy just ONE Rolls Royce and have ONE apartment in Orchard Road, but you could hardly call him frugal. 🙂

In the end, your personal expenditure is down to your personal choice right? Last I heard, no one has been appointed the Judge of Minimalism yet…:D

Keep up the good work!

Posting on behalf of Mr.C

Thanks for your comments! Our objective of publishing our expenses is to create some awareness on how much a typical family is spending in Singapore. Hopefully, people could use it as a reference to gauge how much of their expenses are actually spent on things they do not really need and help them make better financial decisions. Kate and I always believe that life is all about choices and everyone must understand that you cannot always have the best of both worlds.

Minimalism is a personal journey for our family and we want to prove that life is not always about buying new things to keep yourself happy. We believe that there is more to life and we are currently venturing out into that uncharted water. Hopefully, we could uncover something more valuable than things.

Hi Dave,

Enjoyed this post and the accompanying comments.

There is really no “how a minimalist family should spend” definition. I think your are doing a great job and when we publish our expenses, it’s not to show how “frugal” or “minimalist” we are. It’s definitely not a competition to see who can tighten the belt better and own fewer stuff.

In fact, we should be spending more and having more possessions if we truly believe the additions will improve our quality of life.

Hi Thomas, thanks for your comments. Guess you are moving towards minimalism too by the way you just explained. 🙂