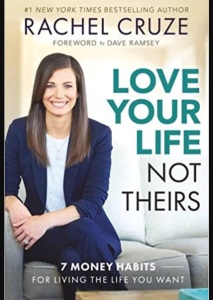

I recently went to a newly re-opened public library at Compass One mall which went through a major asset enhancement. The selections were very little on personal finance but I managed to borrowed this book “Love your life not theirs” by Rachel Cruze who is also the daughter of financial guru Dave Ramsey. She is a seasoned communicator and presenter who helps Americans learn the proper ways to handle money and stay out of debt. She also serves as a Ramsey Personality, using her knowledge and experiences from growing up as Dave Ramsey’s household to educate others on personal finance.

This book talks about the 7 money habits for living the life you want through her real-life experience as the daughter of Dave Ramsey. Below are the key takeaways from each habit and i guess they are pretty good money habits to pick for yourself or your kids.

Habit 1 – Quit the comparisons

She was talking about how social media actually brought the game of comparison to a new level. Rachel and her husband who were newly weds during then, were planning for a short getaway to Charleston, South Carolina as they heard many great things about that coastal town. They were so excited planning the “No work, all play” trip and managed to gather enough cash as newly weds to go for this trip. Eventually, they made it there and everything was simply fantastic over there. They didn’t wanted to leave that place but they have to go back to reality. As soon as she step back into her new house, she started scrolling mindlessly through her Instagram feeds for updates on her social media friends. She saw a fashion blogger which she follows posting some great pictures of her trip to Greece with pictures of yachts, perfect sunset and the most-delicious looking seafood. As she was looking at all the pictures, the warm glow of her great Charleston trip was fading away. She did what normal person will do by researching on the airline tickets to Greece. But as newly weds, they really do not have the budget to go to Greece. Instead of basking at the great trip they just had, they were already thinking how much better this person’s trip to Greece was. They were literally letting someone who they do not know personally influence not only on how they were going to spend their money, but how they should live their life.

So the cure for comparisons is to practice contentment which is a place that you can’t get there financially but a place that you could get there emotionally and spiritually. Contentment is the inner determination to be happy and fulfilled whenever you are with whatever you have. Rachel also outlined that contented people are usually satisfied, peaceful, save more, avoid debt and generous. She also emphasized the two important keys to contentment are gratitude and humility. These are the useful advice she written for people to get out of this comparison trap which we also blog about here.

Habit 2 – Steer clear of debt

When Rachel and her husband moved to their new home, they are like the typical newly weds who started out with just a little money to furnish their new home. They realised how expensive furnitures could be and at that time, they could only afford to buy a few basic pieces with cash they had. She was also embarrassed and freaked out on her intention to invite her good friends over for a simple dinner. She felt very insecure about this fact that most of the good friends were older than them and were more established in their careers. Their homes were filled with nice furnitures and beautiful decor. When her friends did came over eventually, Rachel was busy explaining why they don’t have a lot of stuff. They kept smiling and reassuring me that it was fine. To be honest, they don’t really care that much and they felt happy just to be able hang out together.

Most of the expectations you think you have of yourself doesn’t exist; these are expectations you put on yourself. Rachel refused to go into debt just to make the house looks complete; by the way she only have a debit card. But the temptation to apply credit to purchase was so high that most people would have thought that its a no brainer to pull out your credit card in order to make the whole house filled with nice decors and furnitures (and worry about it later). She also mentioned that we should envision a life without debt where all your salary goes straight to your account and you know that you have enough to pay for all your basic necessities. She also emphasised on delayed gratification and you will tend to value your purchases more. We also blog about the biggest debt of your life here.

Habit 3 – Make a plan for your money

Rachel’s husband once plan for their last couple trip to Florida as they are starting a family soon. He wanted Rachel to relax and spend money without a budget. Rachel is a natural spender and she was so excited about the idea of spending without worrying about the budget. She tried ordering from the food menu without looking at the price but was astonished that the bill came to be quite substantial. Reality sets in and she couldn’t take it any longer. Thats when they started to budget for every meal for the rest of the trip so they could order and enjoy without any stress and anxiety.

There are some budget misconceptions that it is restricting and do not allow you to live life to the fullest. But budgeting is like driving a car with all the road signs that restrict your speed or directions but keeps you and others safe from accident. It’s the same concept. We need to abide to the rules on the road in order to enjoy the freedom of driving to where you want to go to. We need to be responsible to all our actions in order to enjoy the freedom to spend freely. Freedom doesn’t exist outside of responsibility instead they go hand in hand. If we want to live life on our own terms, we have to acknowledge there are certain boundaries we need to set and live within those guidelines. If you want to take control of your money instead of the other way round, we need to live within a budget. A budget gives you permission to spend and not worry about anything else as you already got it all covered like your bills, retirement planning, insurance and mortgage etc. You basically could spend with confidence and are always on top of things relating to money.

to be continued……here

Wow this book sounds more interesting than I thought. I like that Rachel shares her own experience, to which people can relate. I’ve heard about this book time and time again on the Dave Ramsey show and thought it was just a rehash of Dave’s The Money Makeover.

Looking forward to part II =)

Yah I think this book is pretty good and relates very well to people like us. Recommended read for those who wants to develop good money habits.