September is the month where we celebrated Ally’s birthday and also my sister’s wedding. Ally also transited from half day to full day child care where she will be attending additional enrichment classes like speech and drama. We believe she will be able to adapt to it and enjoy it.

My sister’s wedding was a really simple and close affair. It was a church wedding where only family members and close friends were invited. I’m really happy and proud of her who found the right soul mate who will walk this journey with her. I really love this type of simple wedding where they shun the social norms of hosting their wedding at a hotel nowadays. We wish them a blissful and loving marriage.

We also brought Ally to a weekend farm and animal farm at the Tengah area near old Choa Chu Kang. For the weekend farm, we could purchase locally produced fresh vegetables. Visitors could also enjoy a walk through the greenhouses where leafy vegetables are grown under protective nettings which maximizes growth and minimizes damage. There are also some farm animals on display which brought fun and curiosity to all the kids. Then we went to Farmart where Ally could buy some vegetables to feed goats, rabbits, parrots, tortoise and fishes. Ally had lots of fun and enjoys the trip so much that she keeps on harping to go back to feed the goats. Some of the photos taken at the farm.

We believe in spending more time outdoor as kids are fascinated by anything they see. All these simple activities might teach her how to appreciate the simpler things in life. Just to share some of Ally’s other outdoor activities with pictures as below.

Lorong Halus

Marine Cove Playground

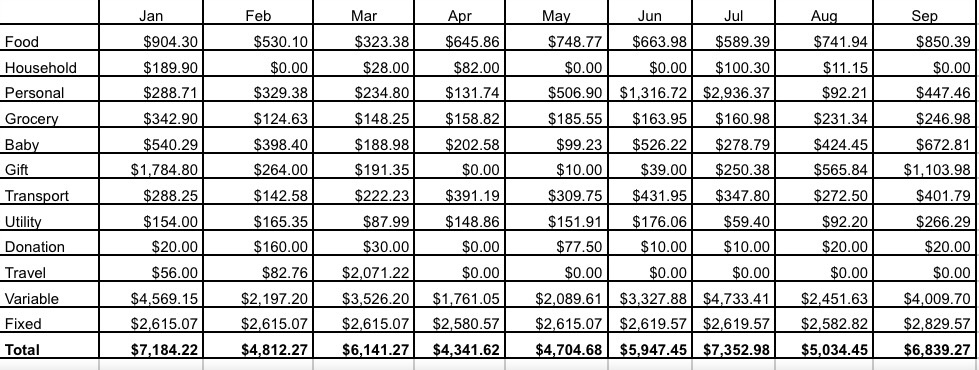

We managed to compile the breakdown for our September 2017 expenses as below.

Food ($850.39)

$699.39 – Mainly meals for the three of us (this includes snacks, and drinks, etc.)

$101.10 – Kate’s sister birthday lunch

$49.90 – Kate’s treat to colleague

Personal ($447.46)

$172.36 – Kate’s toiletries and facial care

$144.00 – health supplements

$78.03 – Prime membership

$50.07 – WordPress renewal

$3.00 – Socks

Grocery ($246.98)

$246.98 – mainly groceries and other household items from the supermarket

Ally ($672.81)

$365 – Additional school deposits and misc fees (Ally transiting from half day to full day child care)

$50.00 – School photo taking and outing

$35.00 – Music trial class

$55.85 – milk powder

$126.80 – snacks, toiletries and misc

$40.16 – Art and craft materials

Gift ($1,103.98)

$1000 – Dave’s red packet for sister’s wedding

$39.98 – Kate’s birthday gift for Ally

$40.00 – Ally’s birthday cake

$24.00 – mooncake for grandma

Transport ($401.79)

$220 – Ezlink card reload for both of us (for bus and train rides)

$105.08 – Cab rides (plus some Grab credits top up)

$76.71 – Drove father-in-law car over the weekend (parking and petrol)

Utility ($266.29)

$218.35 – Mobile phone bills and Internet

$47.94 – Electric, gas and water bill

Donation ($20)

$20 – temple

Monthly Fixed Expenses ($2829.57)

$610 – Full day child care for Ally (inclusive of some optional enrichment class)

$29.90 – Newspaper subscription

$73.50 – Property Services and Conservancy Charges

$1,200 – Parents allowance

$2.58 – iCloud 50 GB storage (monthly fees for Kate and myself)

$913.59 – Insurance premiums – includes savings, whole life, hospital and surgical, home insurance (annual premiums amortized into 12 months)

Total Expenses = Total variable expenses $4,009.70 + Total fixed expenses $2,829.57 = $6,839.27

Note:

- This monthly expense report is use mainly to gauge our post FI expenses

- We included whole life and savings insurance as part of our expenses until they are full paid up. The reason is that we will most probably be still paying for them even though we reach FI.

- We did not include our mortgage in this annual budgeting because we are using CPF to pay for our monthly instalments. Another reason is that we will most probably be clearing off our mortgage upon reaching FI.

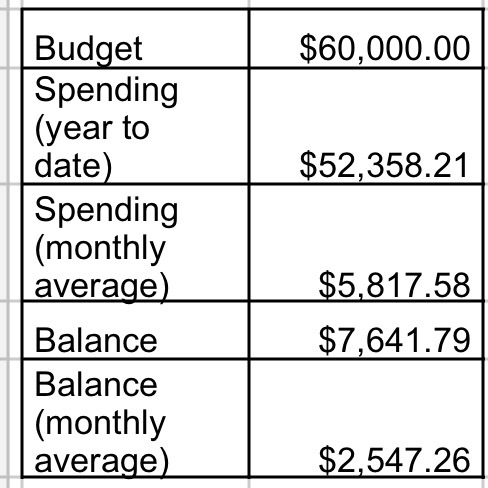

We spent close to our average spending of $5k per month if we exclude the one time event expenses like the Ally’s child care deposit and my sister’s wedding. This year is the first time we are trying to work with a family budget and I believe we could budget better next year with this year’s budget as our reference. We are pretty confident with our financial future as we are spending below our means which creates some buffer for unforeseen events. Even if one of us were to lose our job today, we will not fret about it.

This month also marks the 1st year anniversary of “Minimalist in the City” that we started last year and we think that this is one of the best thing we have done during our lifetime so far. We felt really blessed to find like minded people via this blog to share our experiences. We will continue to share, challenge and experiment towards our goal of maintaining this minimalist lifestyle and achieving financial success at the same time. We would like to thank all our readers and we will continue to share our thoughts during this journey.

We are really grateful with our simple lifestyle nowadays and we hope that we could maintain this lifestyle. How was your September expenses?

Hi, I am amazed at how you can keep the expense for food to so low. Mind sharing what plans do u subscribe to for Mobile phone bills and Internet?

We seldom eat at restaurants and usually eat at home on weekends unless we are going out. When we are out, we usually go for foodcourt as there are more food varieties there. For mobile plan, I use the starhub no contract plan and for Internet it’s the starhub 300mbps plan.

Based on your expense, I don’t see how you are a minimalist..

Hi Bart,

Thanks for your comment. We haven’t really quite chanced upon the expense reports of minimalists in real life so if you could shed some light onto how the expenses of a minimalist family should run, that would really shed some light.

I agree with Bart. This is not a minimalist expense more of an average sg household expense. http://www.singstat.gov.sg/docs/default-source/default-document-library/statistics/browse_by_theme/population/statistical_tables/hes-keyind.pdf

Thanks for your comments. Being minimalists living in a city doesn’t really means that we spend the least. It’s just means that we are more intentional about our lifestyle and choose quality over quantity.

This infographic maybe helpful to all. Average monthly household expenditure as of 2012/2013 is at $4724!

http://www.singstat.gov.sg/docs/default-source/default-document-library/statistics/visualising_data/highlights-of-household-expenditure-survey-20122013.pdf